Intro

Boost your investment analysis with 5 free DCF Excel templates. Master discounted cash flow modeling with our expert-designed templates, featuring cash flow projections, terminal value calculations, and valuation metrics. Perfect for financial analysts, investors, and students seeking to streamline their DCF modeling process and make informed investment decisions.

Every investor, financial analyst, and business professional knows that creating a reliable discounted cash flow (DCF) model is crucial for evaluating investment opportunities, estimating a company's intrinsic value, and making informed decisions. However, building a DCF model from scratch can be a daunting task, especially for those without extensive financial modeling experience. This is where free DCF Excel templates come in handy.

In this article, we'll explore five essential free DCF Excel templates that you need to download now. We'll also provide an overview of the DCF methodology, its importance in finance, and a step-by-step guide on how to use these templates effectively.

What is Discounted Cash Flow (DCF) Analysis?

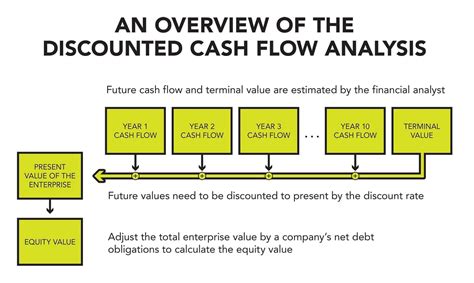

Discounted cash flow analysis is a widely used valuation method that estimates the present value of future cash flows of a company, project, or asset. The DCF model takes into account the time value of money, risk, and growth prospects to arrive at a fair value. This approach is based on the concept that the value of an investment is equal to the sum of its future cash flows, discounted at a rate that reflects the time value of money and the risk associated with the investment.

Why is DCF Analysis Important in Finance?

DCF analysis is a fundamental tool in finance, and its importance cannot be overstated. Here are a few reasons why:

- Informed decision-making: DCF models provide a framework for evaluating investment opportunities, making it easier to compare different projects or companies.

- Valuation: DCF analysis helps estimate the intrinsic value of a company, which can be used to determine whether the stock is undervalued or overvalued.

- Risk assessment: By incorporating risk into the discount rate, DCF models help investors and analysts understand the potential risks associated with an investment.

5 Free DCF Excel Templates You Need Now

Here are five free DCF Excel templates that you can download and use for your financial modeling needs:

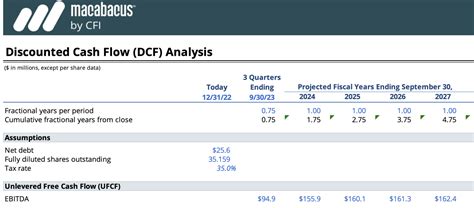

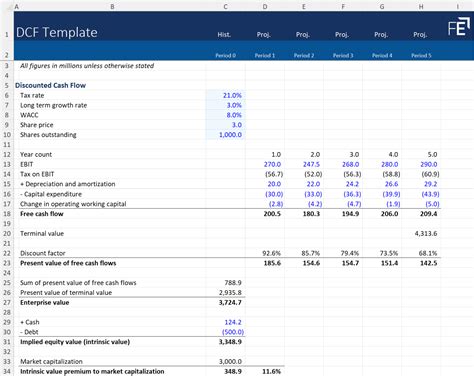

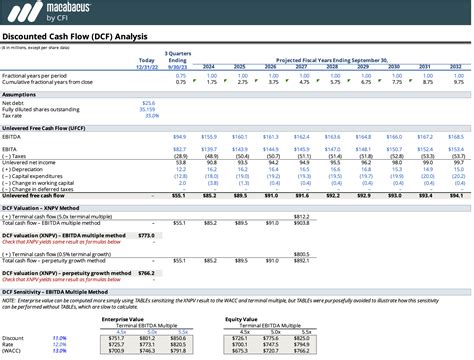

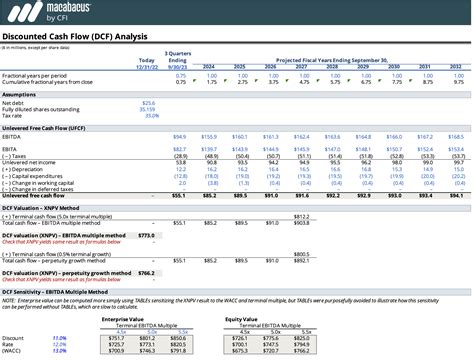

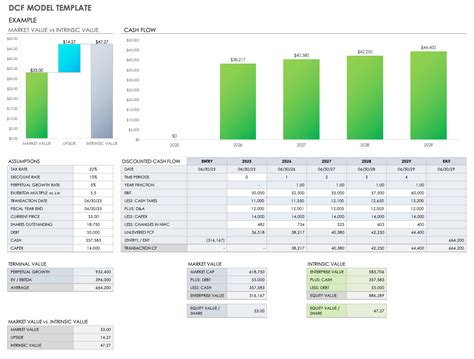

- DCF Model Template by Investopedia: This template provides a basic DCF model that estimates the present value of future cash flows. It includes input sections for revenue growth rates, operating margins, and discount rates.

