Intro

Transform your financial habits with a conscious spending plan. Learn how to prioritize needs over wants, track expenses, and set realistic goals. This 7-step guide will show you how to manage your money mindfully, reduce debt, and cultivate a healthier relationship with your finances.

Creating a conscious spending plan is an essential step towards achieving financial stability and security. By being mindful of where your money is going, you can make intentional decisions about how you spend your hard-earned cash. In this article, we will explore the 7 steps to create a conscious spending plan that aligns with your values and goals.

Understanding the Importance of Conscious Spending

Before we dive into the steps, it's essential to understand why conscious spending is crucial. When you're not mindful of your spending habits, it's easy to get caught up in impulse purchases, overspending, and debt. By creating a conscious spending plan, you can:

- Reduce financial stress and anxiety

- Increase savings and investments

- Align your spending with your values and goals

- Improve your overall financial well-being

Step 1: Track Your Expenses

The first step in creating a conscious spending plan is to track your expenses. For one month, write down every single transaction you make, including small purchases like coffee or snacks. This will help you identify areas where you can cut back and make adjustments. You can use a spreadsheet, a budgeting app, or even just a notebook to track your expenses.

Step 2: Categorize Your Expenses

Once you have a clear picture of your spending habits, it's time to categorize your expenses. Divide your expenses into categories, such as:

- Housing (rent/mortgage, utilities, maintenance)

- Transportation (car loan/gas/insurance, public transportation)

- Food (groceries, dining out)

- Entertainment (hobbies, movies, concerts)

- Debt repayment (credit cards, loans)

- Savings (emergency fund, retirement)

Step 3: Set Financial Goals

Now that you have a clear understanding of your spending habits, it's time to set financial goals. What do you want to achieve with your conscious spending plan? Do you want to:

- Pay off debt?

- Build an emergency fund?

- Save for a big purchase?

- Increase your savings rate?

- Improve your credit score?

Write down your goals and make sure they're specific, measurable, achievable, relevant, and time-bound (SMART).

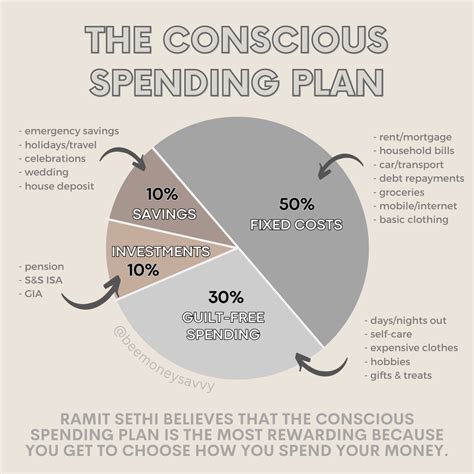

Step 4: Assign Percentages

Next, assign a percentage of your income to each category based on your financial goals. A general rule of thumb is to allocate:

- 30% for housing

- 10% for transportation

- 10% for food

- 5% for entertainment

- 5% for debt repayment

- 10% for savings

Adjust these percentages based on your individual needs and goals.

Step 5: Create a Budget

With your categories and percentages in place, it's time to create a budget. Based on your income, allocate a specific amount of money to each category. Make sure to include a buffer for unexpected expenses.

Step 6: Automate Your Savings

To make saving easier and less prone to being neglected, automate your savings by setting up automatic transfers from your checking account to your savings or investment accounts. This way, you'll ensure that you're saving a fixed amount regularly, without having to think about it.

Step 7: Review and Adjust

Finally, review your conscious spending plan regularly and make adjustments as needed. Life is unpredictable, and your spending plan should be flexible enough to accommodate changes in your income, expenses, or goals.

By following these 7 steps, you'll be well on your way to creating a conscious spending plan that aligns with your values and goals. Remember to stay committed, patient, and kind to yourself throughout the process.

Conscious Spending Plan Image Gallery

We hope this article has provided you with a comprehensive guide to creating a conscious spending plan. By following these 7 steps, you'll be well on your way to achieving financial stability and security. Remember to stay committed, patient, and kind to yourself throughout the process. Share your thoughts and experiences with us in the comments below!