Calculating the payback period is an essential skill for anyone involved in project evaluation, finance, or investment analysis. The payback period is the time it takes for an investment or project to generate returns that cover its initial cost. In this article, we will explore how to calculate the payback period in Excel using a simple formula.

Understanding the Payback Period

The payback period is a critical metric that helps investors, businesses, and project managers assess the viability of a project or investment. It provides an estimate of the time required for the investment to break even, i.e., to recover the initial outlay.

Why Calculate Payback Period?

Calculating the payback period is essential for several reasons:

- Evaluates the liquidity of an investment: A shorter payback period indicates that the investment will generate cash flows that can be used to fund other projects or investments.

- Compares investments: By calculating the payback period, investors can compare different investment opportunities and choose the one with the shortest payback period.

- Identifies cash flow risks: A longer payback period may indicate that an investment carries higher cash flow risks, as it takes longer to recover the initial investment.

How to Calculate Payback Period in Excel

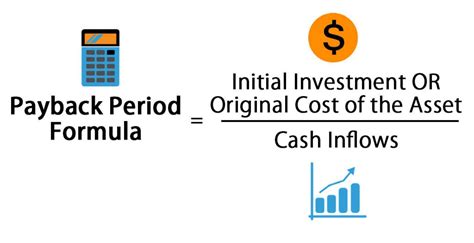

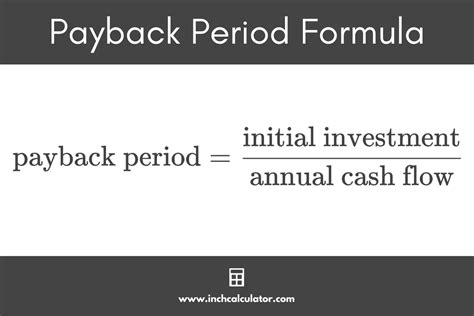

Calculating the payback period in Excel is straightforward. Here's a simple formula:

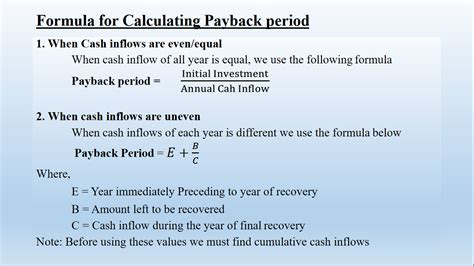

Payback Period = Total Investment / Annual Cash Flow

Suppose you have invested $100,000 in a project, and it generates an annual cash flow of $20,000. To calculate the payback period, you would use the following formula:

Payback Period = $100,000 / $20,000 Payback Period = 5 years

Creating a Payback Period Formula in Excel

To create a payback period formula in Excel, follow these steps:

- Open a new Excel spreadsheet or workbook.

- Create a table with the following columns: Total Investment, Annual Cash Flow, and Payback Period.

- Enter the total investment and annual cash flow values in the respective columns.

- In the Payback Period column, enter the formula: =Total Investment / Annual Cash Flow

- Press Enter to calculate the payback period.

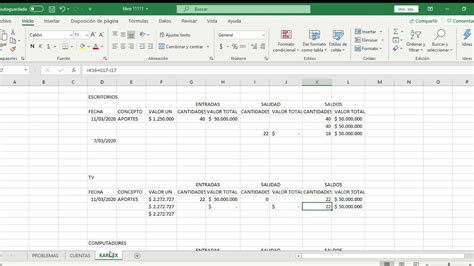

Example of Payback Period Calculation in Excel

Here's an example of how to calculate the payback period in Excel:

| Total Investment | Annual Cash Flow | Payback Period |

|---|---|---|

| $100,000 | $20,000 | = $100,000 / $20,000 = 5 years |

Using the Payback Period Formula with Multiple Investments

If you have multiple investments with different total investments and annual cash flows, you can use the payback period formula to calculate the payback period for each investment. Simply enter the values in the respective columns and use the formula: =Total Investment / Annual Cash Flow

Limitations of the Payback Period Formula

While the payback period formula is a useful metric for evaluating investments, it has some limitations:

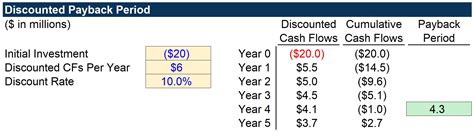

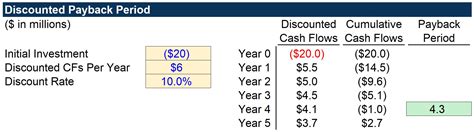

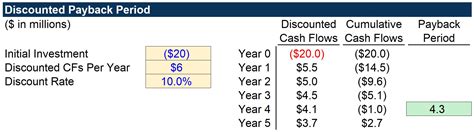

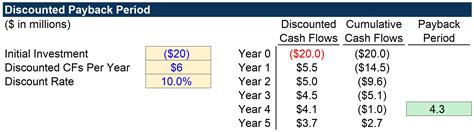

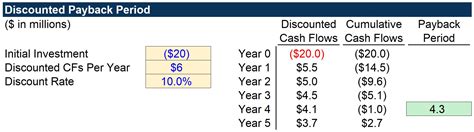

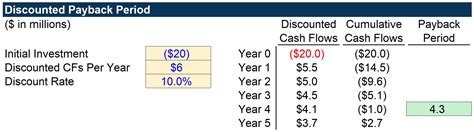

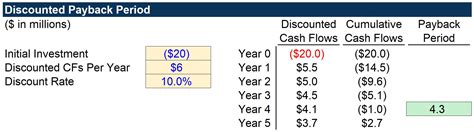

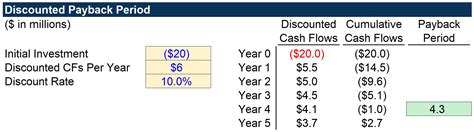

- Ignores the time value of money: The payback period formula does not take into account the time value of money, which means that it does not account for the fact that a dollar received today is worth more than a dollar received in the future.

- Does not account for risks: The payback period formula does not account for the risks associated with an investment, such as market risks, credit risks, or operational risks.

Conclusion

Calculating the payback period is an essential skill for anyone involved in project evaluation, finance, or investment analysis. By using the simple formula: Payback Period = Total Investment / Annual Cash Flow, you can quickly and easily calculate the payback period for an investment. While the payback period formula has some limitations, it remains a useful metric for evaluating investments and making informed decisions.

Gallery of Payback Period Calculation Examples

Payback Period Calculation Examples

We hope this article has provided you with a comprehensive understanding of how to calculate the payback period in Excel using a simple formula. Remember to share your thoughts and comments below, and don't hesitate to reach out if you have any questions or need further clarification.