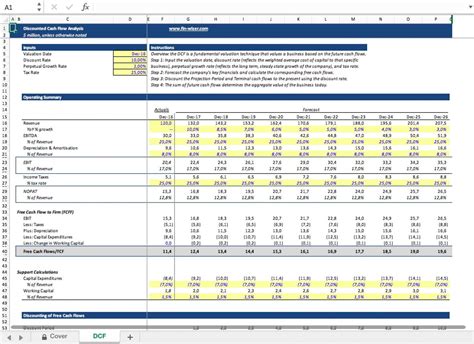

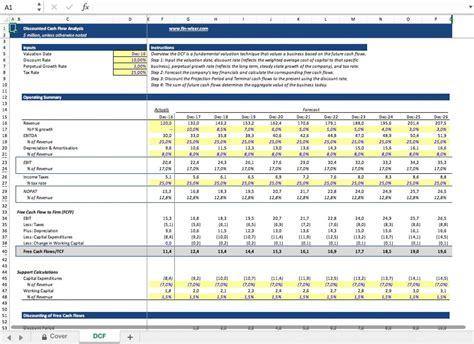

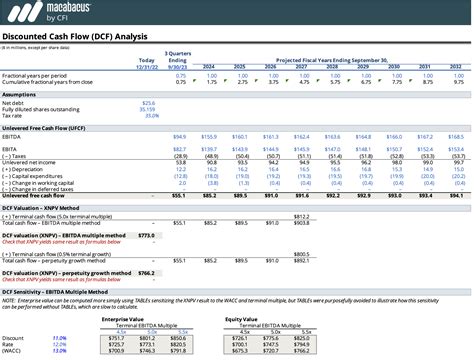

- Discounted Cash Flow Template by Vertex42: This template offers a more comprehensive DCF model that includes a detailed income statement, balance sheet, and cash flow statement. It also allows users to input their own assumptions and scenarios.

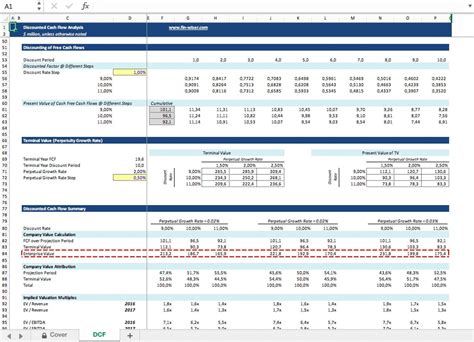

- DCF Valuation Template by Wall Street Prep: This template provides a detailed DCF model that includes a variety of inputs, such as revenue growth rates, operating margins, and discount rates. It also includes a sensitivity analysis section to test different scenarios.

- Free DCF Template by Financial-Modeling: This template offers a basic DCF model that estimates the present value of future cash flows. It includes input sections for revenue growth rates, operating margins, and discount rates.

- DCF Model Template by eFinancialModels: This template provides a comprehensive DCF model that includes a detailed income statement, balance sheet, and cash flow statement. It also allows users to input their own assumptions and scenarios.

How to Use These Templates Effectively

To get the most out of these free DCF Excel templates, follow these steps:

- Download the template: Choose a template that suits your needs and download it to your computer.

- Input your data: Enter your company's financial data, such as revenue growth rates, operating margins, and discount rates.

- Adjust assumptions: Adjust the assumptions in the template to reflect your company's specific situation.

- Run the model: Run the DCF model to estimate the present value of future cash flows.

- Analyze the results: Analyze the results to determine whether the investment is undervalued or overvalued.

DCF Template Gallery

Conclusion

In conclusion, these five free DCF Excel templates are essential tools for anyone involved in financial modeling, investment analysis, or business valuation. By using these templates, you can create a reliable DCF model that estimates the present value of future cash flows, helping you make informed decisions and evaluate investment opportunities effectively. Remember to download the templates, input your data, adjust assumptions, run the model, and analyze the results to get the most out of these free resources.