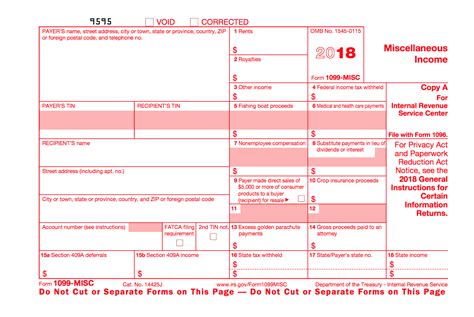

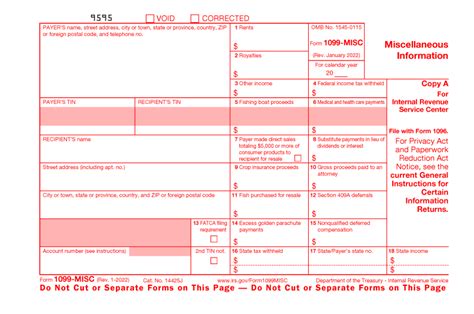

As a freelancer or independent contractor, receiving a 1099-MISC form is a crucial part of your tax obligations. The 1099-MISC form is used to report miscellaneous income, such as freelance work, consulting fees, and other types of non-employee compensation. In this article, we will explore the importance of the 1099-MISC form, its components, and provide a free template in Microsoft Word for download.

The 1099-MISC form is a critical document for freelancers and independent contractors, as it serves as proof of income earned from clients. The form is typically issued by the payer, such as a client or a company, and is used to report payments made to the recipient, such as a freelancer or independent contractor.

