Intro

Discover the Colorado Tabor Stimulus Check and unlock financial relief. Learn 5 ways to qualify for this economic stimulus, including eligibility requirements, application processes, and benefits. Find out how to claim your share of the Tabor refund, including tips on tax refunds, government aid, and economic stimulus packages.

In an effort to provide financial relief to its residents, the state of Colorado has introduced the Tabor Stimulus Check program. This initiative aims to return a portion of the state's tax revenue to eligible individuals, helping to offset the economic challenges faced by many. If you're a Colorado resident looking to benefit from this program, here are five ways to get your Tabor Stimulus Check.

Understanding the Tabor Stimulus Check Program

Before diving into the ways to get your stimulus check, it's essential to understand the program's basics. The Tabor Stimulus Check is a one-time payment made possible by the state's Taxpayer's Bill of Rights (TABOR). This program is designed to provide financial assistance to eligible Colorado residents, with the amount of the payment varying depending on individual circumstances.

Who is Eligible for the Tabor Stimulus Check?

To be eligible for the Tabor Stimulus Check, you must meet specific requirements. These include:

- Being a Colorado resident

- Filing a 2022 state income tax return

- Having a valid Social Security number or Individual Taxpayer Identification Number (ITIN)

- Meeting specific income thresholds

5 Ways to Get Your Colorado Tabor Stimulus Check

Now that you know the basics of the program and the eligibility requirements, here are five ways to get your Tabor Stimulus Check:

1. File Your 2022 State Income Tax Return

The most straightforward way to receive your Tabor Stimulus Check is by filing your 2022 state income tax return. Make sure to file your return by the deadline to ensure you receive your payment. You can file your return electronically or by mail, depending on your preference.

2. Apply for the Tabor Stimulus Check Online

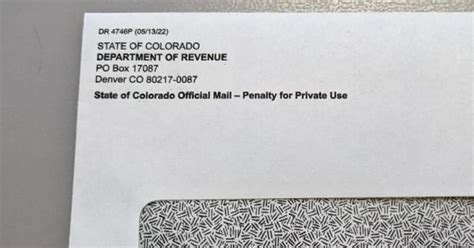

If you're not required to file a state income tax return, you can still apply for the Tabor Stimulus Check online. The Colorado Department of Revenue will provide an online application portal for eligible residents who do not need to file a tax return. Keep an eye on the official website for the application portal's opening date.

3. Submit a Paper Application

For those who prefer to apply by mail or have limited access to the internet, a paper application will be available. You can download the application form from the Colorado Department of Revenue's website or pick one up at a local tax office. Be sure to follow the instructions carefully and submit your application by the designated deadline.

4. Use a Tax Preparation Service

If you're not comfortable filing your tax return or applying for the Tabor Stimulus Check on your own, consider using a tax preparation service. Many tax preparation services, such as H&R Block or TurboTax, offer assistance with state tax returns and may be able to help you apply for the Tabor Stimulus Check.

5. Contact the Colorado Department of Revenue

If you have questions or concerns about the Tabor Stimulus Check program or need assistance with the application process, you can contact the Colorado Department of Revenue directly. They will be able to provide you with more information and guide you through the process.

What to Expect After Applying

Once you've applied for the Tabor Stimulus Check, you can expect to receive your payment within a few weeks. The payment will be made via direct deposit or a paper check, depending on the information provided on your application. Be sure to keep an eye on your bank account or mailbox for your payment.

Gallery of Colorado Tabor Stimulus Check-Related Images

Colorado Tabor Stimulus Check Image Gallery

Frequently Asked Questions (FAQs)

- Q: Who is eligible for the Colorado Tabor Stimulus Check? A: Eligible Colorado residents who meet specific income thresholds and file a 2022 state income tax return.

- Q: How do I apply for the Tabor Stimulus Check? A: You can apply online, submit a paper application, or use a tax preparation service.

- Q: When can I expect to receive my Tabor Stimulus Check payment? A: Payments will be made within a few weeks after applying.

- Q: How will I receive my Tabor Stimulus Check payment? A: Payments will be made via direct deposit or a paper check.

Getting Help with Your Tabor Stimulus Check

If you have questions or concerns about the Tabor Stimulus Check program, don't hesitate to reach out to the Colorado Department of Revenue. They will be able to provide you with more information and guide you through the application process.

Stay Informed

Stay up-to-date with the latest news and updates about the Colorado Tabor Stimulus Check program by following reputable sources and checking the official website.

Next Steps

Now that you know the five ways to get your Colorado Tabor Stimulus Check, take the necessary steps to apply and receive your payment. Don't miss out on this opportunity to receive financial relief from the state of Colorado.