Intro

Discover how HUD treats food stamps when calculating income for housing assistance. Learn if food stamps are considered income and how it affects your eligibility for HUD programs. Get answers to common questions and understand the impact on your housing benefits. Know the rules and maximize your assistance.

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a government program designed to help low-income individuals and families purchase food. The Department of Housing and Urban Development (HUD) is responsible for administering various housing programs, including those that provide rental assistance to low-income families. When it comes to determining eligibility for HUD housing programs, the question of whether food stamps are counted as income is an important one.

For many low-income families, food stamps are a vital source of support, helping them to access nutritious food and make ends meet. However, when applying for HUD housing programs, the way in which food stamps are treated can have a significant impact on eligibility and benefit levels. In this article, we will explore how HUD treats food stamps as income for housing purposes.

What is HUD's Policy on Counting Food Stamps as Income?

HUD's policy on counting food stamps as income is outlined in the HUD Handbook 4350.3, Chapter 5, which addresses income and eligibility determinations for HUD's rental assistance programs. According to this handbook, food stamps are not considered income for HUD's rental assistance programs.

Specifically, the handbook states that "income" does not include "benefits received under the Supplemental Nutrition Assistance Program (SNAP)." This means that when determining a family's eligibility for HUD housing programs, food stamps are not counted as part of their gross income.

Why Doesn't HUD Count Food Stamps as Income?

There are several reasons why HUD does not count food stamps as income for housing purposes. One reason is that food stamps are not considered a source of income that can be used to pay rent or other housing expenses. Food stamps are specifically designed to help families purchase food, and they are not intended to be used for other purposes.

Another reason is that counting food stamps as income could have the unintended consequence of reducing a family's eligibility for HUD housing programs. If food stamps were counted as income, it could increase a family's gross income, potentially making them ineligible for HUD assistance.

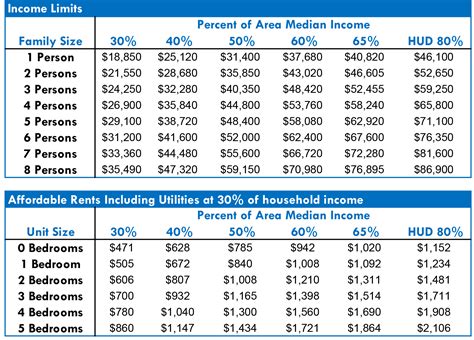

How Does HUD Calculate Income for Housing Purposes?

When determining a family's eligibility for HUD housing programs, HUD calculates their gross income using a variety of sources, including:

- Employment income

- Self-employment income

- Social Security benefits

- Pension or retirement income

- Interest and dividend income

- Rental income

- Unemployment benefits

As noted earlier, food stamps are not included in this calculation.

What are the Implications of HUD's Policy on Food Stamps?

HUD's policy of not counting food stamps as income has several implications for low-income families. On the one hand, it means that families who receive food stamps will not have their HUD benefits reduced as a result of receiving this assistance. This can help to ensure that families have access to the housing assistance they need, even if they are receiving other forms of government assistance.

On the other hand, HUD's policy may have unintended consequences. For example, if a family's income increases due to changes in employment or other factors, they may become ineligible for HUD assistance, even if they are still struggling to make ends meet.

Additional Resources

For more information on HUD's policy on counting food stamps as income, you can consult the following resources:

- HUD Handbook 4350.3, Chapter 5

- HUD's website: hud.gov

- Your local HUD office or housing authority

Conclusion

In conclusion, HUD does not count food stamps as income for housing purposes. This policy is designed to ensure that low-income families have access to the housing assistance they need, without penalizing them for receiving other forms of government assistance. By understanding HUD's policy on food stamps, families can better navigate the process of applying for HUD housing programs and ensure that they receive the assistance they need.

Gallery of HUD Housing Images

HUD Housing Image Gallery

FAQs

Q: Does HUD count food stamps as income for housing purposes? A: No, HUD does not count food stamps as income for housing purposes.

Q: Why doesn't HUD count food stamps as income? A: HUD does not count food stamps as income because they are not considered a source of income that can be used to pay rent or other housing expenses.

Q: How does HUD calculate income for housing purposes? A: HUD calculates income using a variety of sources, including employment income, self-employment income, Social Security benefits, pension or retirement income, interest and dividend income, rental income, and unemployment benefits.

Q: What are the implications of HUD's policy on food stamps? A: HUD's policy means that families who receive food stamps will not have their HUD benefits reduced as a result of receiving this assistance. However, it may also have unintended consequences, such as reducing a family's eligibility for HUD assistance if their income increases.