Intro

Get back on track with your finances using Dave Ramseys budget template, available for free download. Learn how to create a budget that works, prioritizing needs over wants, and tackling debt with a proven plan. Take control of your money with this simple, effective template and start building wealth today.

Creating a budget can be a daunting task, but with the right tools and guidance, it can be a straightforward process. One of the most popular budgeting methods is the Dave Ramsey budget template. In this article, we will delve into the world of budgeting, explore the benefits of using a budget template, and provide a comprehensive guide on how to use the Dave Ramsey budget template.

Why Use a Budget Template?

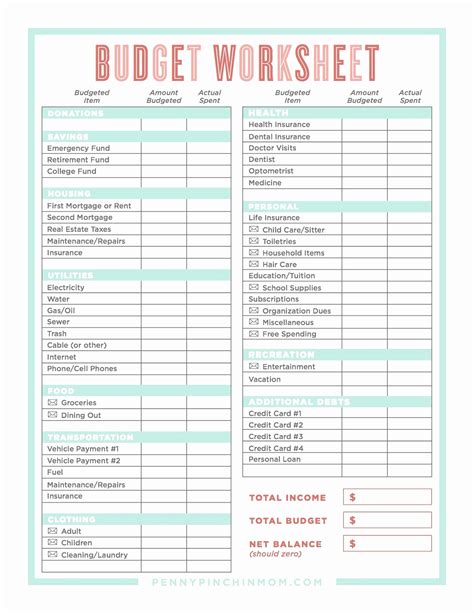

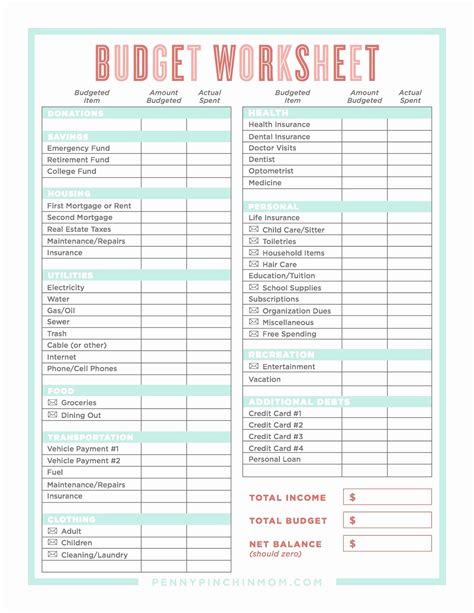

Before we dive into the Dave Ramsey budget template, let's discuss the importance of using a budget template. A budget template is a pre-designed spreadsheet or document that helps you track your income and expenses. By using a budget template, you can:

- Easily track your income and expenses

- Identify areas where you can cut back on spending

- Create a plan for saving and investing

- Stay on top of your finances and avoid financial stress

What is the Dave Ramsey Budget Template?

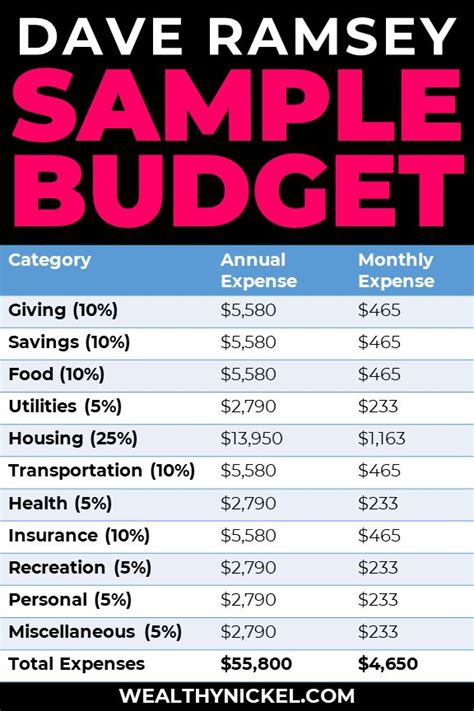

The Dave Ramsey budget template is a free, downloadable template that helps you create a budget based on Dave Ramsey's Baby Steps. The template is designed to help you track your income and expenses, create a plan for getting out of debt, and build wealth.

