Intro

Maximize your tax refund with our expert guide on using a federal tax calculator in Excel. Discover 7 ways to simplify tax calculations, reduce errors, and optimize deductions. Learn how to leverage Excel formulas, functions, and templates to streamline your tax preparation process, including income tax, payroll tax, and more.

Calculating federal taxes can be a daunting task, especially for those who are not familiar with the intricacies of tax laws. However, with the help of a federal tax calculator in Excel, individuals can easily estimate their tax liability and make informed decisions about their financial planning. In this article, we will explore seven ways to use a federal tax calculator in Excel, making it easier for you to navigate the complex world of taxes.

What is a Federal Tax Calculator in Excel?

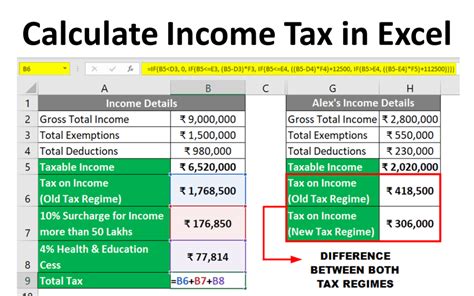

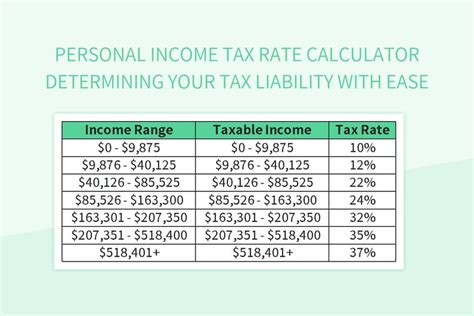

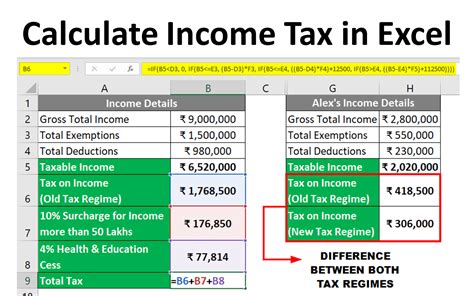

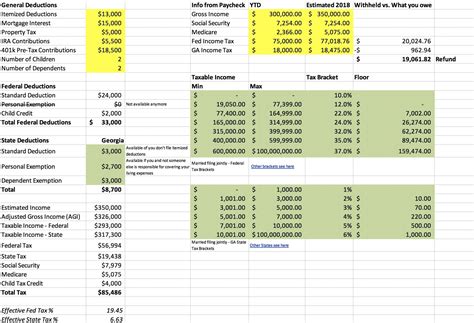

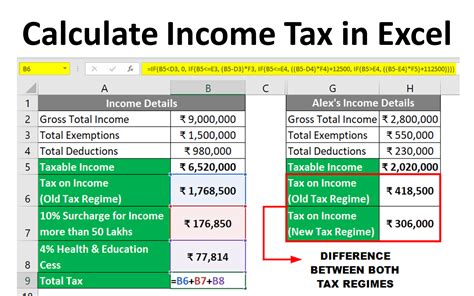

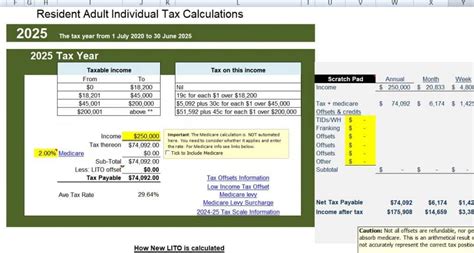

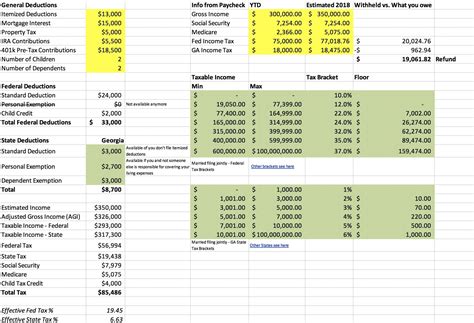

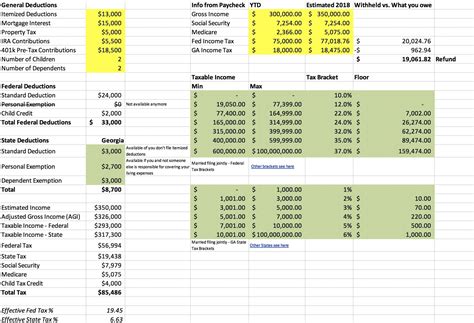

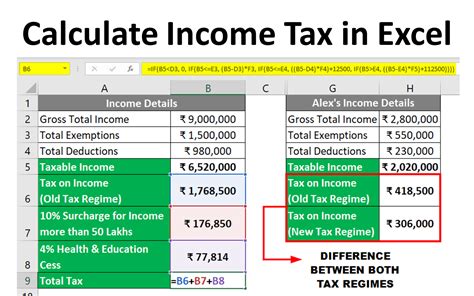

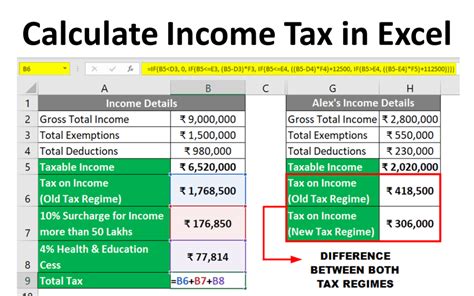

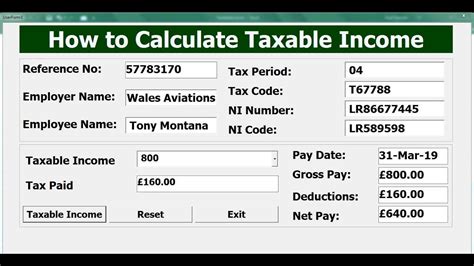

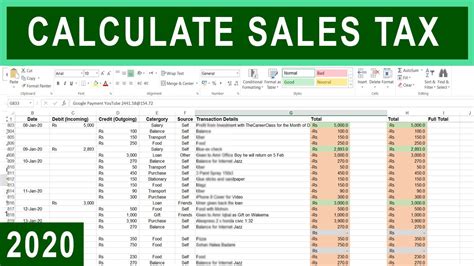

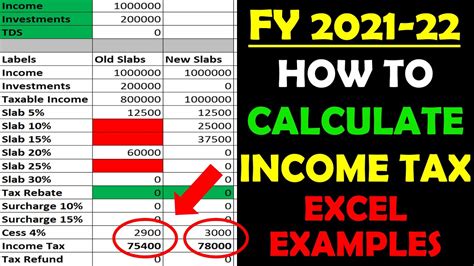

A federal tax calculator in Excel is a spreadsheet template that uses formulas and tables to calculate an individual's federal tax liability based on their income, filing status, and other relevant factors. These calculators are designed to simplify the tax calculation process, eliminating the need for manual calculations and reducing the risk of errors.

Benefits of Using a Federal Tax Calculator in Excel

Using a federal tax calculator in Excel offers several benefits, including:

- Accuracy: The calculator ensures that calculations are accurate and up-to-date, reflecting the latest tax laws and rates.

- Speed: The calculator saves time and effort, allowing individuals to quickly estimate their tax liability.

- Flexibility: The calculator can be customized to accommodate different income scenarios, making it easier to explore "what-if" situations.

7 Ways to Use a Federal Tax Calculator in Excel

Here are seven ways to use a federal tax calculator in Excel, helping you to make the most of this valuable tool:

1. Estimate Tax Liability

