Intro

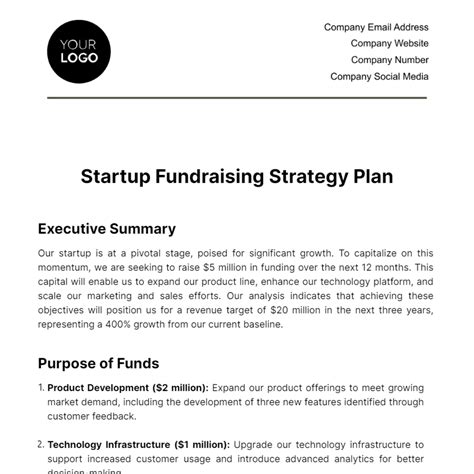

Create a solid financial foundation for your startup with these 5 essential templates. Master budgeting, forecasting, and cash flow management with our expert-approved templates. From startup costs to revenue projections, these tools will help you make informed decisions and secure funding. Boost your financial planning and drive business success.

Effective financial planning is crucial for the success of any startup. It helps entrepreneurs make informed decisions, secure funding, and drive growth. In this article, we will explore five essential templates for startup financial planning. These templates will help you create a comprehensive financial plan, track your expenses, and make data-driven decisions.

Creating a solid financial foundation is essential for startups. It helps entrepreneurs to manage cash flow, forecast revenue, and make strategic decisions. A well-planned financial strategy can make all the difference between success and failure. In this article, we will discuss the importance of financial planning for startups and provide five essential templates to help you get started.

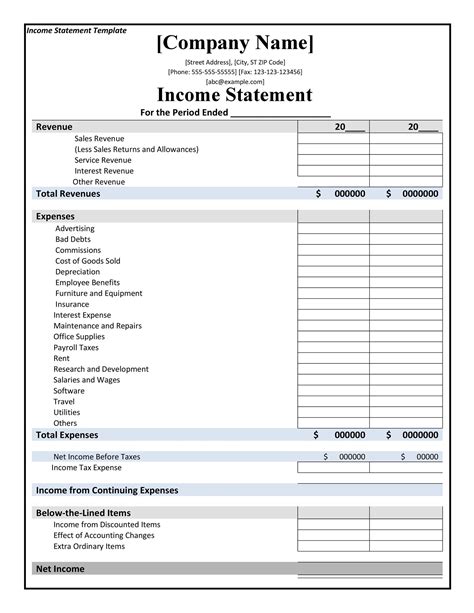

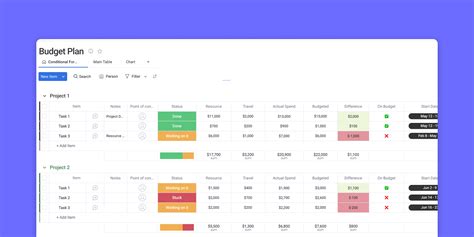

Template 1: Income Statement Template

An income statement, also known as a profit and loss statement, is a critical financial document that outlines your startup's revenue and expenses. It provides a snapshot of your company's financial performance over a specific period. Our income statement template will help you track your revenue, cost of goods sold, operating expenses, and net income.

- Revenue: List all your revenue streams, including sales, services, and any other sources of income.

- Cost of Goods Sold: Calculate the direct costs associated with producing and selling your products or services.

- Gross Profit: Calculate the difference between revenue and cost of goods sold.

- Operating Expenses: List all your operating expenses, including salaries, rent, marketing, and other overheads.

- Net Income: Calculate the net income by subtracting operating expenses from gross profit.

Benefits of Using an Income Statement Template

- Track your revenue and expenses: Identify areas where you can cut costs and optimize your financial performance.

- Make informed decisions: Use your income statement to make data-driven decisions about investments, pricing, and resource allocation.

- Improve cash flow management: Monitor your cash flow and make adjustments to ensure you have sufficient funds to meet your financial obligations.

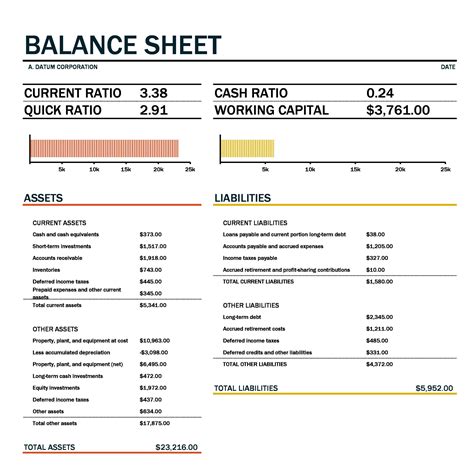

Template 2: Balance Sheet Template

A balance sheet provides a snapshot of your startup's financial position at a specific point in time. It outlines your assets, liabilities, and equity. Our balance sheet template will help you track your company's financial health and make informed decisions about investments and funding.

- Assets: List all your assets, including cash, inventory, equipment, and property.

- Liabilities: List all your liabilities, including loans, accounts payable, and other debts.

- Equity: Calculate your equity by subtracting liabilities from assets.

Benefits of Using a Balance Sheet Template

- Monitor your financial health: Track your assets, liabilities, and equity to ensure you have a solid financial foundation.

- Make informed decisions: Use your balance sheet to make data-driven decisions about investments, funding, and resource allocation.

- Identify areas for improvement: Identify areas where you can optimize your financial performance and improve your bottom line.

