Intro

Master the art of calculating employee cost in Excel with these 5 expert methods. Learn how to accurately determine labor costs, salary expenses, and benefits using formulas and templates. Boost your HR management skills and make informed decisions with these step-by-step guides, covering topics like payroll, workforce analytics, and staffing costs.

Calculating employee costs is a crucial aspect of human resource management and financial planning for any organization. Employee costs can include salaries, benefits, training expenses, and other expenditures related to hiring and maintaining a workforce. Excel, with its powerful formulas and functions, is a versatile tool for calculating employee costs accurately and efficiently. Here are five ways to calculate employee costs in Excel, each focusing on different aspects of employee expenditure.

Understanding Employee Costs

Employee costs go beyond just salaries and wages. They encompass a broad range of expenses including benefits, payroll taxes, training, and more. Understanding the components of employee costs is essential for accurate calculation and budgeting. This includes:

- Direct costs: Salaries, wages, and benefits.

- Indirect costs: Payroll taxes, training costs, and other expenditures.

- Fixed costs: Regular, predictable expenses like salaries and benefits.

- Variable costs: Expenses that can vary based on performance or other factors.

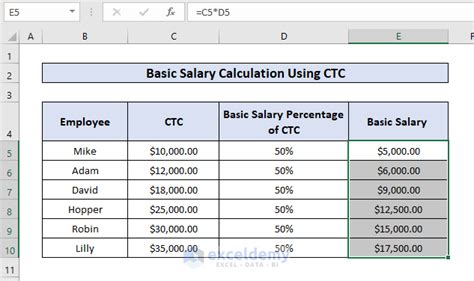

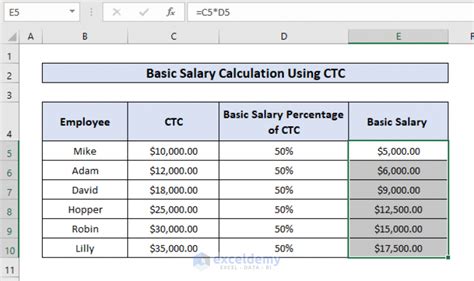

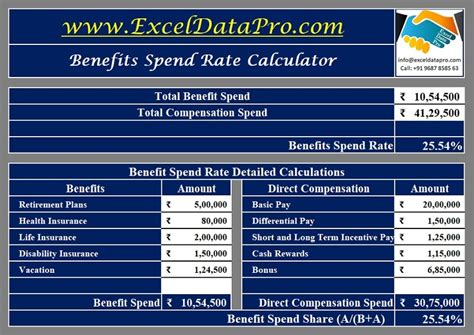

1. Basic Salary and Benefits Calculation

Calculating basic salary and benefits is the foundation of determining employee costs. This can be done by multiplying the employee's hourly wage by the number of hours worked, then adding benefits such as health insurance, retirement plans, and other perks.

In Excel, this can be calculated using simple arithmetic formulas:

=Hourly_Wage * Hours_Worked + Benefits

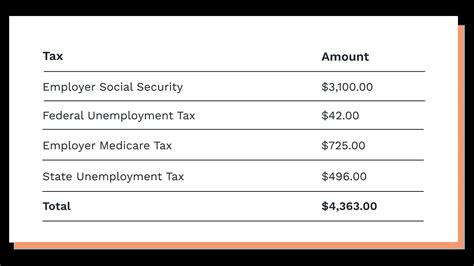

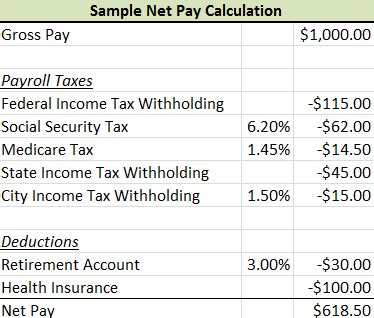

2. Payroll Tax Calculation

Payroll taxes are a significant component of employee costs. These taxes fund social security, Medicare, and other government programs. The calculation typically involves a percentage of the employee's salary.

