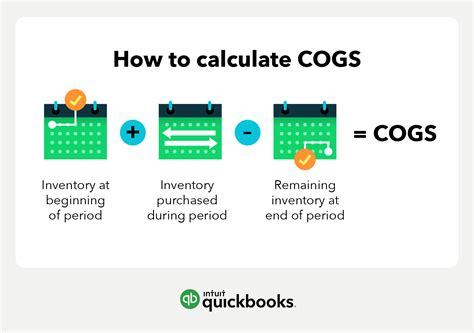

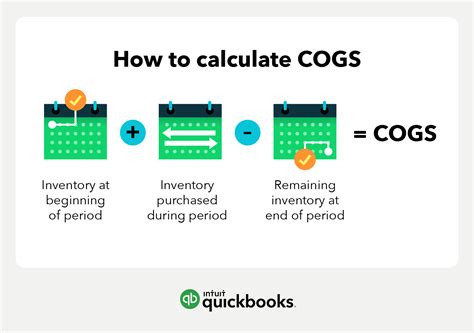

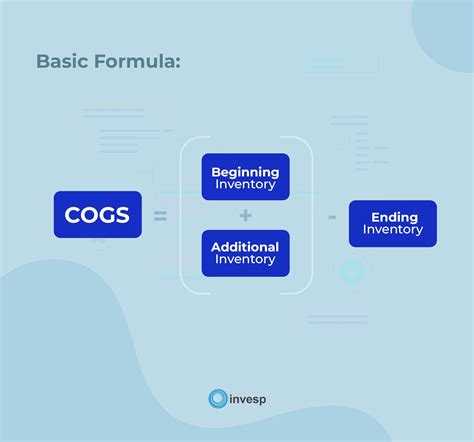

Calculating the Cost of Goods Sold (COGS) is a crucial aspect of accounting for businesses, particularly those in the retail and manufacturing sectors. COGS represents the direct costs associated with producing and selling a company's products or services. It is a key component of a company's profitability analysis and is used to calculate gross profit margin. However, calculating COGS can be a complex and time-consuming process, especially for businesses with multiple products, inventory items, and production processes. Fortunately, Microsoft Excel can help simplify the process of calculating COGS. In this article, we will explore five ways to simplify COGS with Excel.

Understanding COGS Before we dive into the ways to simplify COGS with Excel, it's essential to understand what COGS entails. COGS includes the following costs:

- Direct materials cost (raw materials, labor, and overheads)

- Direct labor cost (wages, salaries, and benefits of production staff)

- Overhead costs (factory rent, utilities, equipment depreciation, and maintenance)

- Packaging costs

- Freight-in costs (transportation costs of raw materials and finished goods)

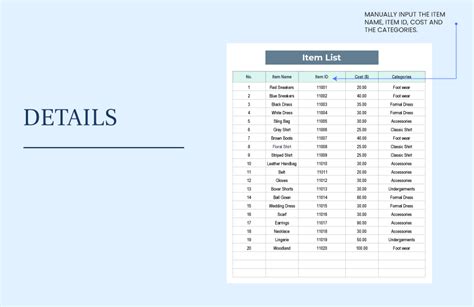

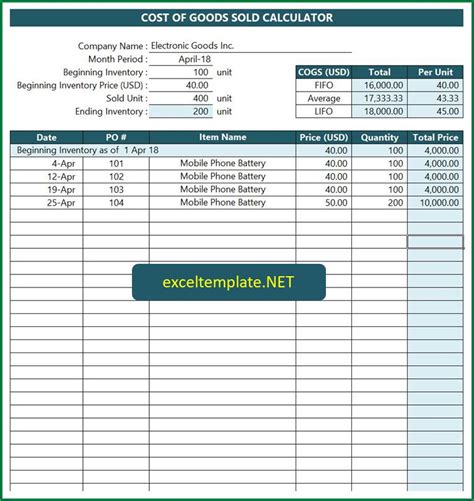

Method 1: Using a COGS Template One of the simplest ways to calculate COGS in Excel is by using a pre-built template. Excel offers a range of templates that can help you calculate COGS quickly and efficiently. To access these templates, follow these steps:

- Open Excel and click on "File" > "New"

