Intro

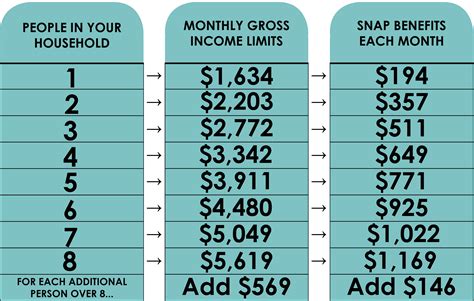

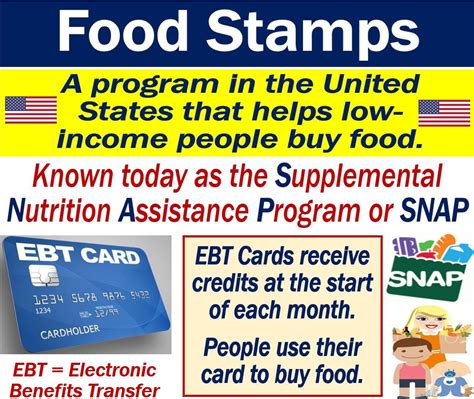

Millions of Americans rely on food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), to help purchase groceries and put food on the table. While food stamps provide essential support, many recipients wonder if receiving this assistance will affect their credit score. In this article, we'll delve into the relationship between food stamps and credit scores, exploring the impact, benefits, and potential consequences.

For many, credit scores are a mysterious entity, influencing everything from loan approvals to apartment rentals. A good credit score can open doors, while a poor score can lead to rejection and higher interest rates. With the average American's credit score hovering around 700, understanding how food stamps factor into this calculation is crucial for those relying on this assistance.

How Food Stamps Affect Credit Scores

Fortunately, receiving food stamps does not directly impact your credit score. The SNAP program is not considered a credit account, and participation is not reported to the three major credit bureaus: Equifax, Experian, and TransUnion. This means that simply receiving food stamps will not lower your credit score or appear on your credit report.

However, it's essential to note that other factors related to food stamps might indirectly affect your credit score. For instance, if you're struggling to pay bills or manage debt due to financial difficulties, your credit score may suffer. In such cases, the root cause of the issue is not the food stamps themselves but rather the underlying financial struggles.

Benefits of Food Stamps for Credit Scores

While food stamps may not directly impact credit scores, the program can have indirect benefits that can help improve your financial situation and, in turn, your credit score. By providing essential support for groceries, food stamps can help individuals and families:

- Reduce debt: By covering a significant portion of food expenses, food stamps can free up more money in your budget to tackle debt, such as credit card balances or loans.

- Build savings: With the financial burden of food costs alleviated, recipients can redirect funds towards building an emergency fund or saving for long-term goals.

- Improve credit utilization: By reducing debt and increasing savings, individuals can lower their credit utilization ratio, which can positively impact their credit score.

Understanding Credit Scores and Reports

To grasp the relationship between food stamps and credit scores, it's essential to understand how credit scores are calculated and what information is included in credit reports.

- Credit scores are calculated based on factors such as payment history, credit utilization, credit age, credit mix, and new credit inquiries.

- Credit reports contain information about your credit accounts, including payment history, balances, and credit limits.

By monitoring your credit report and score regularly, you can identify areas for improvement and take steps to maintain good credit habits.

Common Credit Score Mistakes to Avoid

While food stamps may not directly affect your credit score, there are common mistakes that can negatively impact your credit score. Some of these mistakes include:

- Late payments: Missing payments or making late payments can significantly lower your credit score.

- High credit utilization: Using too much of your available credit can indicate to lenders that you're not managing debt responsibly.

- Applying for too much credit: Submitting multiple credit applications in a short period can raise concerns about your creditworthiness.

By avoiding these common mistakes and maintaining good credit habits, you can protect your credit score and ensure that food stamps don't have an indirect negative impact.

Additional Resources for Food Stamp Recipients

For individuals and families relying on food stamps, there are additional resources available to help manage finances, build credit, and improve overall well-being. Some of these resources include:

- Financial counseling: Non-profit organizations, such as the National Foundation for Credit Counseling, offer free or low-cost financial counseling to help individuals manage debt and improve credit.

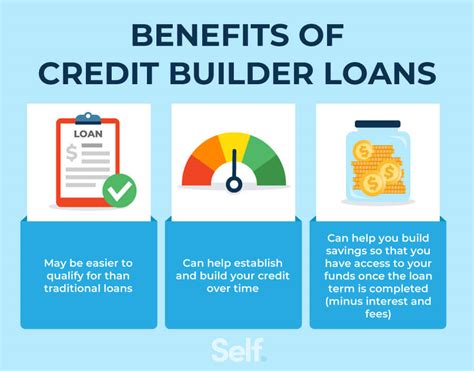

- Credit builder loans: These loans are designed for individuals with poor or no credit and can help build a positive credit history.

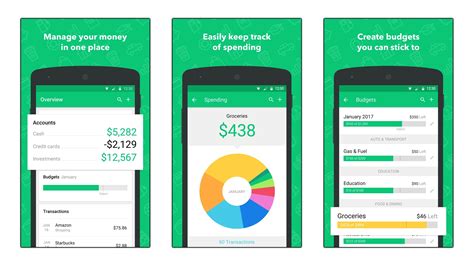

- Budgeting apps: Apps like Mint and You Need a Budget (YNAB) can help individuals track expenses, create a budget, and set financial goals.

By taking advantage of these resources and maintaining good credit habits, food stamp recipients can improve their financial situation and build a stronger credit profile.

Tips for Improving Your Credit Score

- Make on-time payments: Pay bills and debts on time to demonstrate responsible credit behavior.

- Keep credit utilization low: Aim to use less than 30% of your available credit to show lenders you can manage debt responsibly.

- Monitor your credit report: Check your credit report regularly to ensure it's accurate and up-to-date.

- Avoid unnecessary credit inquiries: Only apply for credit when necessary, and space out applications to avoid raising concerns about your creditworthiness.

By following these tips and maintaining good credit habits, you can improve your credit score and increase your financial stability.

Food Stamps and Credit Score Image Gallery

In conclusion, receiving food stamps does not directly impact your credit score. However, by maintaining good credit habits, taking advantage of additional resources, and avoiding common credit score mistakes, you can improve your financial situation and build a stronger credit profile. Remember to monitor your credit report regularly, make on-time payments, and keep credit utilization low to demonstrate responsible credit behavior.

We hope this article has provided valuable insights into the relationship between food stamps and credit scores. If you have any questions or concerns, please don't hesitate to share them in the comments below.