Benefits of Using the Dave Ramsey Budget Template

The Dave Ramsey budget template offers several benefits, including:

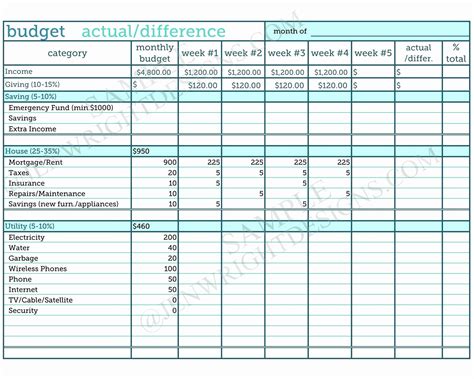

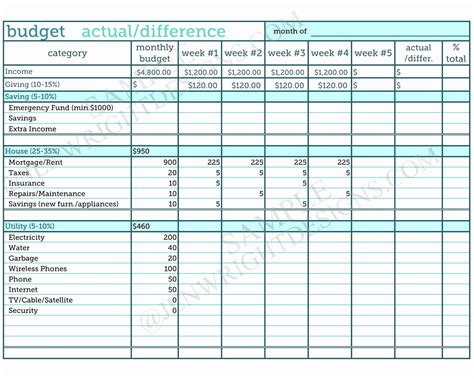

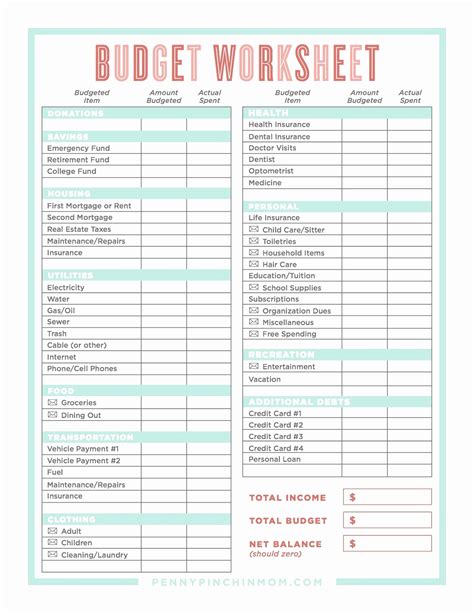

- Easy to use: The template is designed to be user-friendly, making it easy to track your income and expenses.

