Intro

Streamline your financial management with the Notion expense tracker template. Discover 5 expert ways to optimize your finances using this powerful tool, including budgeting, expense categorization, and automation. Boost your financial literacy and take control of your spending with actionable tips and tricks for a stress-free financial life.

Effective financial management is crucial for achieving stability and security in today's fast-paced world. One powerful tool that can help you optimize your finances is the Expense Tracker Notion template. This versatile template offers a comprehensive solution for monitoring and managing your expenses, providing valuable insights that can inform your financial decisions. In this article, we'll explore five ways you can use the Expense Tracker Notion template to streamline your financial management.

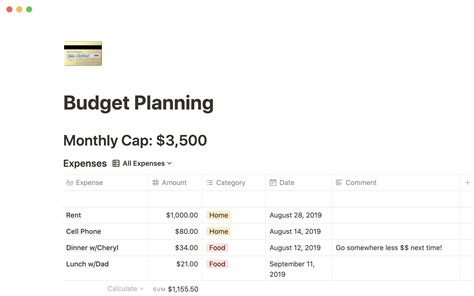

1. Categorize and Track Your Expenses

One of the primary benefits of using the Expense Tracker Notion template is its ability to categorize and track your expenses. By dividing your expenditures into distinct categories, such as housing, transportation, and entertainment, you can gain a deeper understanding of where your money is going. This information can help you identify areas where you can cut back and make adjustments to achieve a more balanced budget.

To set up categorization in your Expense Tracker Notion template, simply create separate pages or sections for each category. Then, use the template's built-in tables or databases to log each expense, assigning it to the relevant category. This will enable you to generate reports and analyze your spending habits with ease.

Benefits of Categorization

- Gain a clear understanding of your spending habits

- Identify areas for cost reduction

- Make informed decisions about budget allocation

- Enhance financial discipline and responsibility

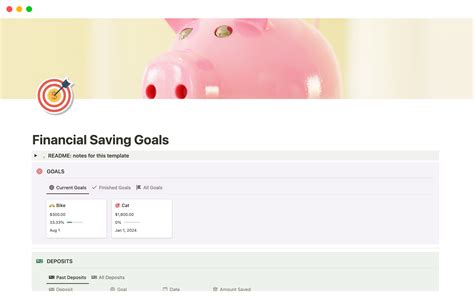

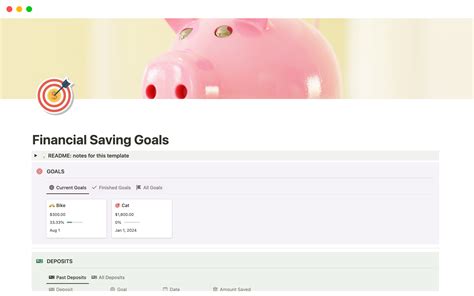

2. Set Financial Goals and Objectives

Setting financial goals and objectives is a crucial step in achieving financial stability. The Expense Tracker Notion template can help you establish clear goals and objectives by providing a framework for tracking progress and measuring success.

To set financial goals in your Expense Tracker Notion template, create a dedicated page or section for goal setting. Use the template's built-in tables or databases to outline specific objectives, such as saving for a down payment on a house or paying off debt. Then, track your progress over time, using the template's reporting features to stay on track.

Benefits of Setting Financial Goals

- Clarify financial priorities and objectives

- Enhance motivation and discipline

- Measure progress and adjust strategies as needed

- Achieve a sense of accomplishment and financial stability

3. Automate Expense Tracking with Integrations

Manual expense tracking can be time-consuming and prone to errors. The Expense Tracker Notion template offers a range of integrations that can help automate the process, saving you time and reducing the risk of mistakes.

To automate expense tracking in your Expense Tracker Notion template, explore the various integrations available, such as linking your bank accounts or credit cards. This will enable you to import transactions directly into your template, streamlining the tracking process and reducing the need for manual entry.

Benefits of Automation

- Save time and reduce manual entry

- Minimize errors and inaccuracies

- Enhance the accuracy and reliability of your financial data

- Focus on higher-level financial analysis and decision-making

4. Visualize Your Financial Data with Dashboards

Effective financial management requires a clear understanding of your financial data. The Expense Tracker Notion template offers a range of visualization tools, including dashboards, that can help you gain insights into your financial performance.

To create a dashboard in your Expense Tracker Notion template, use the template's built-in visualization tools to design a custom dashboard. This can include charts, graphs, and tables that provide a snapshot of your financial data, enabling you to quickly identify trends and patterns.

Benefits of Visualization

- Gain a clear understanding of your financial performance

- Identify trends and patterns in your spending habits

- Enhance decision-making with data-driven insights

- Improve financial discipline and responsibility

5. Collaborate with Others and Share Financial Insights

Effective financial management often requires collaboration with others, such as partners, family members, or financial advisors. The Expense Tracker Notion template offers a range of collaboration tools that can help you share financial insights and work together to achieve common goals.

To collaborate with others in your Expense Tracker Notion template, use the template's built-in sharing features to invite others to edit or view your template. This can include granting permission to specific pages or sections, enabling others to contribute to your financial planning and decision-making.

Benefits of Collaboration

- Enhance financial communication and transparency

- Improve financial decision-making with shared insights

- Foster a sense of teamwork and cooperation

- Achieve common financial goals and objectives

Expense Tracker Notion Template Image Gallery

By implementing these five strategies, you can optimize your finances with the Expense Tracker Notion template, achieving a more balanced budget, reducing financial stress, and improving your overall financial well-being. Whether you're an individual or a business, this versatile template offers a powerful solution for managing your expenses and achieving your financial goals.