Intro

Calculate pro rata amounts with ease using our expert guide to Excel Pro Rata Calculator. Learn how to simplify financial calculations, allocate costs, and perform proportional adjustments. Master Excel formulas and functions, including proportion, percentage, and ratio calculations, to streamline your financial analysis and budgeting tasks.

Excel is an incredibly powerful tool for financial calculations, and one of its most useful features is the ability to calculate pro rata amounts with ease. Pro rata calculations are essential in various financial scenarios, such as allocating costs, distributing dividends, or calculating partial payments. In this article, we will delve into the world of pro rata calculations in Excel, exploring the benefits, formulas, and practical examples to help you master this valuable skill.

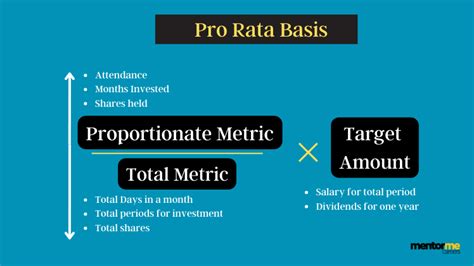

What is Pro Rata Calculation?

Pro rata calculation is a method of allocating a specific amount or percentage of a total sum to individual parties or entities based on their respective shares or proportions. This calculation is commonly used in finance, accounting, and business to ensure fair distribution of resources, costs, or benefits.

Benefits of Pro Rata Calculation in Excel

Using Excel for pro rata calculations offers several benefits, including:

- Accuracy: Excel's formulas and functions ensure precise calculations, reducing errors and discrepancies.

- Efficiency: Excel automates the calculation process, saving time and effort compared to manual calculations.

- Flexibility: Excel allows for easy modification of formulas and data, making it simple to update and adjust calculations as needed.

- Scalability: Excel can handle large datasets and complex calculations with ease, making it an ideal tool for large-scale financial analysis.

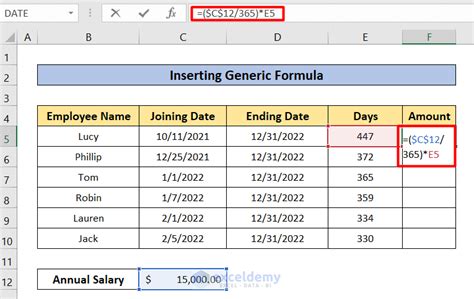

Pro Rata Formula in Excel

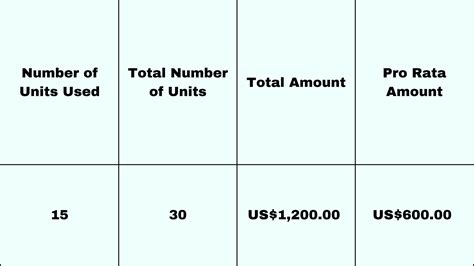

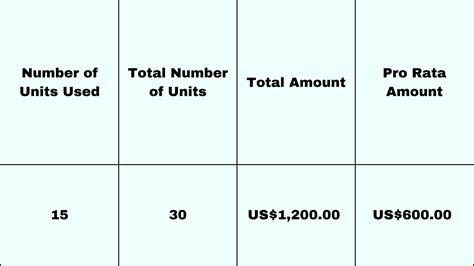

The pro rata formula in Excel is relatively simple and can be expressed as:

Pro Rata Amount = (Total Amount x Individual Share) / Total Share

Where:

- Total Amount is the total sum to be allocated

- Individual Share is the proportion or share of the individual entity

- Total Share is the total proportion or share of all entities

In Excel, this formula can be represented as:

= (Total_Amount * Individual_Share) / Total_Share

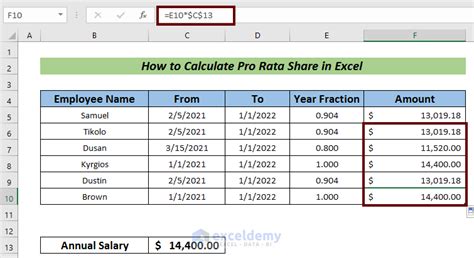

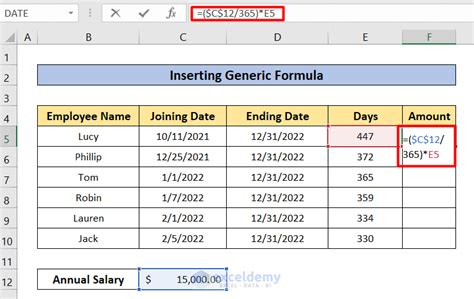

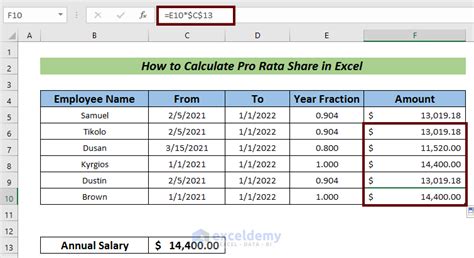

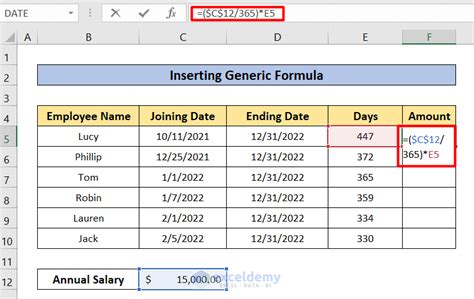

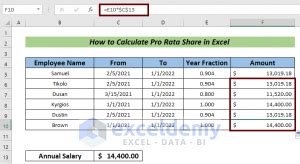

Example: Calculating Pro Rata Amounts for Employee Bonuses

Suppose a company wants to distribute a total bonus amount of $100,000 among its employees based on their individual performance ratings. The performance ratings are as follows:

| Employee | Performance Rating |

|---|---|

| John | 80% |

| Jane | 70% |

| Bob | 90% |

To calculate the pro rata bonus amount for each employee, we can use the formula:

= (Total_Bonus * Performance_Rating) / Total_Rating

Assuming the total rating is 240% (80% + 70% + 90%), the calculations would be:

| Employee | Pro Rata Bonus Amount |

|---|---|

| John | $33,333.33 |

| Jane | $29,166.67 |

| Bob | $37,500.00 |

Common Pro Rata Calculation Scenarios in Excel

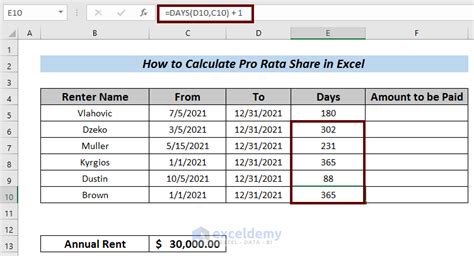

Pro rata calculations are used in various financial scenarios, including:

- Allocating costs or expenses among departments or projects

- Distributing dividends or profits among shareholders

- Calculating partial payments or refunds

- Determining insurance premiums or payouts

In each of these scenarios, the pro rata formula can be applied to ensure fair and accurate allocations.

Best Practices for Pro Rata Calculations in Excel

To ensure accurate and efficient pro rata calculations in Excel, follow these best practices:

- Use clear and concise labels for formulas and data

- Organize data in a logical and structured manner

- Use formulas and functions consistently throughout the calculation

- Verify calculations for accuracy and consistency

- Document calculations and formulas for future reference

By following these best practices and mastering the pro rata formula, you can unlock the full potential of Excel for financial calculations and make informed decisions with confidence.

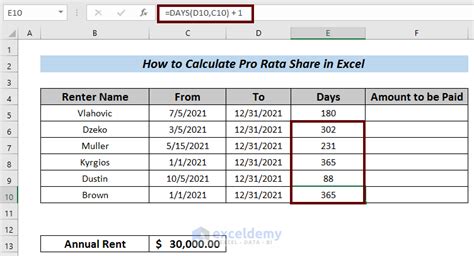

Excel Pro Rata Calculator Image Gallery

We hope this comprehensive guide to Excel pro rata calculations has been informative and helpful. Whether you're a financial professional or a business owner, mastering pro rata calculations can save you time and ensure accuracy in your financial analysis. Share your thoughts and experiences with pro rata calculations in the comments below, and don't hesitate to reach out if you have any questions or need further clarification.