Tax season is a time of year that many people dread, but it's also an opportunity to claim the refunds and benefits you're eligible for. If you're a recipient of food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), you may be wondering how your tax return affects your eligibility for these benefits. In this article, we'll explore five ways your tax return can impact your food stamps eligibility.

How Tax Returns Affect Food Stamps Eligibility

The Supplemental Nutrition Assistance Program (SNAP) is a program designed to help low-income individuals and families purchase food. Eligibility for SNAP is based on a variety of factors, including income, expenses, and family size. When you file your tax return, the information you report can impact your eligibility for food stamps in several ways.

1. Income Calculations

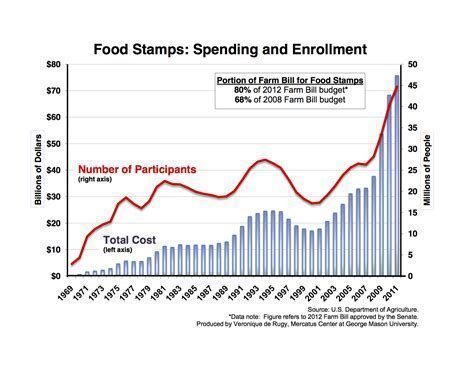

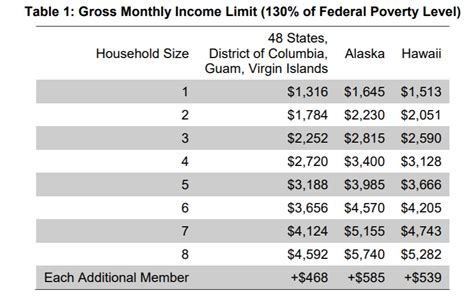

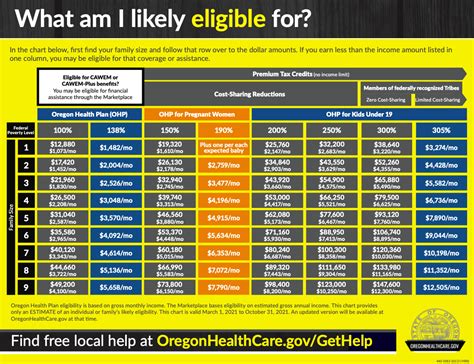

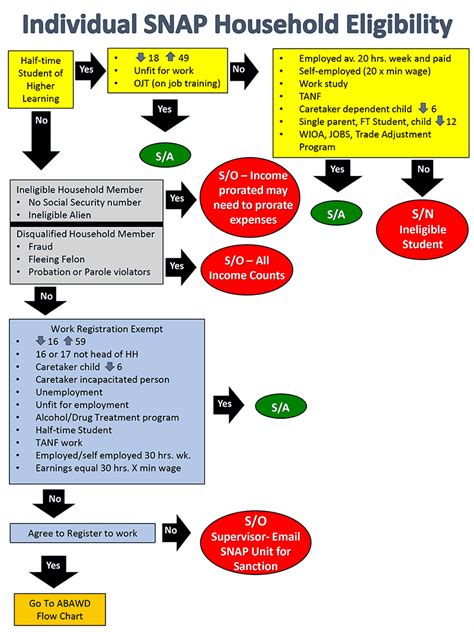

Your tax return reports your income from various sources, including employment, self-employment, and investments. The income you report on your tax return is used to calculate your gross income, which is a key factor in determining your eligibility for food stamps. If your gross income exceeds the limits set by your state, you may no longer be eligible for SNAP benefits.

How Gross Income Affects SNAP Eligibility

- Gross income includes all income earned from employment, self-employment, and investments.

- SNAP eligibility limits vary by state, but generally, gross income must be at or below 130% of the federal poverty level.

2. Deductions and Expenses

Your tax return also reports your deductions and expenses, which can impact your eligibility for food stamps. Certain deductions, such as medical expenses and childcare costs, can reduce your gross income and make you eligible for SNAP benefits. However, other expenses, such as mortgage payments and utility bills, may not be deductible for SNAP purposes.

