Calculating income tax can be a daunting task, especially for those who are not familiar with the intricacies of tax laws. However, with the help of Excel, this process can be simplified and made more efficient. In this article, we will explore how to use Excel formulas to calculate income tax, making it easier for individuals and businesses to manage their tax obligations.

Understanding the Basics of Income Tax Calculation

Before we dive into the world of Excel formulas, it's essential to understand the basics of income tax calculation. Income tax is a type of tax levied by governments on an individual's or business's income or profits. The tax rates and laws vary depending on the country, state, or province. In general, income tax is calculated based on the taxpayer's income, deductions, and exemptions.

Using Excel Formulas for Income Tax Calculation

Excel provides a range of formulas that can be used to calculate income tax. Here are some of the most commonly used formulas:

- Tax Rate Formula: This formula calculates the tax rate based on the taxpayer's income. For example:

=IF(A1<10000,0.1,IF(A1<20000,0.15,IF(A1<50000,0.2,0.25)))

This formula assumes that the tax rate is 10% for income up to $10,000, 15% for income between $10,001 and $20,000, 20% for income between $20,001 and $50,000, and 25% for income above $50,000.

- Taxable Income Formula: This formula calculates the taxable income based on the taxpayer's gross income and deductions. For example:

=A1-B1-C1

This formula assumes that the taxpayer's gross income is in cell A1, and the deductions are in cells B1 and C1.

- Tax Liability Formula: This formula calculates the tax liability based on the taxable income and tax rate. For example:

=A1*E1

This formula assumes that the taxable income is in cell A1, and the tax rate is in cell E1.

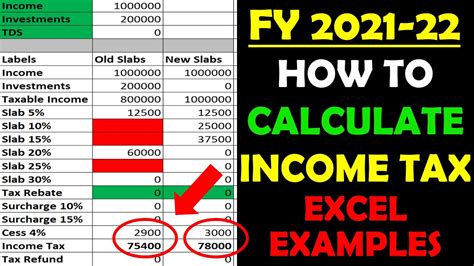

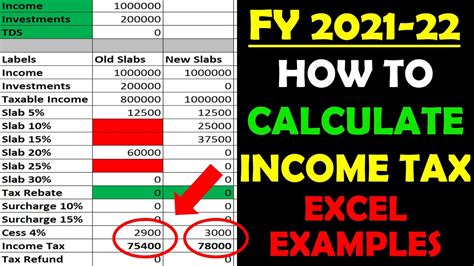

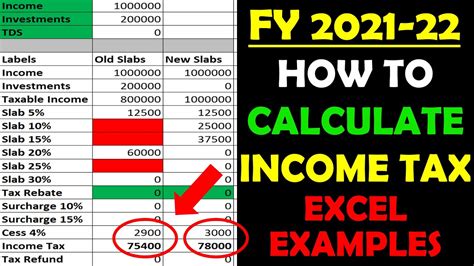

Creating an Income Tax Calculator in Excel

Now that we have covered the basic formulas, let's create an income tax calculator in Excel. Here's a step-by-step guide:

- Create a new Excel worksheet and set up the following columns:

- Gross Income

- Deductions

- Exemptions

- Taxable Income

- Tax Rate

- Tax Liability

- Enter the formulas for each column:

- Gross Income:

=A1 - Deductions:

=B1+C1 - Exemptions:

=D1 - Taxable Income:

=A1-B1-C1-D1 - Tax Rate:

=IF(A1<10000,0.1,IF(A1<20000,0.15,IF(A1<50000,0.2,0.25))) - Tax Liability:

=E1*F1

- Gross Income:

- Enter sample data to test the calculator.

Tips and Variations

Here are some tips and variations to enhance your income tax calculator:

- Use named ranges to make the formulas more readable and easier to maintain.

- Add more columns to calculate other tax-related values, such as tax credits or tax deductions.

- Use Excel's built-in functions, such as

VLOOKUPorINDEX/MATCH, to look up tax rates or other values in a table. - Create a drop-down list to select the tax year or tax jurisdiction.

- Use conditional formatting to highlight cells that require attention, such as cells with errors or cells that exceed a certain threshold.

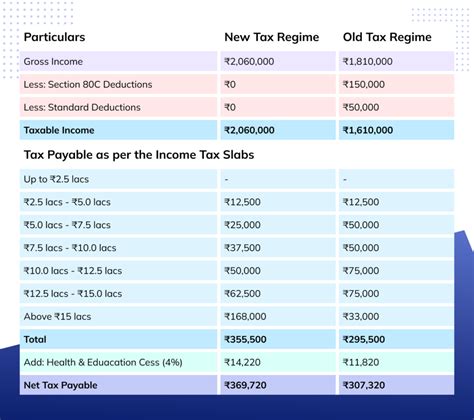

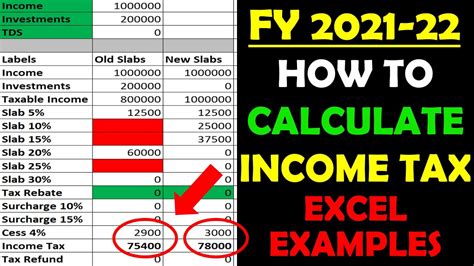

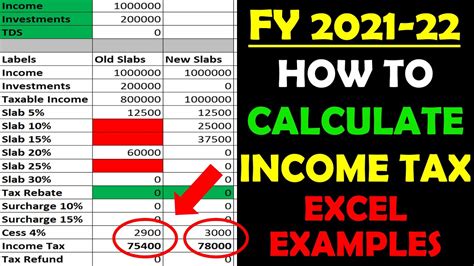

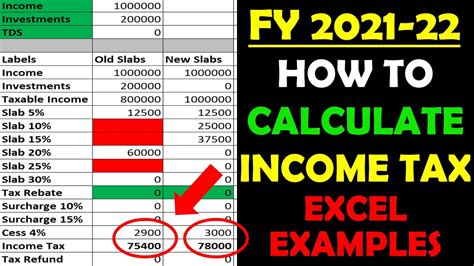

Gallery of Income Tax Calculator Examples

Income Tax Calculator Examples

Conclusion

Calculating income tax can be a complex and time-consuming task, but with the help of Excel formulas, it can be made easier and more efficient. By creating an income tax calculator in Excel, individuals and businesses can simplify their tax calculations and reduce errors. Remember to use named ranges, add more columns, and use Excel's built-in functions to enhance your calculator. Happy calculating!