Intro

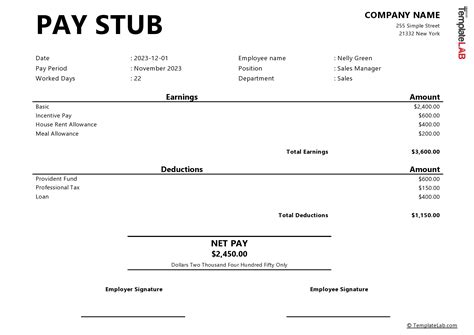

Create accurate pay stubs instantly with our free Excel template download. Easily calculate payroll, deductions, and net pay. Customize for your business with our intuitive template. Get instant access to our free pay stub template Excel download and simplify your payroll processing with ease, accuracy, and compliance.

Managing employee salaries and benefits can be a daunting task, especially for small businesses or startups. One crucial aspect of payroll management is generating pay stubs, which provide a clear breakdown of an employee's earnings and deductions. In this article, we will explore the importance of pay stubs, their components, and how to create a free pay stub template using Excel.

The Importance of Pay Stubs

Pay stubs, also known as pay slips or wage statements, serve as a record of an employee's earnings and deductions for a specific pay period. They are an essential document for both employees and employers, as they provide a clear understanding of the salary paid, taxes withheld, and benefits deducted. Pay stubs are also useful for tax purposes, as they provide a detailed record of an employee's income and deductions.

