Intro

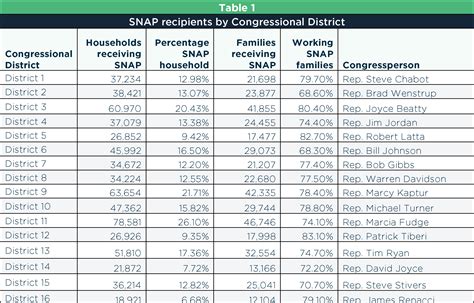

Maximize your Ohio food stamps benefits with these 5 expert tips. Discover how to get extra food assistance, navigate the Supplemental Nutrition Assistance Program (SNAP), and access additional resources like EBT perks and nutrition incentives. Learn how to optimize your benefits and make the most of Ohios food stamp program.

Receiving Ohio food stamps can be a vital lifeline for many individuals and families struggling to make ends meet. The Supplemental Nutrition Assistance Program (SNAP) provides essential support to help purchase groceries and maintain a healthy diet. However, for many recipients, the standard benefits may not be enough to cover their monthly food expenses. Fortunately, there are several ways to potentially increase your Ohio food stamps benefits. In this article, we will explore five methods to help you get extra benefits and make the most of your SNAP assistance.

Understanding Ohio Food Stamps Eligibility

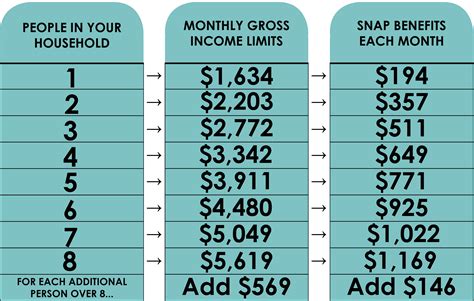

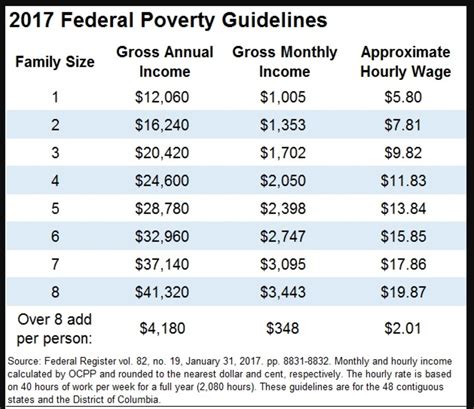

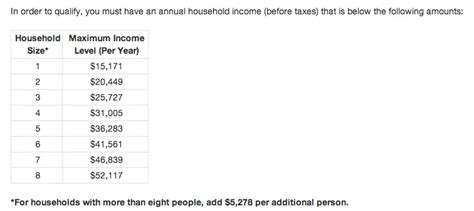

Before we dive into the ways to increase your benefits, it's essential to understand the eligibility requirements for Ohio food stamps. To qualify, applicants must meet specific income and resource guidelines, which vary depending on household size and composition. Generally, households with gross incomes below 130% of the federal poverty level (FPL) may be eligible for SNAP benefits. Additionally, applicants must also meet specific work requirements, such as registering for work or participating in a job training program.

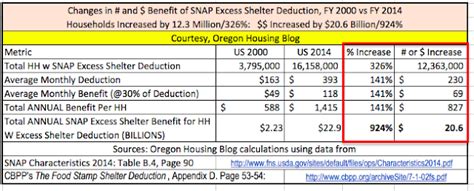

1. Claiming Excess Shelter Expenses

One way to increase your Ohio food stamps benefits is by claiming excess shelter expenses. If your household's shelter expenses exceed 50% of your gross income, you may be eligible for a deduction. This can include rent or mortgage payments, utilities, and other related expenses. By claiming these expenses, you may be able to reduce your household's net income, which can result in higher SNAP benefits.

How to Calculate Excess Shelter Expenses

To calculate excess shelter expenses, you will need to gather documentation of your household's shelter costs, including:

- Rent or mortgage payments

- Utility bills (electricity, gas, water, etc.)

- Property taxes

- Homeowners insurance

Once you have gathered this information, you can calculate your excess shelter expenses by subtracting 50% of your gross income from your total shelter costs. If the result is a positive number, you may be eligible for a deduction.

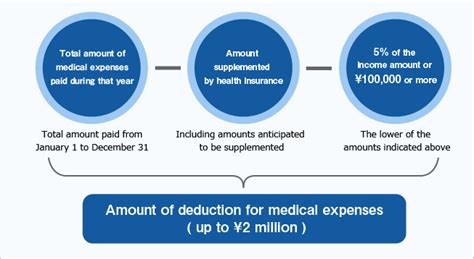

2. Utilizing the Standard Medical Expense Deduction

Another way to increase your Ohio food stamps benefits is by utilizing the standard medical expense deduction. If you or a household member has a disability or illness that requires ongoing medical expenses, you may be eligible for a deduction. This can include expenses such as:

- Medical bills

- Prescription medication

- Medical equipment

- Transportation costs related to medical care

To qualify for the standard medical expense deduction, you will need to provide documentation of your medical expenses, including receipts and invoices.

