Intro

Unlock the power of Excels Cumipmt formula to simplify complex financial calculations. Learn how to use Cumipmt to calculate cumulative interest payments on a loan, including principal and interest, with ease. Master this essential formula and streamline your financial modeling, amortization schedules, and investment analyses with precision and accuracy.

Calculating cumulative interest payments on a loan can be a daunting task, especially for those who are not familiar with financial calculations. However, with the help of Excel, you can easily calculate cumulative interest payments using the CUMIPMT formula. In this article, we will explore how to use the CUMIPMT formula in Excel, its syntax, and provide examples to make it easy to understand.

What is the CUMIPMT Formula?

The CUMIPMT formula in Excel calculates the cumulative interest paid on a loan between a specified start period and end period. The formula takes into account the interest rate, the number of payments, and the payment amount.

Syntax of the CUMIPMT Formula

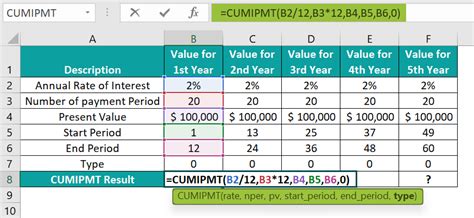

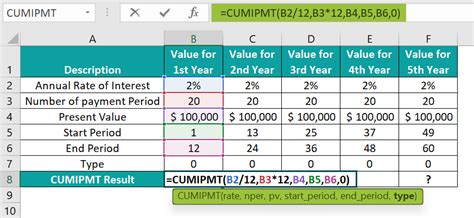

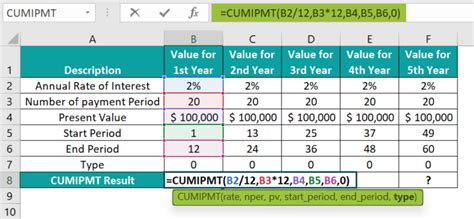

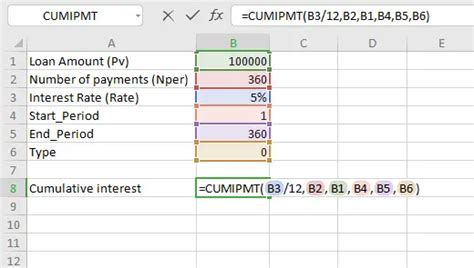

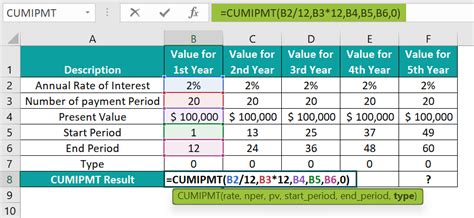

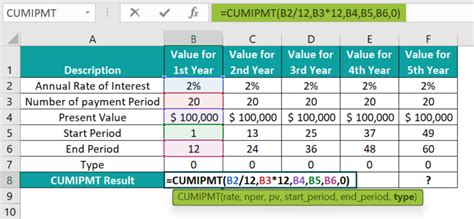

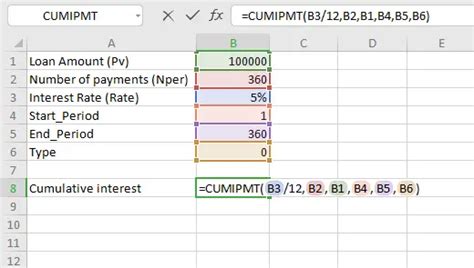

The syntax of the CUMIPMT formula is as follows:

CUMIPMT(rate, nper, pv, start_period, end_period, type)

- rate: The interest rate of the loan

- nper: The total number of payments

- pv: The present value of the loan (the initial amount borrowed)

- start_period: The starting period for which you want to calculate the cumulative interest

- end_period: The ending period for which you want to calculate the cumulative interest

- type: The type of payment (0 for end of period, 1 for beginning of period)