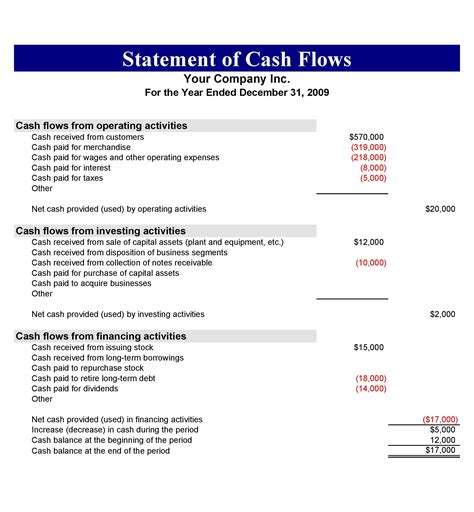

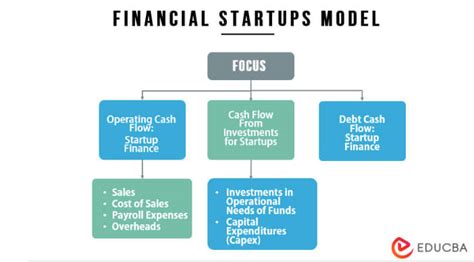

Template 3: Cash Flow Statement Template

A cash flow statement outlines your startup's inflows and outflows of cash over a specific period. It helps you track your cash flow and make informed decisions about investments and funding. Our cash flow statement template will help you identify areas where you can optimize your cash flow and improve your financial performance.

- Operating Activities: List all your operating activities, including cash received from customers and cash paid to suppliers.

- Investing Activities: List all your investing activities, including purchases of equipment and investments in other companies.

- Financing Activities: List all your financing activities, including loans and equity investments.

Benefits of Using a Cash Flow Statement Template

- Track your cash flow: Monitor your inflows and outflows of cash to ensure you have sufficient funds to meet your financial obligations.

- Make informed decisions: Use your cash flow statement to make data-driven decisions about investments, funding, and resource allocation.

- Identify areas for improvement: Identify areas where you can optimize your cash flow and improve your financial performance.

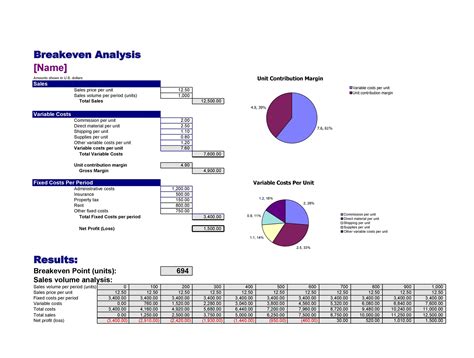

Template 4: Break-Even Analysis Template

A break-even analysis helps you determine the point at which your startup's revenue equals its total fixed and variable costs. It helps you identify the sales volume required to break even and make a profit. Our break-even analysis template will help you calculate your break-even point and make informed decisions about pricing and production.

- Fixed Costs: List all your fixed costs, including rent, salaries, and equipment.

- Variable Costs: List all your variable costs, including materials, labor, and marketing.

- Revenue: Calculate your revenue based on your sales volume and pricing.

- Break-Even Point: Calculate the break-even point by dividing your fixed costs by your contribution margin.

Benefits of Using a Break-Even Analysis Template

- Determine your break-even point: Calculate the sales volume required to break even and make a profit.

- Make informed decisions: Use your break-even analysis to make data-driven decisions about pricing, production, and resource allocation.

- Identify areas for improvement: Identify areas where you can optimize your financial performance and improve your bottom line.

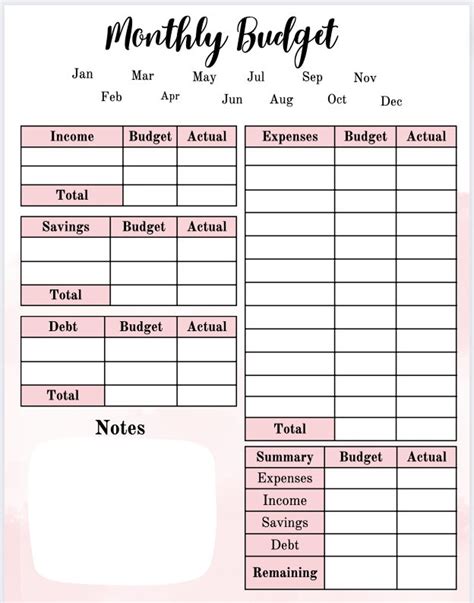

Template 5: Budgeting Template

A budgeting template helps you plan and manage your startup's finances over a specific period. It helps you track your income and expenses, identify areas for cost savings, and make informed decisions about investments and funding. Our budgeting template will help you create a comprehensive budget that aligns with your business goals.

- Income: List all your income streams, including sales, services, and any other sources of income.

- Fixed Expenses: List all your fixed expenses, including rent, salaries, and equipment.

- Variable Expenses: List all your variable expenses, including materials, labor, and marketing.

- Capital Expenditures: List all your capital expenditures, including equipment, property, and investments.

Benefits of Using a Budgeting Template

- Track your income and expenses: Monitor your financial performance and identify areas for cost savings.

- Make informed decisions: Use your budget to make data-driven decisions about investments, funding, and resource allocation.

- Achieve your business goals: Create a comprehensive budget that aligns with your business goals and helps you achieve success.

Startup Financial Planning Image Gallery

In conclusion, startup financial planning is a critical component of any successful business. By using the five essential templates outlined in this article, you can create a comprehensive financial plan, track your expenses, and make data-driven decisions. Remember to monitor your cash flow, track your income and expenses, and identify areas for cost savings. With a solid financial foundation, you can drive growth, secure funding, and achieve your business goals.

We hope this article has provided you with valuable insights and practical tools to help you manage your startup's finances effectively. If you have any questions or comments, please feel free to share them with us.