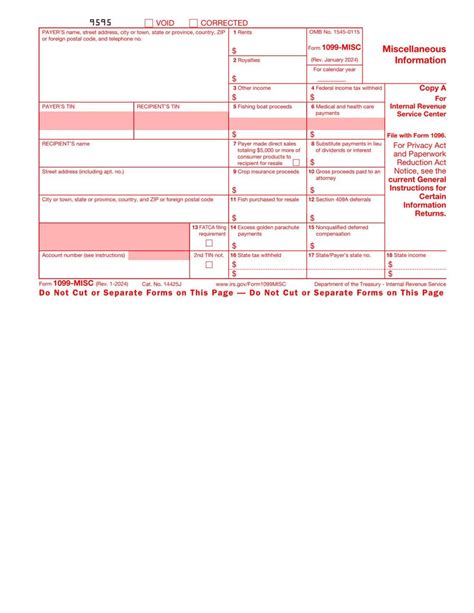

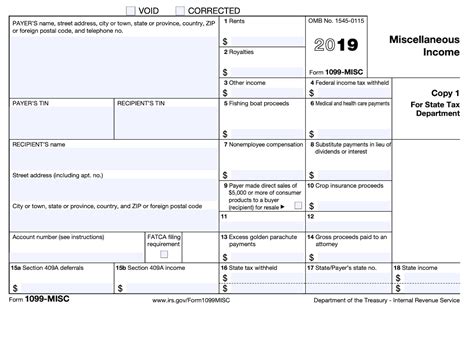

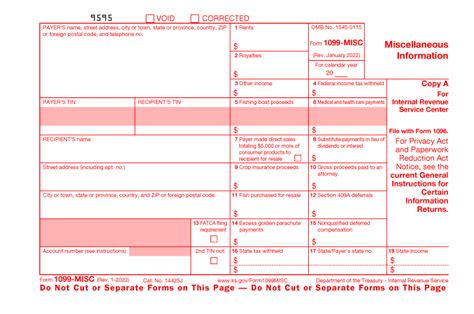

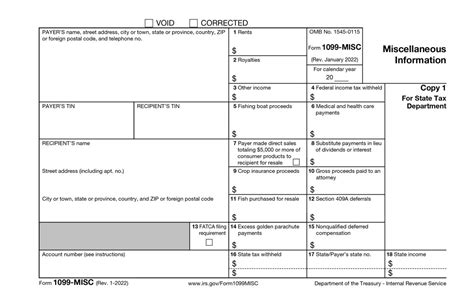

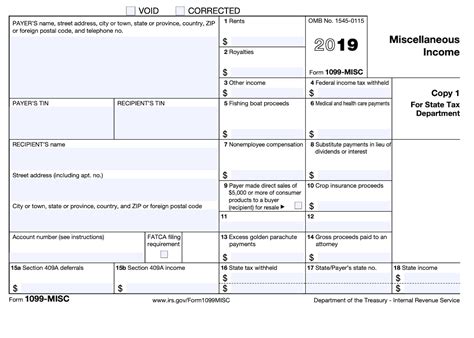

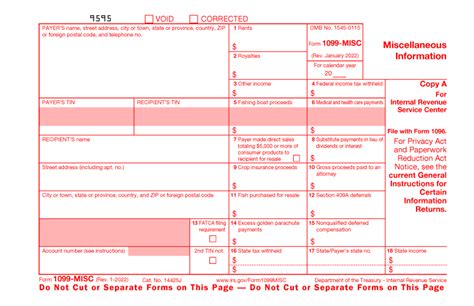

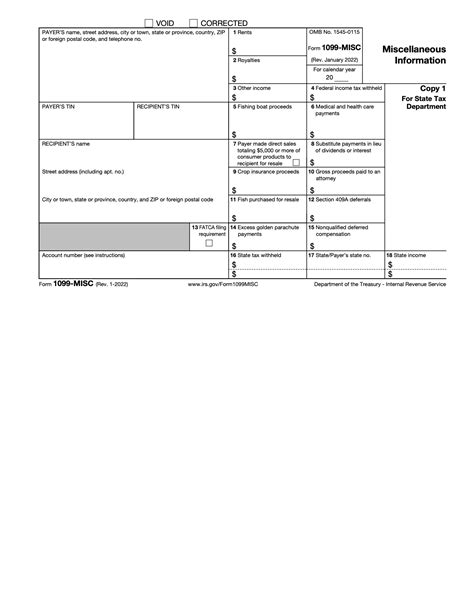

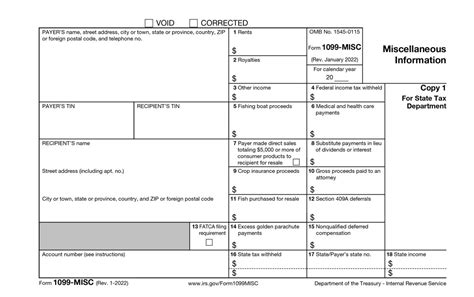

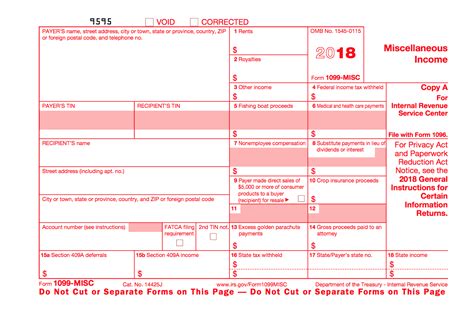

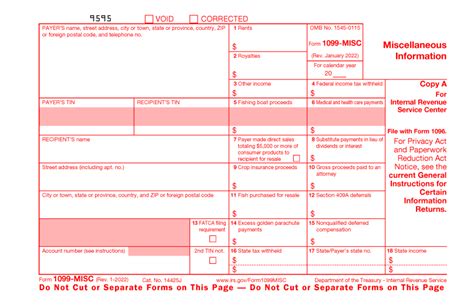

Components of the 1099-MISC Form

The 1099-MISC form consists of several key components, including:

-

Payer Information

+ Payer's name, address, and tax identification number (TIN) -

Recipient Information

+ Recipient's name, address, and TIN -

Payment Information

+ Amount of payment made to the recipient + Type of payment (e.g., freelance work, consulting fees) -

Boxes 1-17

+ Various types of income, such as: - Freelance work (Box 7) - Prizes and awards (Box 3) - Other income (Box 2)

Importance of the 1099-MISC Form

The 1099-MISC form is essential for freelancers and independent contractors, as it serves as proof of income earned from clients. The form is used to report payments made to the recipient, and it is used by the Internal Revenue Service (IRS) to track income earned by individuals and businesses.

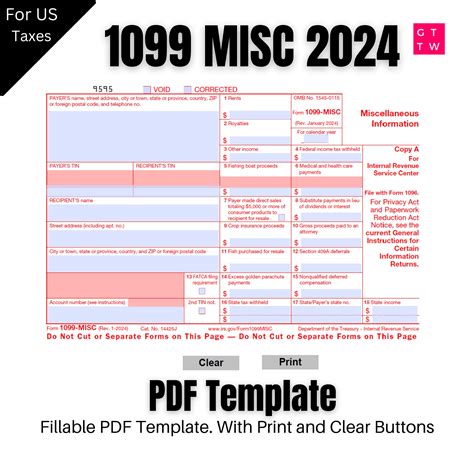

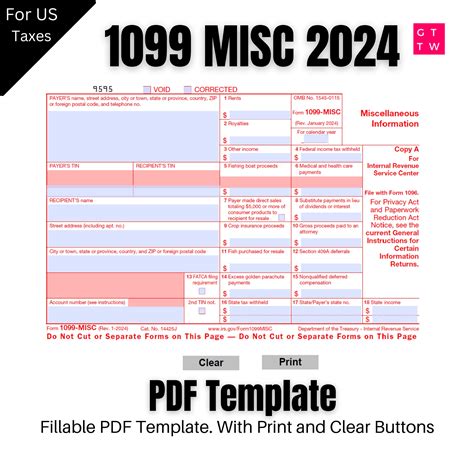

Free 1099-MISC Template in Microsoft Word Download

To help you get started with creating your own 1099-MISC form, we have provided a free template in Microsoft Word for download. This template includes all the necessary components, including payer and recipient information, payment information, and boxes 1-17.

How to Use the 1099-MISC Template

Using the 1099-MISC template is easy. Simply download the template, fill in the necessary information, and print out the form. Here are some steps to follow:

-

Step 1: Download the Template

+ Click on the download link to access the 1099-MISC template in Microsoft Word. -

Step 2: Fill in the Necessary Information

+ Enter the payer's name, address, and TIN. + Enter the recipient's name, address, and TIN. + Enter the payment information, including the amount and type of payment. -

Step 3: Print Out the Form

+ Print out the completed form on white paper.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about the 1099-MISC form:

-

Q: Who needs to file a 1099-MISC form?

+ A: Any payer who has made payments to a recipient, such as a freelancer or independent contractor, must file a 1099-MISC form. -

Q: What is the deadline for filing the 1099-MISC form?

+ A: The deadline for filing the 1099-MISC form is January 31st of each year. -

Q: Can I use a 1099-MISC form for personal expenses?

+ A: No, the 1099-MISC form is only for reporting income earned from clients, not for personal expenses.

1099 Misc Form Gallery

In conclusion, the 1099-MISC form is an essential document for freelancers and independent contractors. It serves as proof of income earned from clients and is used by the IRS to track income earned by individuals and businesses. By using the free 1099-MISC template in Microsoft Word, you can easily create and print out the form. Remember to follow the instructions carefully and fill in the necessary information accurately.

We hope you found this article informative and helpful. If you have any questions or need further assistance, please don't hesitate to contact us.