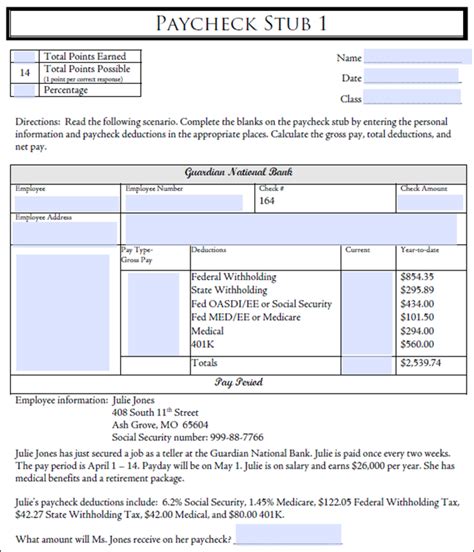

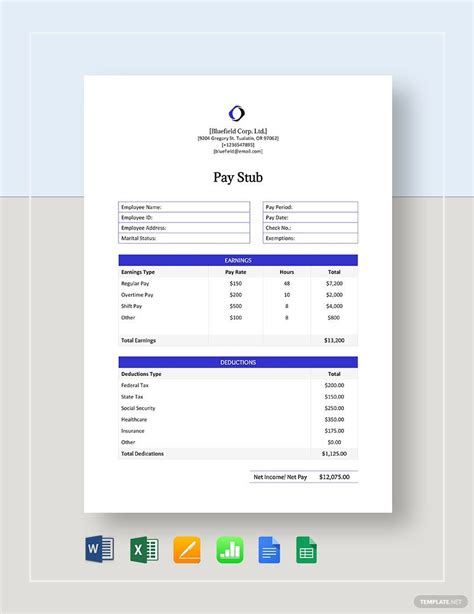

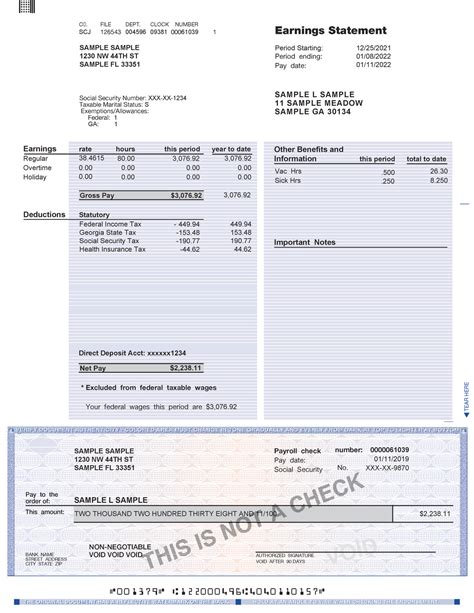

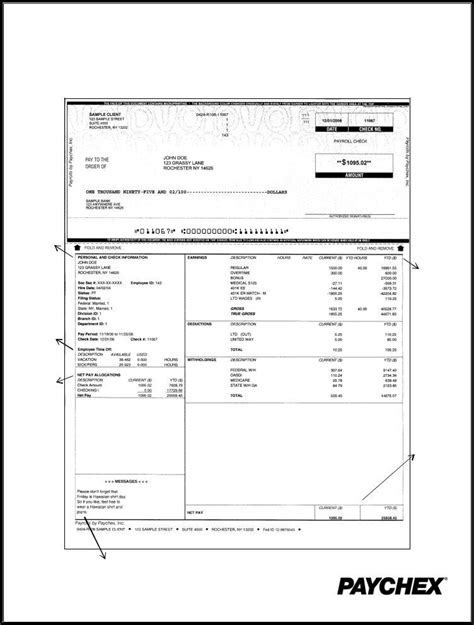

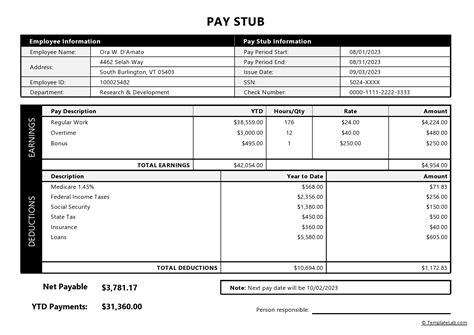

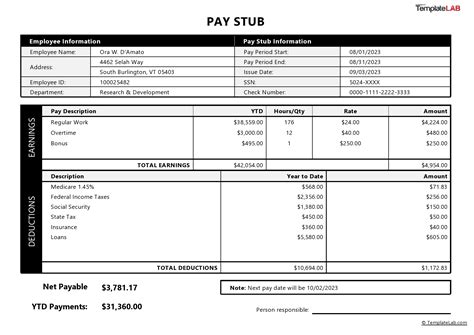

Components of a Pay Stub

A standard pay stub typically includes the following components:

- Employee information (name, address, employee ID)

- Pay period and pay date

- Gross earnings (total salary before deductions)

- Deductions (taxes, benefits, etc.)

- Net earnings (take-home pay)

- Year-to-date (YTD) earnings and deductions

Creating a Free Pay Stub Template in Excel

Fortunately, creating a pay stub template in Excel is a straightforward process. Here's a step-by-step guide to get you started:

- Open a new Excel spreadsheet and set up the following columns:

- Employee Information ( columns A-C)

- Pay Period and Pay Date (columns D-E)

- Earnings and Deductions (columns F-K)

- Net Earnings and YTD (columns L-M)

- Format the columns to fit your needs, and add headers to each column.

- Enter the employee information, pay period, and pay date in the corresponding columns.

- Set up formulas to calculate the gross earnings, deductions, and net earnings. You can use Excel's built-in formulas, such as SUMIF and VLOOKUP, to simplify the calculations.

- Use Excel's formatting options to make the template visually appealing and easy to read.

Free Pay Stub Template Excel Download

If you're not comfortable creating a pay stub template from scratch, you can download a free template from various online sources. Some popular websites that offer free pay stub templates include:

- Microsoft Excel Templates

- Template.net

- Vertex42

When downloading a template, make sure to choose one that is compatible with your version of Excel and meets your specific needs.

Benefits of Using a Pay Stub Template

Using a pay stub template can simplify your payroll management process and provide several benefits, including:

- Accuracy: A template ensures that all necessary information is included, reducing the risk of errors.

- Efficiency: A template saves time and effort, as you don't need to create a new pay stub from scratch for each employee.

- Consistency: A template ensures that all pay stubs are formatted consistently, making it easier to review and compare employee earnings.

- Compliance: A template helps ensure that you are meeting all relevant tax and labor laws, reducing the risk of non-compliance.

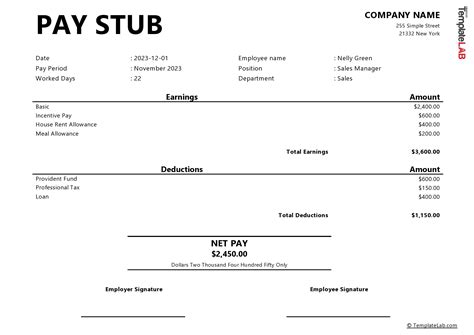

How to Customize a Pay Stub Template

Customizing a pay stub template is essential to meet your specific business needs. Here are some tips to help you customize a template:

- Add company logo: Include your company logo to make the pay stubs look more professional.

- Change font and formatting: Adjust the font, size, and formatting to match your company's brand.

- Add or remove columns: Add or remove columns to include or exclude specific information.

- Modify formulas: Update the formulas to reflect changes in tax rates, benefits, or other deductions.

Best Practices for Managing Pay Stubs

Managing pay stubs effectively is crucial for both employees and employers. Here are some best practices to follow:

- Keep accurate records: Ensure that all pay stubs are accurate and up-to-date.

- Store pay stubs securely: Store pay stubs in a secure location, such as a locked cabinet or encrypted digital file.

- Provide pay stubs to employees: Provide pay stubs to employees on a regular basis, such as with each paycheck.

- Review pay stubs regularly: Review pay stubs regularly to ensure accuracy and detect any errors or discrepancies.

Common Mistakes to Avoid When Creating Pay Stubs

When creating pay stubs, it's essential to avoid common mistakes that can lead to errors or non-compliance. Here are some mistakes to avoid:

- Inaccurate information: Ensure that all information on the pay stub is accurate, including employee information, pay period, and earnings.

- Missing information: Ensure that all necessary information is included, such as deductions and YTD earnings.

- Incorrect formulas: Double-check formulas to ensure that they are accurate and up-to-date.

Conclusion

Creating a pay stub template in Excel is a straightforward process that can simplify your payroll management process. By using a template, you can ensure accuracy, efficiency, and compliance with tax and labor laws. Remember to customize the template to meet your specific business needs and follow best practices for managing pay stubs. By avoiding common mistakes and using a well-designed template, you can create pay stubs that are accurate, easy to read, and beneficial for both employees and employers.

Pay Stub Template Gallery

We hope this article has provided you with a comprehensive guide to creating a pay stub template in Excel. If you have any questions or need further assistance, please don't hesitate to ask.