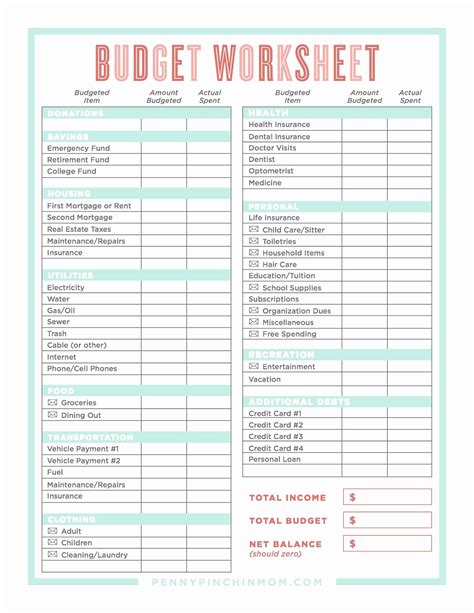

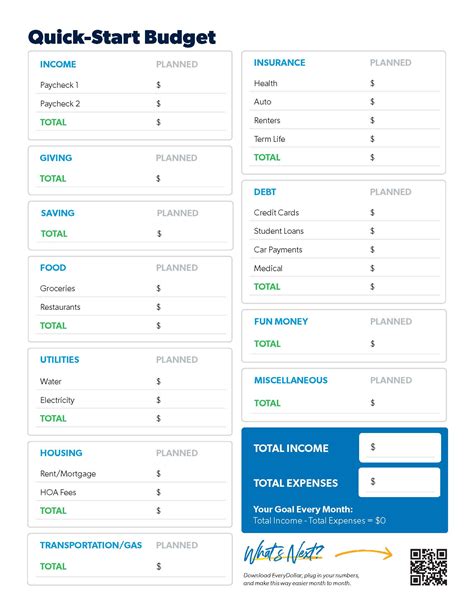

- Comprehensive: The template includes categories for income, fixed expenses, variable expenses, debt repayment, and savings.

- Customizable: You can customize the template to fit your specific financial needs and goals.

- Free: The template is free to download and use.

How to Use the Dave Ramsey Budget Template

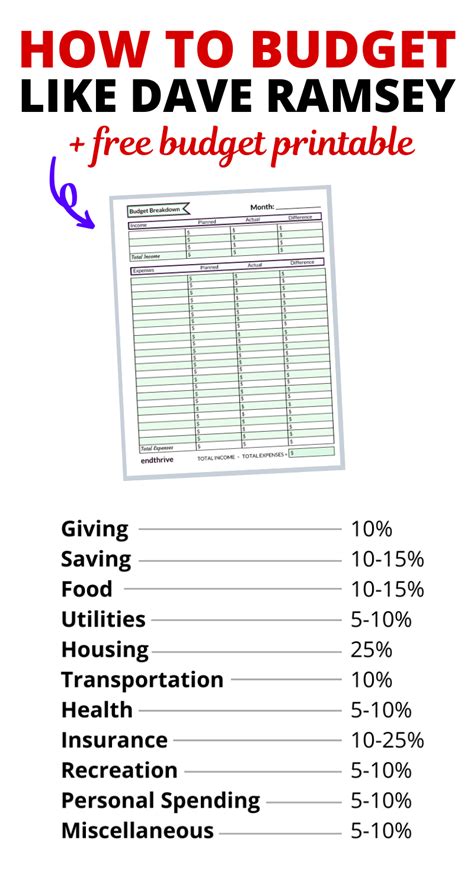

Using the Dave Ramsey budget template is a straightforward process. Here's a step-by-step guide to get you started:

- Download the Template: Download the Dave Ramsey budget template from the official Dave Ramsey website or other online resources.

- Fill in Your Income: Fill in your monthly income, including all sources of income, such as your salary, investments, and any side hustles.

- List Your Fixed Expenses: List your fixed expenses, such as rent/mortgage, utilities, car payment, and insurance.

- List Your Variable Expenses: List your variable expenses, such as groceries, entertainment, and travel.

- Track Your Debt: Track your debt, including credit cards, student loans, and personal loans.

- Create a Plan for Debt Repayment: Create a plan for debt repayment, including how much you will pay each month and when you will pay off each debt.

- Set Savings Goals: Set savings goals, including building an emergency fund and saving for retirement.

