Intro

Understanding SSDI and Food Stamps Benefits

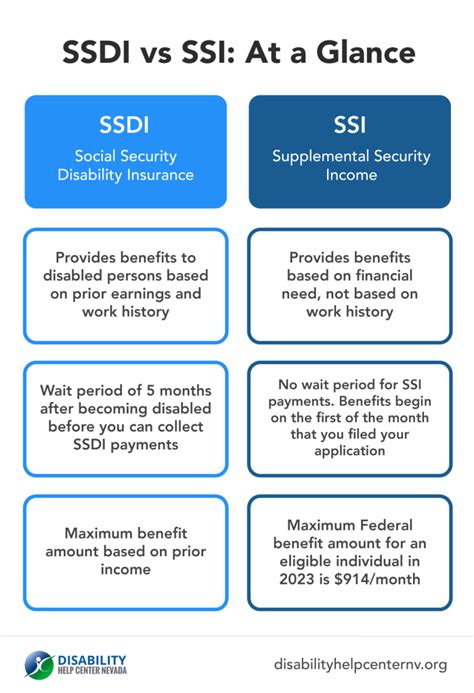

The Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) programs provide financial assistance to individuals with disabilities. However, the impact of these benefits on food stamps eligibility can be confusing. In this article, we will explore whether SSDI counts as income for food stamps benefits and what other factors affect eligibility.

SSDI benefits are considered unearned income, which means they are not derived from a job or employment. This distinction is crucial when determining eligibility for food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP). SNAP is a need-based program, and eligibility is based on household income, expenses, and resources.

Does SSDI Count as Income for Food Stamps Benefits?

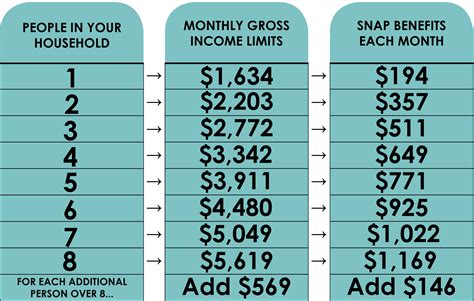

In most cases, SSDI benefits are counted as income when determining eligibility for food stamps. However, the way SSDI benefits are treated can vary depending on the state and local SNAP policies.

In general, SSDI benefits are considered income, but some states may exclude a portion or all of the benefits when calculating eligibility. For example, some states may exclude the first $20 or $50 of SSDI benefits from the income calculation.

Additionally, some states may have different income limits for households receiving SSDI benefits. These income limits may be higher or lower than the standard income limits for SNAP eligibility.

How to Calculate SSDI Income for Food Stamps Benefits

To calculate SSDI income for food stamps benefits, you will need to follow these steps:

- Determine the gross income from SSDI benefits.

- Exclude any deductions or expenses allowed by the state or local SNAP policies.

- Calculate the net income from SSDI benefits.

- Add the net SSDI income to the household's total income.

- Compare the total household income to the state's income limits for SNAP eligibility.

Other Factors Affecting Food Stamps Eligibility

While SSDI benefits are an essential factor in determining food stamps eligibility, other factors can also impact eligibility. These factors include:

- Household size and composition

- Gross income from all sources

- Expenses, such as rent, utilities, and childcare costs

- Resources, such as cash, savings, and investments

- Citizenship and immigration status

Applying for Food Stamps with SSDI Benefits

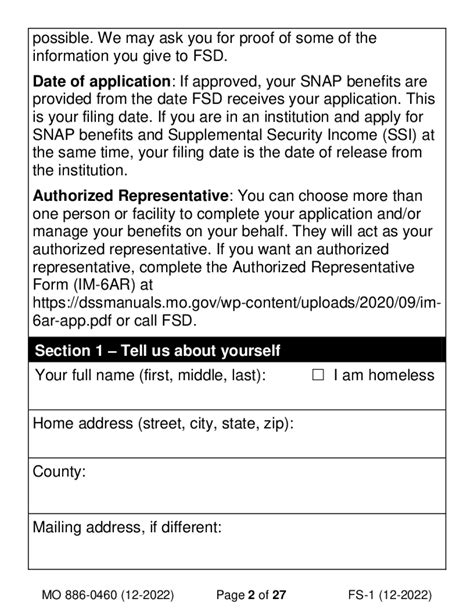

To apply for food stamps with SSDI benefits, follow these steps:

- Gather required documents, including proof of identity, income, and expenses.

- Contact your local SNAP office to schedule an application appointment.

- Complete the SNAP application form and provide required documentation.

- Participate in an eligibility interview with a SNAP representative.

- Wait for the SNAP office to process your application and determine eligibility.

Tips for Maximizing Food Stamps Benefits with SSDI

To maximize food stamps benefits with SSDI, consider the following tips:

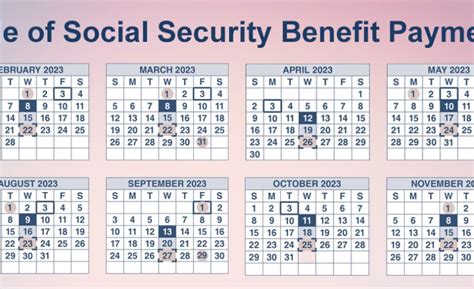

- Apply for SNAP benefits as soon as possible after receiving SSDI benefits.

- Ensure accurate reporting of income and expenses on the SNAP application.

- Ask about state-specific exclusions or deductions for SSDI benefits.

- Explore other assistance programs, such as Medicaid or housing assistance.

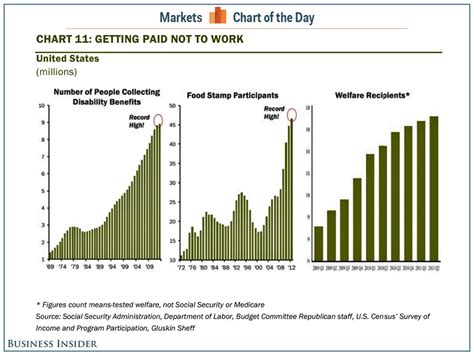

Gallery of SSDI and Food Stamps Benefits

SSDI and Food Stamps Benefits Image Gallery

Take Action Today!

If you are receiving SSDI benefits and need assistance with food, consider applying for food stamps benefits today. Remember to gather required documents, report accurate income and expenses, and explore state-specific exclusions or deductions for SSDI benefits. By taking these steps, you can maximize your food stamps benefits and ensure access to nutritious food for you and your household.

Don't hesitate to share this article with friends and family who may be struggling to make ends meet. Together, we can make a difference in the lives of those in need.