- In the search box, type "COGS template" and press Enter

- Select a template that suits your business needs

- Customize the template by entering your business data

Method 2: Creating a COGS Formula If you prefer to create your own COGS formula, you can use the following steps:

- Create a table with the following columns: Product, Direct Materials Cost, Direct Labor Cost, Overhead Cost, Packaging Cost, and Freight-in Cost

- Enter the relevant data for each product

- Create a formula to calculate COGS using the following syntax:

=SUM(Direct Materials Cost + Direct Labor Cost + Overhead Cost + Packaging Cost + Freight-in Cost) - Apply the formula to each product

Method 3: Using Excel's Built-in Functions Excel has several built-in functions that can help you calculate COGS, including the SUMIF and INDEX/MATCH functions. These functions allow you to calculate COGS for specific products or product groups.

For example, to calculate COGS using the SUMIF function:

- Create a table with the following columns: Product, Direct Materials Cost, Direct Labor Cost, Overhead Cost, Packaging Cost, and Freight-in Cost

- Enter the relevant data for each product

- Use the SUMIF function to calculate COGS for a specific product:

=SUMIF(Product, "Product A", Direct Materials Cost) + SUMIF(Product, "Product A", Direct Labor Cost) + SUMIF(Product, "Product A", Overhead Cost) + SUMIF(Product, "Product A", Packaging Cost) + SUMIF(Product, "Product A", Freight-in Cost)

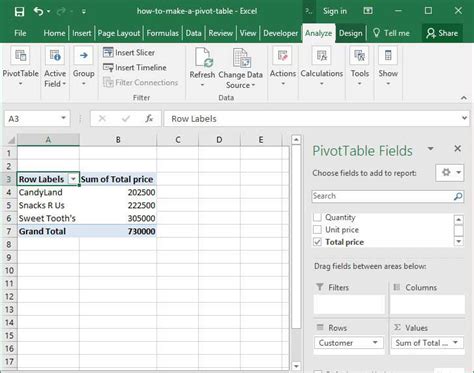

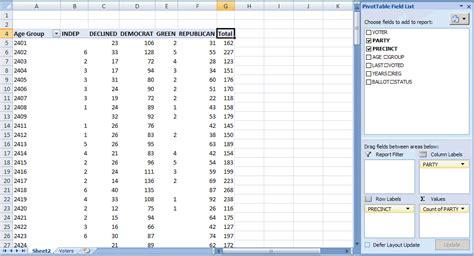

Method 4: Using PivotTables PivotTables are a powerful tool in Excel that can help you analyze and summarize large datasets. You can use PivotTables to calculate COGS for different products or product groups.

To create a PivotTable:

- Create a table with the following columns: Product, Direct Materials Cost, Direct Labor Cost, Overhead Cost, Packaging Cost, and Freight-in Cost

- Go to the "Insert" tab and click on "PivotTable"

- Select a cell range for the PivotTable

- Drag and drop the relevant fields into the PivotTable

- Use the PivotTable to calculate COGS for different products or product groups

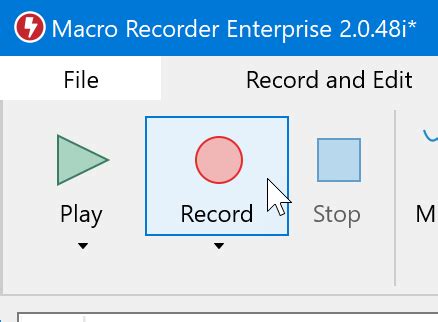

Method 5: Automating COGS Calculations Finally, you can automate COGS calculations using Excel's macro feature. Macros allow you to record a series of steps and play them back with a single click.

To create a macro:

- Go to the "Developer" tab and click on "Record Macro"

- Record the steps to calculate COGS

- Save the macro and assign a shortcut key

- Use the macro to calculate COGS for different products or product groups

Gallery of COGS-related keywords:

COGS Image Gallery

We hope this article has provided you with valuable insights on how to simplify COGS calculations using Excel. By using these methods, you can streamline your accounting processes and make more informed business decisions. Remember to explore the different methods and find the one that works best for your business needs. Happy calculating!