Intro

Unlock the secrets of Excel bond price calculation with our expert guide. Learn how to calculate bond prices, yields, and durations using Excel formulas and functions. Master bond valuation and investment analysis with ease, and discover how to optimize your portfolio with our simple, step-by-step instructions and examples.

Calculating bond prices in Excel can be a daunting task, especially for those who are new to finance or unfamiliar with the software. However, with the right tools and techniques, it can be made easy and efficient. In this article, we will explore the importance of bond price calculation, the different types of bonds, and provide a step-by-step guide on how to calculate bond prices in Excel.

Bonds are a type of investment where an investor loans money to an entity, typically a corporation or government, in exchange for regular interest payments and the return of their principal investment. Bond prices are influenced by a variety of factors, including interest rates, credit ratings, and market conditions. Accurate bond price calculation is crucial for investors, portfolio managers, and analysts to make informed decisions.

There are several types of bonds, including government bonds, corporate bonds, municipal bonds, and high-yield bonds. Each type of bond has its own unique characteristics and risks. Government bonds, for example, are generally considered to be low-risk investments, while corporate bonds carry more credit risk.

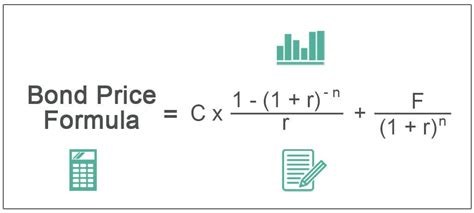

Understanding Bond Pricing Formulas

Before we dive into the Excel calculation, it's essential to understand the bond pricing formulas. The most common formula used to calculate bond prices is the present value of the cash flows formula:

PV = ∑ (CFt / (1 + r)^t)

Where: PV = present value of the bond CFt = cash flow at time t r = interest rate t = time period

Breaking Down the Formula

The formula consists of two main components: the cash flows and the discount rate. The cash flows include the periodic interest payments and the return of the principal investment at maturity. The discount rate is the interest rate used to calculate the present value of the cash flows.

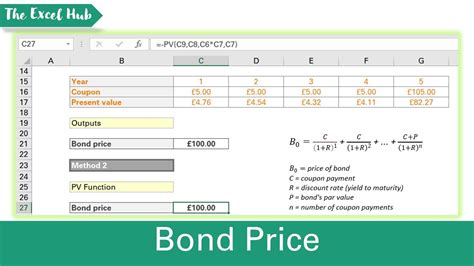

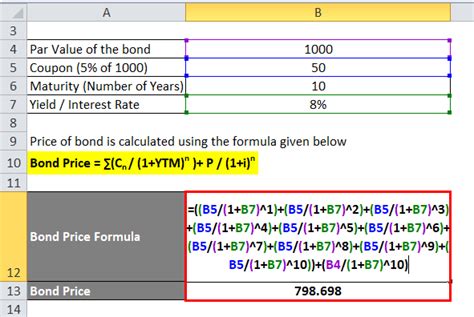

Calculating Bond Prices in Excel

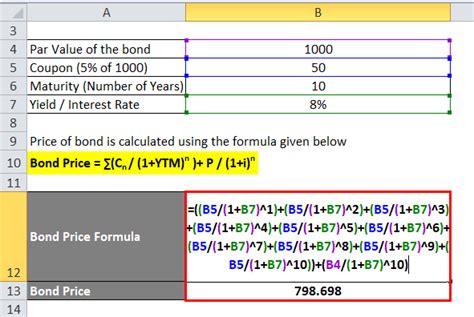

Now that we have a basic understanding of the bond pricing formula, let's move on to the Excel calculation. To calculate bond prices in Excel, we will use the following steps:

- Create a table with the bond's characteristics, including the face value, coupon rate, yield to maturity, and number of periods.

- Use the PV function to calculate the present value of the cash flows.

- Use the IPMT function to calculate the interest payments.

- Use the PPMT function to calculate the principal payments.

Here's an example of how to calculate bond prices in Excel:

| Face Value | Coupon Rate | Yield to Maturity | Number of Periods |

|---|---|---|---|

| 1000 | 5% | 6% | 10 |

Using the PV function, we can calculate the present value of the cash flows:

=PV(0.06,10,-50,1000,0)

Where: 0.06 = yield to maturity 10 = number of periods -50 = periodic interest payment 1000 = face value 0 = type (0 for ordinary annuity, 1 for annuity due)

The result is the present value of the bond, which is $921.97.

Using the IPMT and PPMT Functions

To calculate the interest payments, we can use the IPMT function:

=IPMT(0.06,10,-50,1000,1)

Where: 0.06 = yield to maturity 10 = number of periods -50 = periodic interest payment 1000 = face value 1 = type (1 for annuity due)

The result is the interest payment for the first period, which is $30.

To calculate the principal payments, we can use the PPMT function:

=PPMT(0.06,10,-50,1000,1)

Where: 0.06 = yield to maturity 10 = number of periods -50 = periodic interest payment 1000 = face value 1 = type (1 for annuity due)

The result is the principal payment for the first period, which is $20.

Gallery of Bond Pricing Examples

Bond Pricing Examples

Conclusion and Next Steps

Calculating bond prices in Excel can be a complex task, but by breaking it down into smaller steps and using the right formulas and functions, it can be made easy and efficient. By understanding the bond pricing formula and using the PV, IPMT, and PPMT functions, you can calculate bond prices with accuracy and confidence.

We hope this article has been informative and helpful in your bond pricing calculations. If you have any questions or need further assistance, please don't hesitate to comment below. We would love to hear from you and help you with your bond pricing needs.

Remember, practice makes perfect, so try calculating bond prices in Excel using the steps and formulas outlined in this article. With time and practice, you will become proficient in calculating bond prices and be able to make informed investment decisions.