In Excel, you can calculate payroll taxes using the formula:

=Salary * Payroll_Tax_Rate

3. Training and Development Costs

Investing in employee training and development is essential for workforce growth and retention. These costs can include course fees, travel expenses, and the value of the employee's time.

To calculate these costs in Excel, you can use:

=Course_Fee + Travel_Expenses + (Employee_Hourly_Wage * Training_Hours)

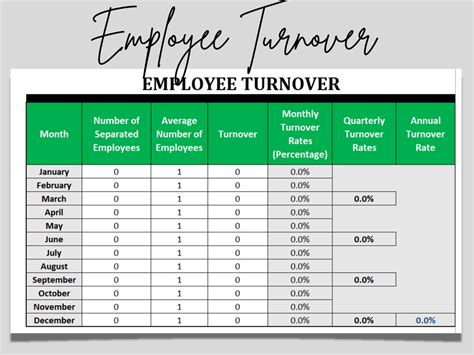

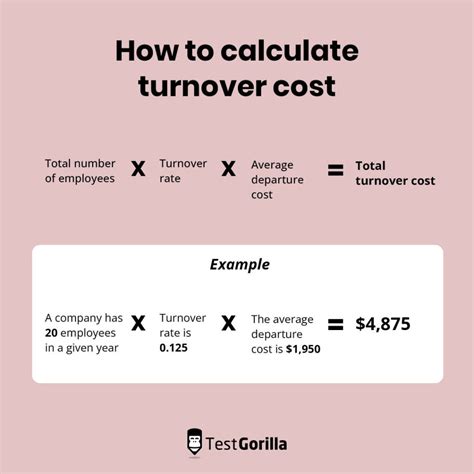

4. Employee Turnover Costs

Employee turnover can be a significant expense due to recruitment, training, and loss of productivity. Calculating these costs involves estimating the cost of replacing an employee.

In Excel, you might estimate turnover costs using:

=Recruitment_Cost + Training_Cost + Productivity_Loss

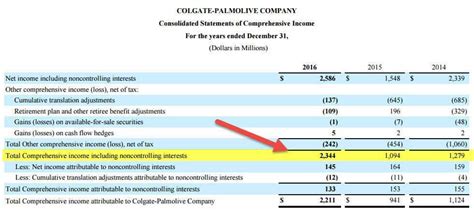

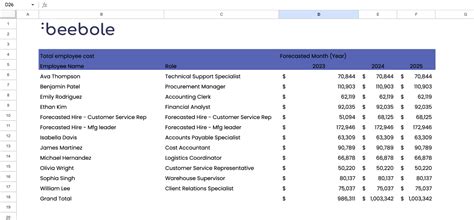

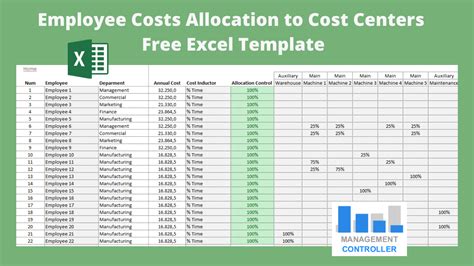

5. Comprehensive Employee Cost Calculation

For a comprehensive view, you can calculate the total employee cost by summing up all the components discussed above.

The formula would look something like:

=Basic_Salary + Benefits + Payroll_Tax + Training_Costs + Turnover_Costs

Gallery of Employee Cost Calculations

Employee Cost Calculations

Calculating employee costs in Excel is a practical approach to managing workforce expenses. By understanding the components of employee costs and using the right formulas and functions in Excel, organizations can make informed decisions about budgeting and resource allocation. Whether you're calculating basic salaries, payroll taxes, training costs, employee turnover costs, or taking a comprehensive approach, Excel provides the flexibility and precision needed for accurate financial planning.