How to Use the CUMIPMT Formula

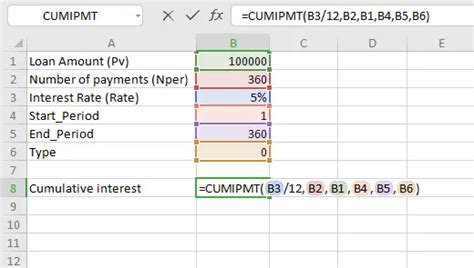

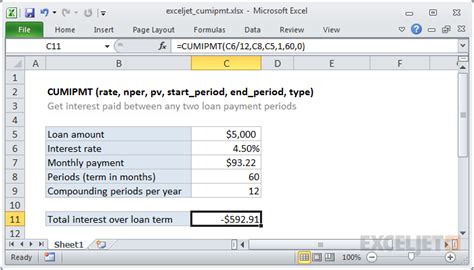

Using the CUMIPMT formula is straightforward. Here's an example:

Suppose you borrowed $10,000 at an interest rate of 6% per annum, and you want to calculate the cumulative interest paid over the first 3 years of the loan. The loan has a total term of 5 years, and the payments are made at the end of each period.

In this example, the CUMIPMT formula would be:

=CUMIPMT(6%/12, 5*12, 10000, 1, 3*12, 0)

This formula calculates the cumulative interest paid from the beginning of the loan to the end of the third year.

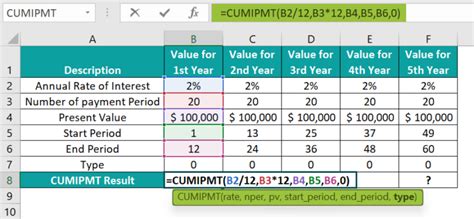

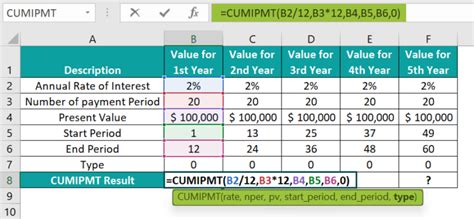

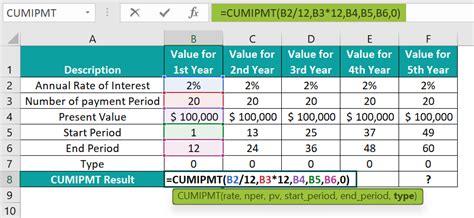

Examples of Using the CUMIPMT Formula

Here are a few more examples to illustrate how to use the CUMIPMT formula:

- Suppose you want to calculate the cumulative interest paid over the entire term of the loan (5 years). The formula would be: =CUMIPMT(6%/12, 5*12, 10000, 1, 5*12, 0)

- Suppose you want to calculate the cumulative interest paid from the beginning of the loan to the end of the second year. The formula would be: =CUMIPMT(6%/12, 5*12, 10000, 1, 2*12, 0)

Tips and Tricks

Here are a few tips and tricks to keep in mind when using the CUMIPMT formula:

- Make sure to enter the interest rate as a decimal value (e.g., 6% = 0.06).

- The payment type (0 or 1) determines whether the payment is made at the end or beginning of each period.

- The start_period and end_period arguments must be entered as numerical values, not dates.

- If you want to calculate the cumulative interest paid over a specific range of periods, make sure to adjust the start_period and end_period arguments accordingly.

Common Errors When Using the CUMIPMT Formula

When using the CUMIPMT formula, there are a few common errors to watch out for:

- Incorrect interest rate: Make sure to enter the interest rate as a decimal value.

- Incorrect payment type: Ensure that you enter the correct payment type (0 or 1).

- Incorrect start_period or end_period: Double-check that you have entered the correct start_period and end_period values.

Troubleshooting the CUMIPMT Formula

If you encounter any errors or issues when using the CUMIPMT formula, here are some troubleshooting steps to follow:

- Check your interest rate: Verify that you have entered the correct interest rate.

- Check your payment type: Ensure that you have entered the correct payment type (0 or 1).

- Check your start_period and end_period: Double-check that you have entered the correct start_period and end_period values.

Cumipmt Formula in Excel Image Gallery

Conclusion

The CUMIPMT formula in Excel is a powerful tool for calculating cumulative interest payments on a loan. By following the syntax and examples provided in this article, you can easily calculate the cumulative interest paid over a specified range of periods. Remember to troubleshoot any errors that may occur, and don't hesitate to reach out if you need further assistance.

We hope this article has been helpful in explaining how to use the CUMIPMT formula in Excel. If you have any questions or comments, please feel free to share them below!