Intro

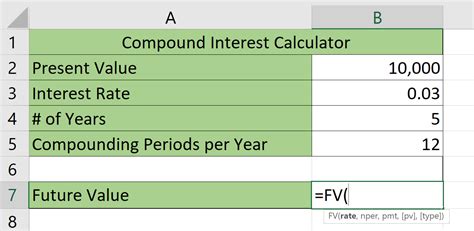

Unlock the power of compound interest with Excel! Discover 3 easy methods to calculate daily compound interest using formulas and functions. Learn how to harness the potential of compound interest rates, principal amounts, and time to maximize your investments and savings. Master Excels built-in functions, such as FV and IPMT, to simplify your calculations.

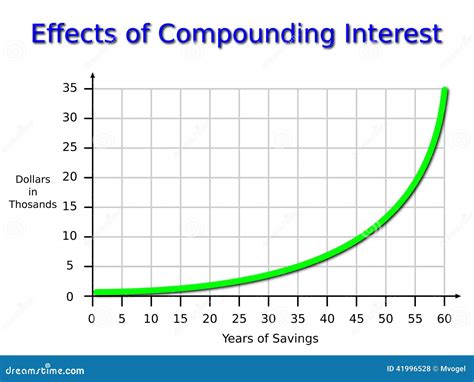

Understanding compound interest and how to calculate it is crucial for managing personal finances, investments, and business growth. Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods. Calculating compound interest daily can provide a more accurate picture of financial growth over time, as it takes into account the effect of daily compounding. Excel, with its powerful formula and function capabilities, offers a straightforward way to calculate compound interest daily. Here are three methods to do so:

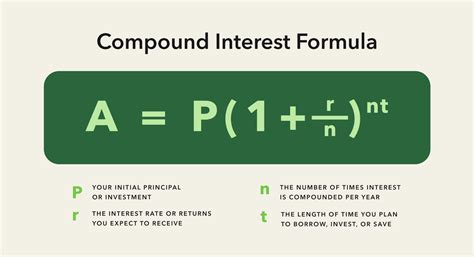

Understanding Compound Interest

Before diving into the methods, it's essential to understand the components of compound interest:

- Principal (P): The initial amount of money.

- Interest Rate (r): The rate at which interest is paid, usually expressed as a percentage.

- Time (n): The period over which the interest is calculated, expressed in years or days in our case.

- Compounding Frequency: How often the interest is compounded, which we will set to daily for these calculations.

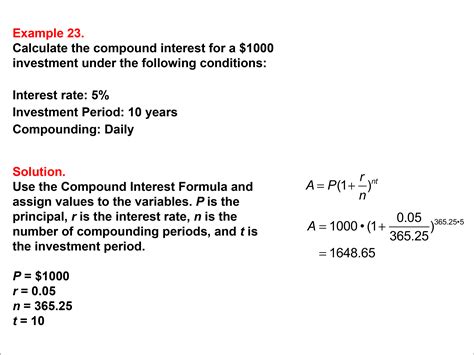

Method 1: Using the Formula for Compound Interest

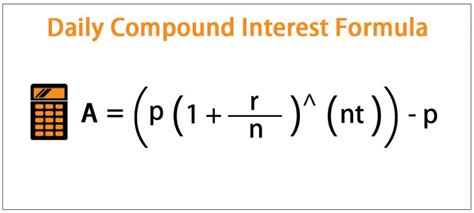

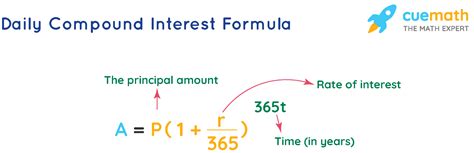

The formula for compound interest is:

[A = P \left(1 + \frac{r}{n}\right)^{nt}]

Where:

- A = the future value of the investment/loan, including interest

- P = principal investment amount (the initial deposit or loan amount)

- r = annual interest rate (decimal)

- n = number of times that interest is compounded per year

- t = time the money is invested or borrowed for, in years

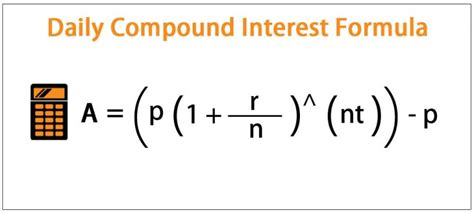

To calculate daily compound interest, you'll need to adjust the formula slightly:

- Convert the annual interest rate to a decimal: r = annual interest rate / 100

- Set n = 365 (days in a year) for daily compounding

- Convert the time to years (t)

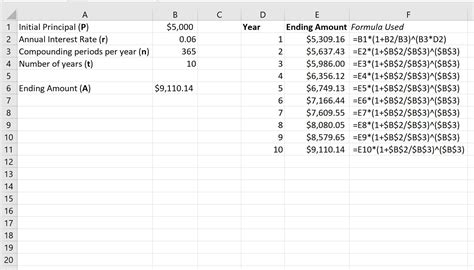

In Excel, this can be represented as:

=P*(1+r/n)^(n*t)

Where:

Pis the principal amountris the annual interest rate as a decimalnis 365 for daily compoundingtis the time in years

Example in Excel:

Assuming you have $1,000 (P) in a savings account with an annual interest rate of 5% (r=0.05), compounded daily over 5 years (t=5).

=1000*(1+0.05/365)^(365*5)

This will calculate the future value of your investment with daily compounding.

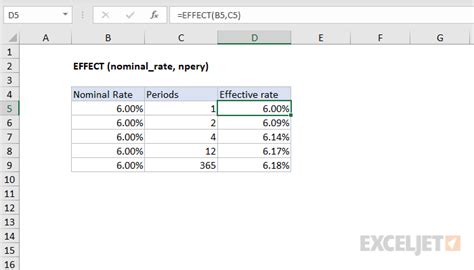

Method 2: Using the EFFECT Function

Excel provides a specific function for calculating the effective interest rate (EFFECT), which can be used in conjunction with the formula for compound interest to find the daily compound interest.

The syntax for the EFFECT function is:

EFFECT(nominal_rate, npery)

Where:

nominal_rateis the annual interest rate (in decimal form)nperyis the number of compounding periods per year (365 for daily)

You can then use the result as the effective daily interest rate in your compound interest formula.

Example in Excel:

Using the same scenario as before:

=1000*(1+EFFECT(0.05, 365))^(365*5)

However, this method is more about calculating the effective interest rate rather than directly calculating compound interest, so it's less straightforward for daily compound interest calculations.

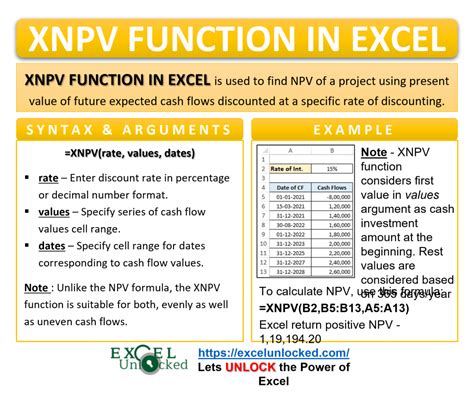

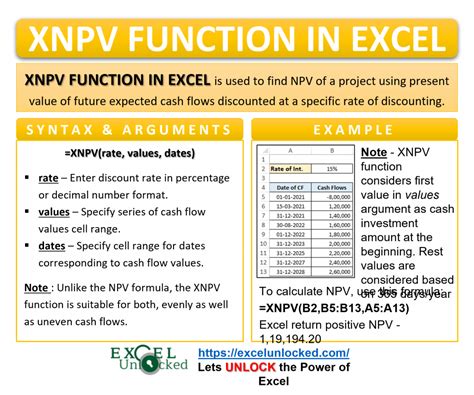

Method 3: Using the XNPV Function for More Complex Scenarios

For more complex scenarios where payments or withdrawals are made at irregular intervals, the XNPV function can be used. This function calculates the present value of a series of cash flows that occur at irregular intervals.

The syntax for the XNPV function is:

XNPV(rate, dates, cash flows)

Where:

rateis the interest rate (in decimal form) at which the cash flows are discounteddatesis a series of dates corresponding to the cash flowscash flowsis the series of cash flows that correspond to the dates

To calculate daily compound interest using XNPV, you would structure your cash flows and dates to represent the investment or loan scenario.

Example in Excel:

This method is more complex and typically used for scenarios involving multiple payments or withdrawals. For a simple investment scenario, the first method using the compound interest formula is more straightforward.

Calculating compound interest daily can significantly impact the perceived growth or cost of an investment or loan, providing a more accurate financial picture. Excel's capabilities, through its various formulas and functions, make it an indispensable tool for personal finance management and financial analysis.

Daily Compound Interest Image Gallery

We hope this comprehensive guide has helped you understand how to calculate compound interest daily in Excel. Whether you're managing personal finances, analyzing investments, or studying financial concepts, mastering these methods will provide you with a solid foundation in financial analysis. If you have any questions or need further clarification, feel free to ask in the comments below.