Understanding the Baby Steps

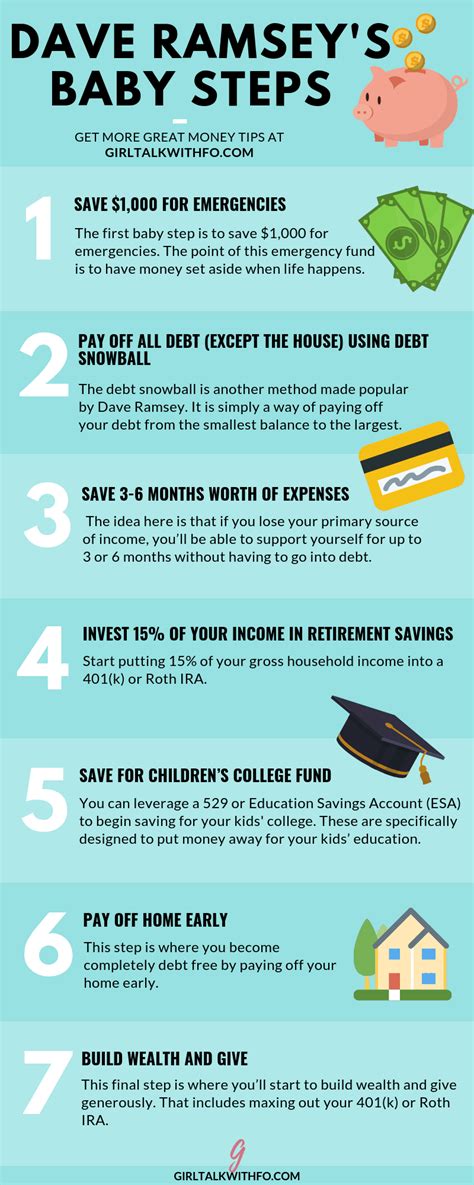

The Dave Ramsey budget template is based on Dave Ramsey's Baby Steps. The Baby Steps are a proven plan for getting out of debt and building wealth. Here's an overview of the Baby Steps:

Baby Step 1: Save $1,000 as an Emergency Fund

- Save $1,000 as an emergency fund to cover unexpected expenses.

Baby Step 2: Pay Off All Debt Using the Debt Snowball

- Pay off all debt, except for your mortgage, using the debt snowball method.

- List your debts, starting with the smallest balance first.

- Pay the minimum payment on all debts, except for the smallest debt.

- Pay as much as possible towards the smallest debt until it's paid off.

- Repeat the process until all debt is paid off.

Baby Step 3: Save 3-6 Months of Expenses in a Savings Account

- Save 3-6 months of expenses in a savings account to cover living expenses in case of job loss or other financial emergencies.

Baby Step 4: Invest 15% of Your Income in Retirement Accounts

- Invest 15% of your income in retirement accounts, such as a 401(k) or IRA.

Baby Step 5: Save for College for Your Children

- Save for college for your children, using a 529 college savings plan or other savings vehicles.

Baby Step 6: Pay Off Your Mortgage

- Pay off your mortgage, using a combination of increased payments and lump sums.

Baby Step 7: Build Wealth and Give Generously

- Build wealth and give generously, using a combination of investing and charitable giving.

Tips for Using the Dave Ramsey Budget Template

Here are some tips for using the Dave Ramsey budget template:

- Be Honest: Be honest about your income and expenses.

- Track Your Expenses: Track your expenses to see where your money is going.

- Make Adjustments: Make adjustments to your budget as needed.

- Avoid Impulse Purchases: Avoid impulse purchases and stay on track with your budget.

- Use the 50/30/20 Rule: Use the 50/30/20 rule to allocate your income: 50% for fixed expenses, 30% for discretionary spending, and 20% for saving and debt repayment.

Frequently Asked Questions

Here are some frequently asked questions about the Dave Ramsey budget template:

Q: Is the Dave Ramsey budget template free?

A: Yes, the Dave Ramsey budget template is free to download and use.

Q: Can I customize the template?

A: Yes, you can customize the template to fit your specific financial needs and goals.

Q: Is the template easy to use?

A: Yes, the template is designed to be user-friendly, making it easy to track your income and expenses.

Q: What is the debt snowball method?

A: The debt snowball method is a debt reduction strategy that involves paying off debts in a specific order, starting with the smallest balance first.

Dave Ramsey Budget Template Image Gallery

Conclusion

The Dave Ramsey budget template is a powerful tool for taking control of your finances and achieving financial freedom. By following the Baby Steps and using the template, you can create a budget that works for you and helps you achieve your financial goals. Remember to be honest, track your expenses, and make adjustments as needed. With the right tools and guidance, you can achieve financial freedom and live the life you deserve.