How to Calculate the Standard Medical Expense Deduction

To calculate the standard medical expense deduction, you will need to gather documentation of your household's medical expenses. Once you have gathered this information, you can calculate your deduction by subtracting any reimbursements or insurance payments from your total medical expenses.

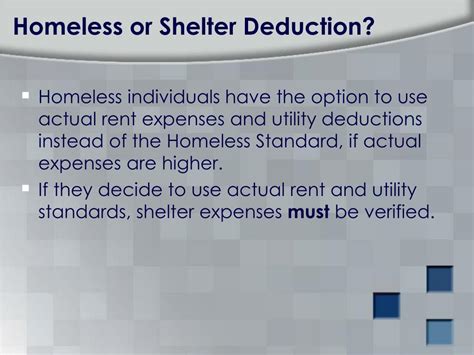

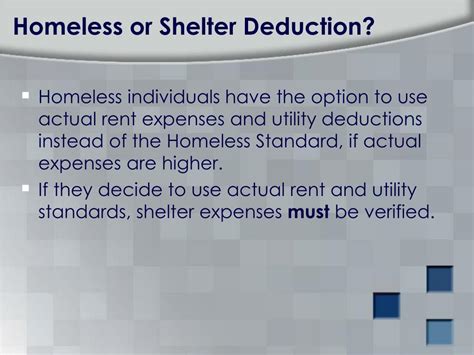

3. Applying for the Homeless Shelter Expense Deduction

If you or a household member is homeless, you may be eligible for the homeless shelter expense deduction. This deduction can help reduce your household's net income, resulting in higher SNAP benefits.

To qualify for the homeless shelter expense deduction, you will need to provide documentation of your homeless status, including:

- A letter from a homeless shelter or social services agency

- A lease agreement or rental receipt

Once you have gathered this information, you can calculate your deduction by subtracting any income or benefits from your total shelter expenses.

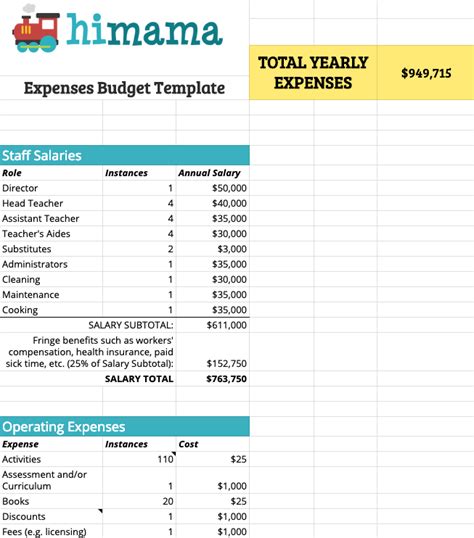

4. Claiming Child Care Expenses

If you or a household member is working or attending school, you may be eligible to claim child care expenses as a deduction. This can include expenses such as:

- Daycare costs

- After-school program costs

- Babysitting costs

To qualify for the child care expense deduction, you will need to provide documentation of your child care expenses, including receipts and invoices.

How to Calculate Child Care Expenses

To calculate your child care expenses, you will need to gather documentation of your child care costs. Once you have gathered this information, you can calculate your deduction by subtracting any reimbursements or subsidies from your total child care expenses.

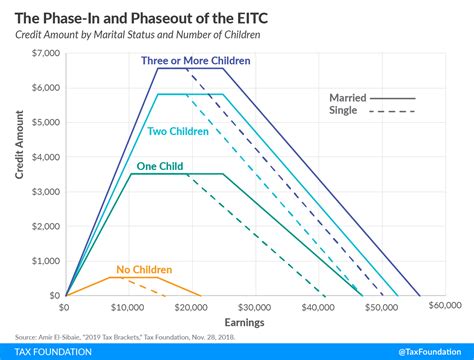

5. Applying for the Earned Income Tax Credit (EITC)

Finally, if you or a household member is working, you may be eligible for the Earned Income Tax Credit (EITC). The EITC is a tax credit that can help reduce your household's net income, resulting in higher SNAP benefits.

To qualify for the EITC, you will need to meet specific income and eligibility guidelines. You can claim the EITC when you file your taxes, and the credit will be applied to your SNAP benefits.

Gallery of Ohio Food Stamps Images

Ohio Food Stamps Image Gallery

We hope this article has provided you with valuable information on how to increase your Ohio food stamps benefits. By claiming excess shelter expenses, utilizing the standard medical expense deduction, applying for the homeless shelter expense deduction, claiming child care expenses, and applying for the Earned Income Tax Credit (EITC), you may be able to receive additional benefits to help support your household's nutritional needs.

If you have any questions or would like to learn more about Ohio food stamps, please don't hesitate to reach out to us. You can also share your experiences or ask questions in the comments section below.