Intro

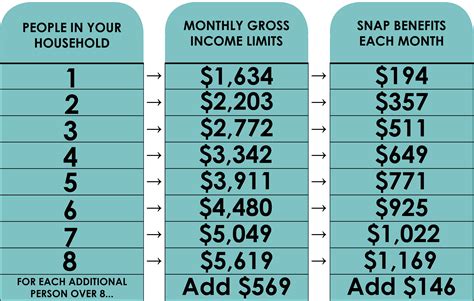

Receiving food stamps can be a significant help for individuals and families struggling to make ends meet. However, many people wonder if food stamps will affect their taxes. In this article, we will explore the relationship between food stamps and taxes, and provide you with the information you need to understand the impact on your tax situation.

Understanding Food Stamps

Before we dive into the tax implications of food stamps, let's quickly review what food stamps are and how they work. Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), are a government-funded program designed to help low-income individuals and families purchase food. Eligible individuals receive an Electronic Benefits Transfer (EBT) card, which can be used to buy food at participating grocery stores and supermarkets.

Tax Implications of Food Stamps

The good news is that food stamps are generally not considered taxable income. According to the Internal Revenue Service (IRS), SNAP benefits are not subject to federal income tax. This means that you do not need to report your food stamp benefits on your tax return.

However, there are some exceptions and considerations to keep in mind:

- Cash assistance: If you receive cash assistance, such as Temporary Assistance for Needy Families (TANF), in addition to food stamps, the cash assistance may be considered taxable income.

- Work requirements: Some states require SNAP recipients to work or participate in work-related activities. If you receive income from these activities, it may be subject to taxation.

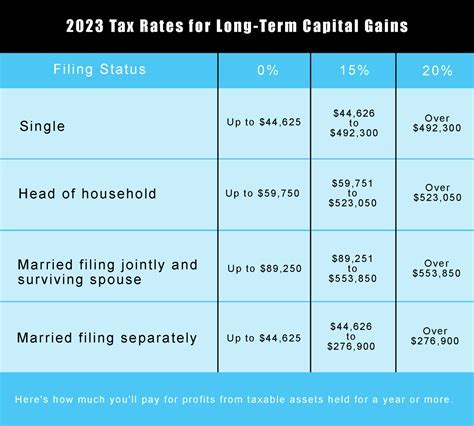

- Tax credits: While food stamps are not taxable, you may still be eligible for tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit.

How Food Stamps Affect Your Tax Filing Status

Receiving food stamps can also impact your tax filing status. Here are some key considerations:

- Filing status: If you receive food stamps, you may still be required to file a tax return, even if you do not owe taxes. You can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Dependents: If you have dependents, such as children or elderly relatives, you may be eligible for tax credits or deductions. Receiving food stamps does not affect your ability to claim dependents on your tax return.

- Tax deductions: You may still be eligible for tax deductions, such as the standard deduction or itemized deductions, even if you receive food stamps.

Reporting Food Stamps on Your Tax Return

While food stamps are not taxable, you may still need to report them on your tax return in certain situations:

- Form 1099-G: If you receive cash assistance or other benefits, you may receive a Form 1099-G, which reports the amount of benefits you received. You will need to report this income on your tax return.

- Schedule C: If you are self-employed or have a side business, you may need to report your business income and expenses on Schedule C. Receiving food stamps does not affect your business income or expenses.

Tips for Taxpayers Receiving Food Stamps

Here are some tips to keep in mind if you receive food stamps and are preparing your tax return:

- Keep records: Keep accurate records of your food stamp benefits, including the amount and date of each benefit.

- Consult a tax professional: If you are unsure about how to report your food stamp benefits or have other tax questions, consider consulting a tax professional.

- Take advantage of tax credits: Don't forget to claim tax credits, such as the EITC or Child Tax Credit, if you are eligible.

Gallery of Food Stamps and Taxes

Food Stamps and Taxes Image Gallery

Conclusion

Receiving food stamps can be a significant help for individuals and families struggling to make ends meet. While food stamps are not taxable, there are some exceptions and considerations to keep in mind when filing your tax return. By understanding the tax implications of food stamps and following these tips, you can ensure that you are taking advantage of all the tax benefits available to you. If you have any further questions or concerns, don't hesitate to reach out to a tax professional or seek guidance from a trusted resource.