The most obvious use of a federal tax calculator in Excel is to estimate tax liability. By inputting your income, filing status, and other relevant information, the calculator can quickly provide an estimate of your federal tax liability.

2. Plan for Tax Savings

A federal tax calculator in Excel can help individuals plan for tax savings by identifying opportunities for deductions and credits. By experimenting with different scenarios, you can optimize your tax strategy and minimize your tax liability.

3. Explore "What-If" Scenarios

The calculator allows you to explore different income scenarios, making it easier to understand how changes in income or filing status can impact your tax liability. This feature is particularly useful for individuals who are considering a job change or retirement.

4. Compare Tax Rates

A federal tax calculator in Excel can help individuals compare tax rates across different filing statuses or income levels. This feature is useful for individuals who are considering a change in filing status or who want to understand how tax rates change as income increases.

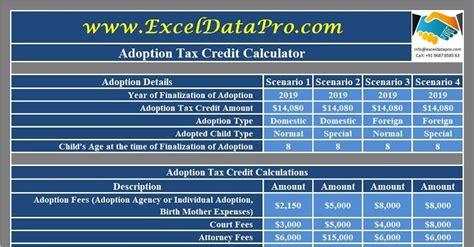

5. Identify Tax Credits

The calculator can help individuals identify tax credits that they may be eligible for, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit. By claiming these credits, individuals can reduce their tax liability and increase their refund.

6. Plan for Quarterly Estimated Tax Payments

For individuals who are self-employed or have other sources of income that are not subject to withholding, a federal tax calculator in Excel can help plan for quarterly estimated tax payments. By using the calculator to estimate tax liability, individuals can ensure that they are making timely and accurate payments.

7. Review and Revise Tax Strategy

Finally, a federal tax calculator in Excel can help individuals review and revise their tax strategy. By regularly reviewing their tax situation and adjusting their strategy as needed, individuals can ensure that they are minimizing their tax liability and maximizing their refund.

Gallery of Federal Tax Calculator in Excel

Federal Tax Calculator in Excel Image Gallery

By using a federal tax calculator in Excel, individuals can simplify the tax calculation process, reduce errors, and make informed decisions about their financial planning. Whether you are a tax professional or an individual looking to estimate your tax liability, a federal tax calculator in Excel is a valuable tool that can help you achieve your goals.