Intro

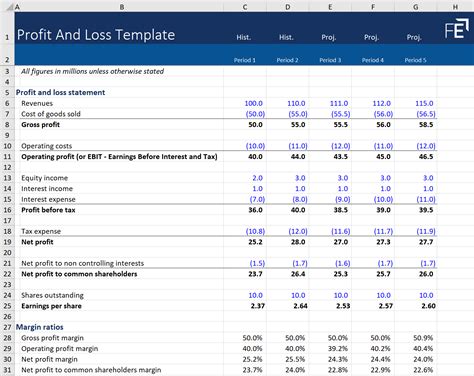

Boost your trucking business profitability with a comprehensive Owner Operator P&L Template. Discover the 5 essential line items to include, covering revenue, expenses, and profitability metrics. Optimize your financial management with a well-structured template, incorporating key categories such as fuel, maintenance, and insurance costs.

As an owner operator, managing your finances effectively is crucial to the success of your business. One essential tool to help you stay on top of your finances is a Profit and Loss (P&L) template. A well-structured P&L template provides a clear picture of your business's income and expenses, enabling you to make informed decisions about investments, expenses, and growth strategies. Here, we'll discuss the five essential line items to include in your owner operator P&L template.

Understanding the Importance of a P&L Template

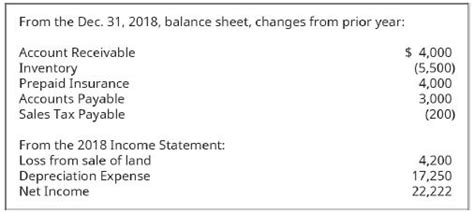

Before diving into the essential line items, it's essential to understand why a P&L template is vital for your business. A P&L template helps you:

- Track your business's income and expenses

- Identify areas for cost reduction and optimization

- Make informed decisions about investments and expenses

- Analyze your business's performance over time

- Create a budget and forecast future financial performance

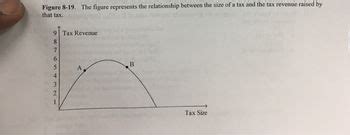

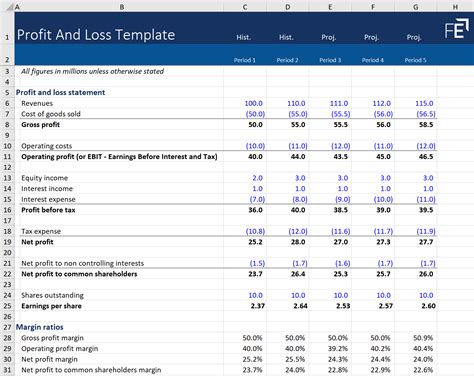

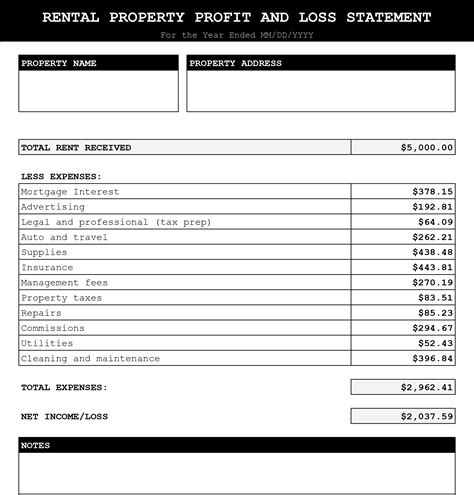

1. Revenue

Revenue is the top line item in your P&L template, representing the total income earned by your business. This includes:

- Freight revenue

- Fuel surcharges

- Accessorial revenue (e.g., loading/unloading fees)

- Other revenue streams (e.g., brokerage fees)

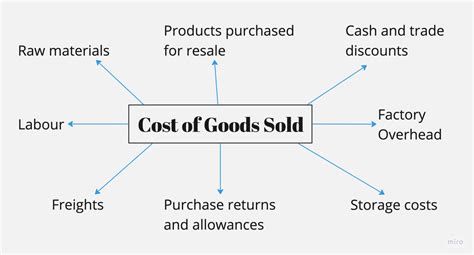

2. Cost of Goods Sold (COGS)

COGS represents the direct costs associated with producing and delivering your services. For owner operators, COGS includes:

- Fuel costs

- Maintenance and repair costs

- Tolls and other expenses related to transportation

- Insurance premiums

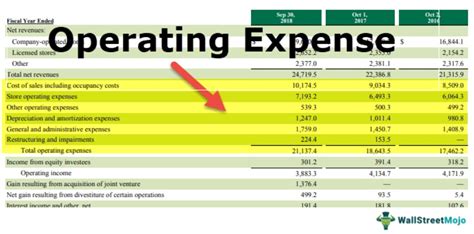

3. Operating Expenses

Operating expenses include indirect costs related to running your business. These expenses are not directly related to the production or delivery of your services but are necessary to support your operations. Examples of operating expenses include:

- Salaries and benefits (if you have employees)

- Office expenses (e.g., rent, utilities, supplies)

- Marketing and advertising expenses

- Professional fees (e.g., accounting, legal)

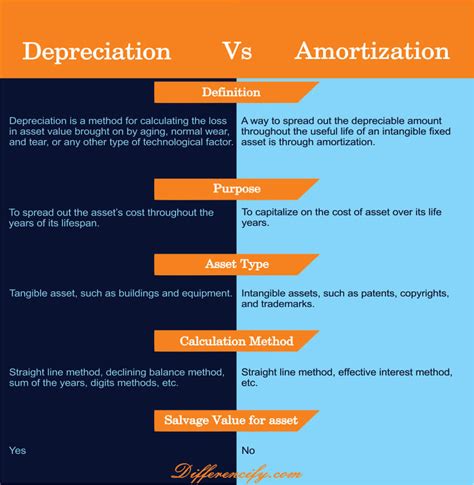

4. Depreciation and Amortization

Depreciation and amortization represent the decrease in value of your assets over time. As an owner operator, you may have assets such as:

- Trucks and trailers

- Equipment (e.g., maintenance equipment, technology)

- Intangible assets (e.g., software, patents)

5. Net Income

Net income represents the bottom line of your P&L template, showing the total profit earned by your business. This is calculated by subtracting your total expenses from your total revenue.

Gallery of Owner Operator P&L Template Examples

Owner Operator P&L Template Gallery

By including these five essential line items in your owner operator P&L template, you'll be able to effectively track your business's financial performance and make informed decisions to drive growth and profitability.

We'd love to hear from you!

Do you have any questions or comments about creating an owner operator P&L template? Share your thoughts in the comments below. If you found this article helpful, please share it with your network.