Intro

Discover how food stamps impact your tax return filing. Learn if SNAP benefits are taxable, how to report them, and the potential effects on your refund. Understand the intersection of food stamps and tax law, including eligibility, deductions, and credits. Get expert insights to navigate tax season with confidence.

As the year comes to a close, many individuals and families begin preparing for tax season. For those who receive food stamps, also known as Supplemental Nutrition Assistance Program (SNAP) benefits, there may be some uncertainty about how these benefits impact their tax return filing. In this article, we will delve into the relationship between food stamps and tax returns, exploring the key factors to consider and providing guidance on how to navigate the process.

What are Food Stamps?

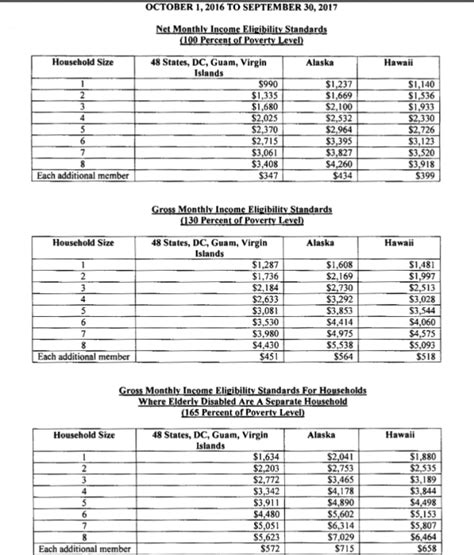

Food stamps, or SNAP benefits, are a government-funded program designed to assist low-income individuals and families in purchasing food. The program is administered by the United States Department of Agriculture (USDA) and is available to eligible recipients in all 50 states.

Do Food Stamps Affect Tax Returns?

In general, food stamps do not directly affect tax returns. SNAP benefits are not considered taxable income and are not reported on your tax return. According to the IRS, "SNAP benefits are not subject to federal income tax and are not reported on your tax return."

However, there are some indirect ways in which food stamps may impact your tax return. For example, if you receive other forms of government assistance, such as Temporary Assistance for Needy Families (TANF) or Social Security benefits, these may be considered taxable income and impact your tax return.

Reporting Income and Benefits on Your Tax Return

When filing your tax return, you will need to report all sources of income, including wages, tips, and self-employment income. However, as mentioned earlier, food stamps are not considered taxable income and should not be reported.

If you receive other benefits, such as TANF or Social Security, you will need to report these on your tax return. You will receive a Form 1099-G or SSA-1099 showing the amount of benefits you received, which you will need to report on your tax return.

How to Report Food Stamps on Your Tax Return

While food stamps are not taxable income, you may still need to report some information related to your SNAP benefits on your tax return. For example:

- If you sold or traded food stamps, you will need to report the income from these transactions on your tax return.

- If you received cash or other benefits in addition to food stamps, you may need to report these on your tax return.

In general, it is best to consult with a tax professional or the IRS if you have questions about reporting food stamps or other benefits on your tax return.

Tax Credits and Deductions

While food stamps may not directly impact your tax return, you may be eligible for tax credits and deductions that can help reduce your tax liability. For example:

- The Earned Income Tax Credit (EITC) is a refundable tax credit available to low-income working individuals and families.

- The Child Tax Credit is a tax credit available to families with qualifying children.

- The Supplemental Security Income (SSI) deduction is available to individuals who receive SSI benefits.

How to Claim Tax Credits and Deductions

To claim tax credits and deductions, you will need to complete the relevant forms and schedules when filing your tax return. For example:

- To claim the EITC, you will need to complete Schedule EIC (Form 1040).

- To claim the Child Tax Credit, you will need to complete Form 8812.

- To claim the SSI deduction, you will need to complete Schedule 1 (Form 1040).

Additional Resources

If you have questions about food stamps and tax returns, or need help with the tax filing process, there are several resources available:

- The IRS website (irs.gov) provides information and guidance on tax-related topics, including food stamps and tax returns.

- The USDA website (usda.gov) provides information on SNAP benefits and eligibility.

- Tax professionals and tax preparation software can also provide guidance and assistance with the tax filing process.

Conclusion

In conclusion, food stamps do not directly affect tax returns, as they are not considered taxable income. However, there may be indirect impacts, such as the reporting of other government benefits or the eligibility for tax credits and deductions. By understanding the relationship between food stamps and tax returns, you can ensure a smooth and accurate tax filing process.

Gallery of Food Stamps and Tax Returns

Food Stamps and Tax Returns Image Gallery

FAQ

Q: Do food stamps affect my tax return? A: No, food stamps are not considered taxable income and do not directly affect your tax return.

Q: How do I report food stamps on my tax return? A: You do not need to report food stamps on your tax return, as they are not taxable income.

Q: Can I claim tax credits and deductions if I receive food stamps? A: Yes, you may be eligible for tax credits and deductions, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit.