Intro

Streamline your accounting with our Excel General Ledger Template. Easily manage debits and credits with pre-formatted sheets and automatic calculations. Learn how to simplify your financial record-keeping, balance your books, and make informed decisions with our easy-to-use template, perfect for small businesses and financial professionals alike.

Managing finances is a crucial aspect of any business or personal endeavor. One of the most important tools for financial management is the general ledger, which serves as a central repository for all financial transactions. Understanding how to effectively use a general ledger template in Excel can significantly simplify your financial record-keeping and analysis. In this article, we'll delve into the basics of debits and credits within the context of an Excel general ledger template, making financial management easier for you.

The significance of a general ledger lies in its ability to provide a comprehensive overview of a company's financial health. It's the backbone of the accounting system, recording every financial transaction and organizing them in a way that's easy to understand and analyze. By using an Excel general ledger template, you can streamline your financial management processes, from tracking transactions to preparing financial statements.

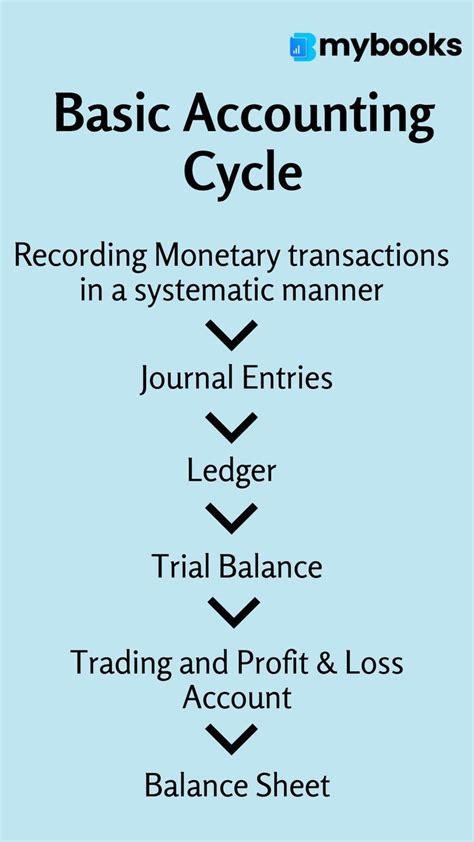

Understanding Debits and Credits

Before diving into how to use an Excel general ledger template, it's essential to grasp the fundamental concepts of debits and credits. These are the basic building blocks of accounting and are crucial for accurately recording financial transactions.

- Debits: A debit is an entry that increases an asset account or decreases a liability account. It's recorded on the left side of the ledger.

- Credits: A credit is an entry that decreases an asset account or increases a liability account. It's recorded on the right side of the ledger.

Every financial transaction involves at least two accounts: one that is debited and another that is credited. The total value of debits must always equal the total value of credits for each transaction.

How Debits and Credits Work Together

To illustrate how debits and credits work together, consider a simple transaction. Suppose a company purchases office supplies worth $100. In this case:

- The asset account "Office Supplies" is increased by $100, so it's debited.

- The equity account "Cash" (which is considered an asset) is decreased by $100 because the company pays for the supplies, so it's credited.

Here's a simple representation:

| Account | Debit | Credit |

|---|---|---|

| Office Supplies | $100 | |

| Cash | $100 |

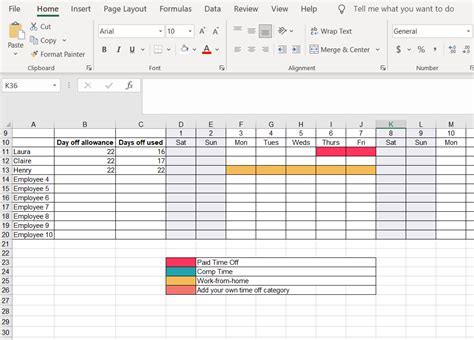

Setting Up an Excel General Ledger Template

To set up an Excel general ledger template, follow these steps:

-

Create a New Excel Workbook: Open Excel and create a new workbook. Give it a name that reflects its purpose, such as "General Ledger Template."

-

Set Up the Ledger Structure: In the first sheet, create columns for the date, account name, debit, and credit. You can also include additional columns for the account number, transaction description, and running balance.

-

Input Accounts: List all your company's accounts in a separate sheet. This includes asset, liability, equity, revenue, and expense accounts.

-

Enter Transactions: For each financial transaction, enter the date, account names involved, and the debit or credit amount. Ensure that each transaction's debits equal its credits.

-

Calculate Running Balance: Use Excel formulas to calculate the running balance for each account. This will help you see the current state of your accounts at any time.

Benefits of Using an Excel General Ledger Template

Using an Excel general ledger template offers several benefits, including:

- Easy to Set Up and Use: Excel is a familiar platform for many, making it easy to set up and use a general ledger template.

- Flexibility: You can customize the template to fit your specific accounting needs.

- Automatic Calculations: Excel's formula capabilities allow for automatic calculations of balances and totals, reducing the risk of errors.

- ** Scalability:** As your business grows, your Excel general ledger template can grow with it, handling more accounts and transactions.

Best Practices for Managing Your Excel General Ledger Template

To get the most out of your Excel general ledger template, consider the following best practices:

- Regularly Back Up Your Data: Protect your financial records by regularly backing up your Excel workbook.

- Use Password Protection: Secure your financial data by password-protecting your workbook.

- Keep It Organized: Use clear and descriptive account names and ensure that your transactions are well-documented.

- Review and Reconcile: Regularly review your accounts and reconcile any discrepancies to ensure accuracy.

Tips for Efficient Financial Analysis

- Use Excel Formulas: Leverage Excel's powerful formula capabilities to analyze your financial data, such as calculating ratios and trends.

- Create Charts and Graphs: Visualize your financial data using charts and graphs to better understand your company's financial health.

- Set Up Dashboards: Create a financial dashboard to provide a quick overview of your company's key financial metrics.

Gallery of Excel General Ledger Templates

Excel General Ledger Template Gallery

We hope this article has provided you with a comprehensive understanding of how to use an Excel general ledger template effectively, focusing on the core concepts of debits and credits. By implementing these strategies and best practices, you can significantly enhance your financial management capabilities. Remember, effective financial management is key to the success of any business or personal financial endeavor.

Feel free to share your thoughts or ask questions about using Excel general ledger templates in the comments below.