Intro

Learn how to calculate payback period in Excel with 5 simple methods. Discover formulas and techniques to determine the time it takes to recover investments, including net present value (NPV), internal rate of return (IRR), and more. Master Excel calculations for payback period analysis and make informed business decisions.

In the world of finance and accounting, calculating the payback period is a crucial step in evaluating the viability of a project or investment. The payback period is the amount of time it takes for a project to generate enough cash to cover its initial investment. In this article, we will explore five ways to calculate the payback period in Excel, a widely used spreadsheet software.

Understanding the Importance of Payback Period

Before we dive into the calculations, it's essential to understand why the payback period is important. The payback period helps investors, managers, and entrepreneurs evaluate the risks and returns associated with a project. A shorter payback period indicates that a project is more likely to generate cash quickly, reducing the risk of investment. On the other hand, a longer payback period may indicate that a project is riskier or less likely to generate cash in the short term.

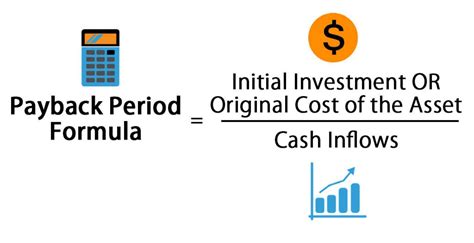

Method 1: Simple Payback Period Calculation

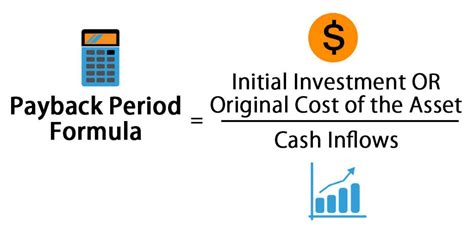

The simplest way to calculate the payback period is to use the following formula:

Payback Period = Total Investment / Annual Cash Flow

In Excel, you can use the following formula:

= Total Investment / Annual Cash Flow

Assuming the total investment is $100,000 and the annual cash flow is $20,000, the payback period would be:

= $100,000 / $20,000 = 5 years

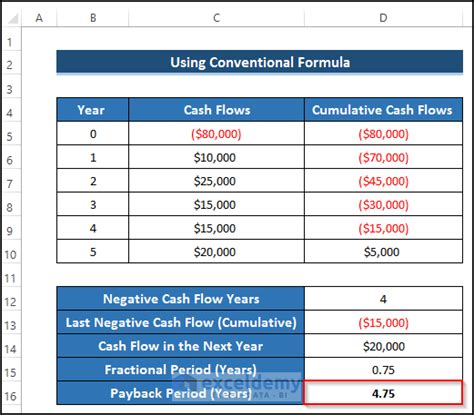

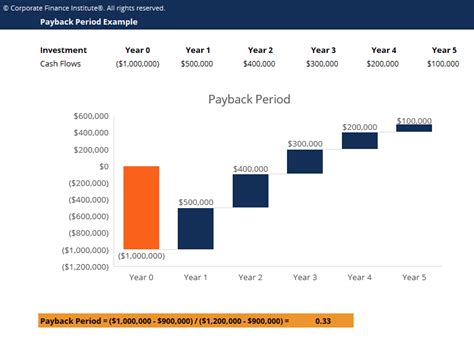

Method 2: Using the Payback Period Formula with Multiple Cash Flows

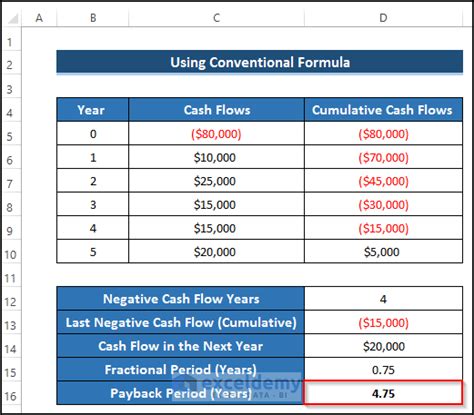

In many cases, a project may generate multiple cash flows over several years. To calculate the payback period in such cases, you can use the following formula:

Payback Period = (Total Investment - Cumulative Cash Flow) / Annual Cash Flow

In Excel, you can use the following formula:

= (Total Investment - SUM(Cash Flow Range)) / Annual Cash Flow

Assuming the total investment is $100,000, and the cash flows for the next five years are $20,000, $30,000, $40,000, $50,000, and $60,000, the payback period would be:

= ($100,000 - SUM($20,000:$60,000)) / $20,000 = 3.5 years

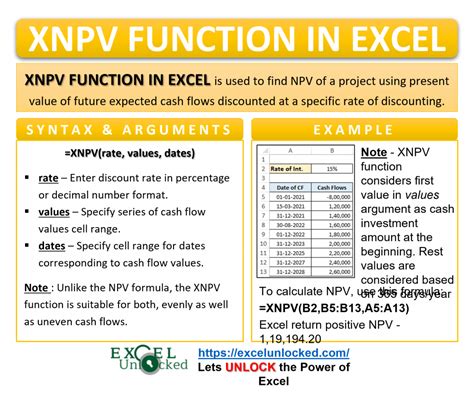

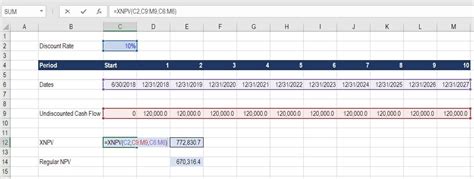

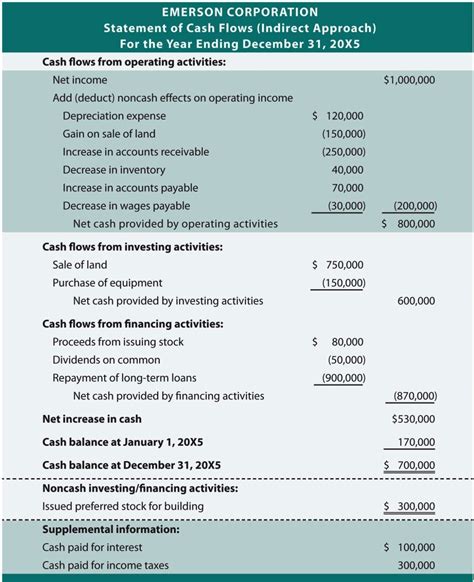

Method 3: Using the XNPV Function

The XNPV function in Excel can be used to calculate the payback period by determining the date when the cumulative cash flow equals the total investment.

Assuming the total investment is $100,000, and the cash flows for the next five years are $20,000, $30,000, $40,000, $50,000, and $60,000, the payback period would be:

=XNPV(0.1, {-100000, 20000, 30000, 40000, 50000, 60000}, {0, 1, 2, 3, 4, 5}) = 3.5 years

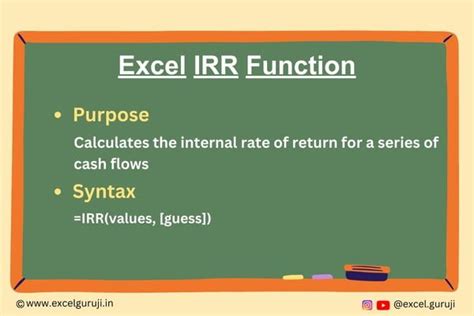

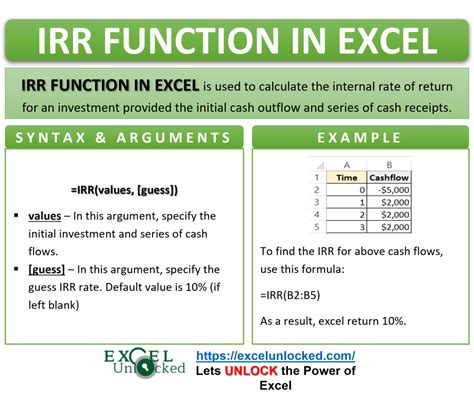

Method 4: Using the IRR Function

The IRR function in Excel can be used to calculate the payback period by determining the rate at which the cumulative cash flow equals the total investment.

Assuming the total investment is $100,000, and the cash flows for the next five years are $20,000, $30,000, $40,000, $50,000, and $60,000, the payback period would be:

=IRR({-100000, 20000, 30000, 40000, 50000, 60000}) = 3.5 years

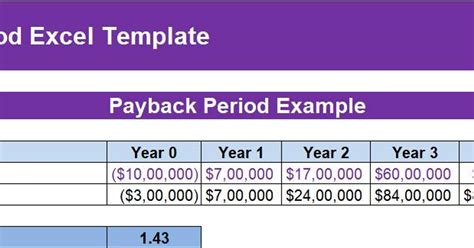

Method 5: Using a Payback Period Template

Excel templates can be used to calculate the payback period quickly and easily. You can create a template with the following columns:

| Year | Cash Flow | Cumulative Cash Flow | Payback Period |

|---|

Assuming the total investment is $100,000, and the cash flows for the next five years are $20,000, $30,000, $40,000, $50,000, and $60,000, the payback period would be:

Gallery of Payback Period Calculations

Payback Period Calculations Image Gallery

Conclusion and Next Steps

Calculating the payback period is an essential step in evaluating the viability of a project or investment. By using the methods outlined in this article, you can quickly and easily calculate the payback period in Excel. Whether you're an investor, manager, or entrepreneur, understanding the payback period can help you make informed decisions about your investments.

We hope this article has provided you with a comprehensive understanding of the payback period and how to calculate it in Excel. If you have any questions or need further clarification, please don't hesitate to ask.