Common Deductions and Expenses That Affect SNAP Eligibility

- Medical expenses, including health insurance premiums and out-of-pocket costs.

- Childcare costs, including daycare and after-school programs.

- Housing costs, including rent and utilities.

3. Tax Credits and Refunds

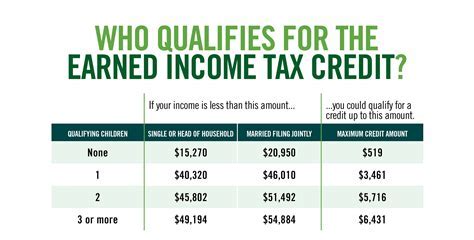

Tax credits and refunds can also impact your eligibility for food stamps. The Earned Income Tax Credit (EITC) and Child Tax Credit are two tax credits that can increase your refund, but may also affect your SNAP eligibility. If you receive a large refund, it may be considered income and affect your eligibility for food stamps.

How Tax Credits and Refunds Affect SNAP Eligibility

- The Earned Income Tax Credit (EITC) and Child Tax Credit can increase your refund, but may also affect your SNAP eligibility.

- Large refunds may be considered income and affect your eligibility for food stamps.

4. Asset Limits

In addition to income and expenses, your tax return may also report assets, such as savings and investments. SNAP eligibility is also subject to asset limits, which vary by state. If your assets exceed the limits, you may not be eligible for food stamps.

Common Assets That Affect SNAP Eligibility

- Savings accounts and certificates of deposit (CDs).

- Stocks and bonds.

- Real estate and vehicles.

5. Household Composition

Finally, your tax return may also report changes in your household composition, such as the addition of a new family member or the departure of a household member. Changes in household composition can affect your eligibility for food stamps, as well as the amount of benefits you receive.

How Household Composition Affects SNAP Eligibility

- Changes in household composition can affect your eligibility for food stamps and the amount of benefits you receive.

- New family members may increase your benefits, while departing household members may decrease your benefits.

In conclusion, your tax return can affect your eligibility for food stamps in several ways, including income calculations, deductions and expenses, tax credits and refunds, asset limits, and household composition. It's essential to understand how your tax return impacts your SNAP eligibility and to report any changes to your state's SNAP agency.

What to Do Next

If you're a recipient of food stamps, it's crucial to understand how your tax return affects your eligibility for these benefits. Here are some steps you can take to ensure you're in compliance with SNAP regulations:

- Review your tax return to ensure you're reporting all income and expenses accurately.

- Check your state's SNAP eligibility limits to ensure you're within the income and asset limits.

- Report any changes in household composition or income to your state's SNAP agency.

- Seek assistance from a tax professional or SNAP representative if you have questions or concerns about your eligibility.

By understanding how your tax return affects your food stamps eligibility, you can ensure you're receiving the benefits you need to support yourself and your family.

Gallery of Tax Returns and Food Stamps Eligibility

Tax Returns and Food Stamps Eligibility Image Gallery

FAQs

Q: How does my tax return affect my food stamps eligibility? A: Your tax return reports your income, deductions, and expenses, which can impact your eligibility for food stamps.

Q: What income is counted for SNAP eligibility? A: Gross income, including income from employment, self-employment, and investments, is counted for SNAP eligibility.

Q: How do tax credits and refunds affect SNAP eligibility? A: Tax credits and refunds can increase your refund, but may also affect your SNAP eligibility.

Q: What assets are counted for SNAP eligibility? A: Savings accounts, stocks, bonds, real estate, and vehicles are counted for SNAP eligibility.

Q: How does household composition affect SNAP eligibility? A: Changes in household composition can affect your eligibility for food stamps and the amount of benefits you receive.

By understanding how your tax return affects your food stamps eligibility, you can ensure you're receiving the benefits you need to support yourself and your family.