Intro

Secure your financial agreements with a California promissory note template. Learn the 5 essential tips to create a binding contract, including interest rates, payment terms, and lender protection. Ensure compliance with California laws and regulations, and avoid common pitfalls with our expert guide to promissory notes.

In the state of California, a promissory note is a crucial document that outlines the terms of a loan agreement between two parties. It serves as a legally binding contract that ensures the borrower repays the lender according to the agreed-upon terms. Creating a comprehensive and accurate promissory note is essential to protect both parties' interests. In this article, we will discuss the California promissory note template and provide five essential tips to help you create a valid and enforceable document.

Understanding the Importance of a Promissory Note

A promissory note is a written promise by the borrower to repay the lender a specified amount of money, known as the principal amount, plus interest. The note outlines the repayment terms, including the interest rate, payment schedule, and any late fees. In California, a promissory note is governed by the state's laws and regulations, and it is essential to comply with these requirements to ensure the note's validity.

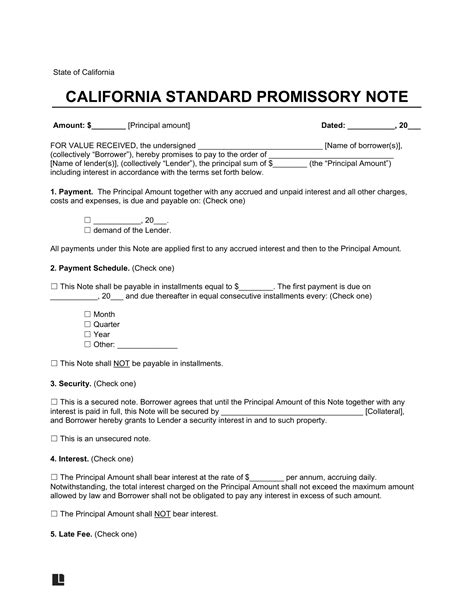

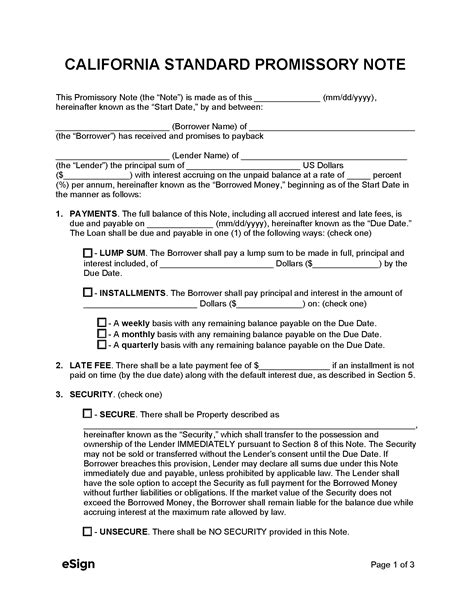

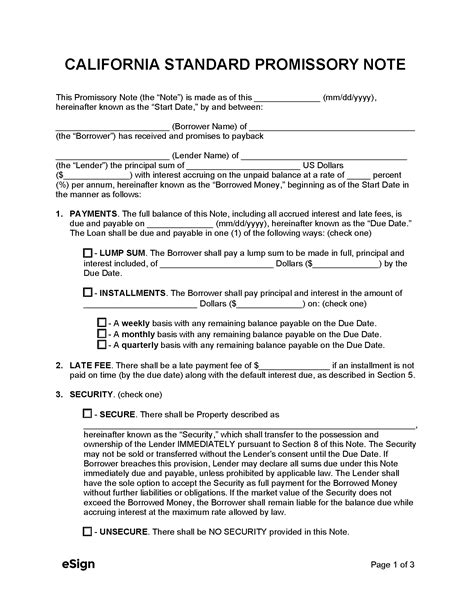

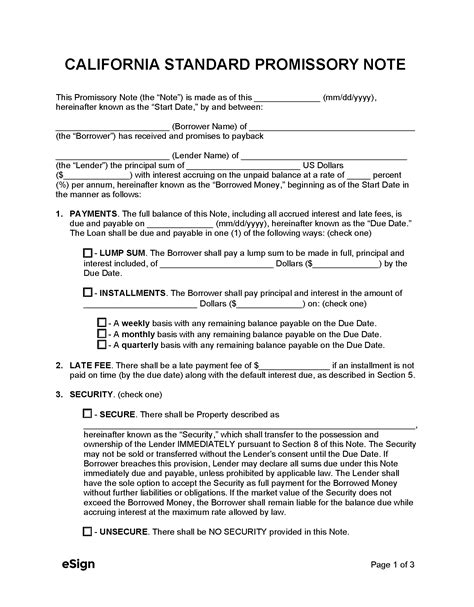

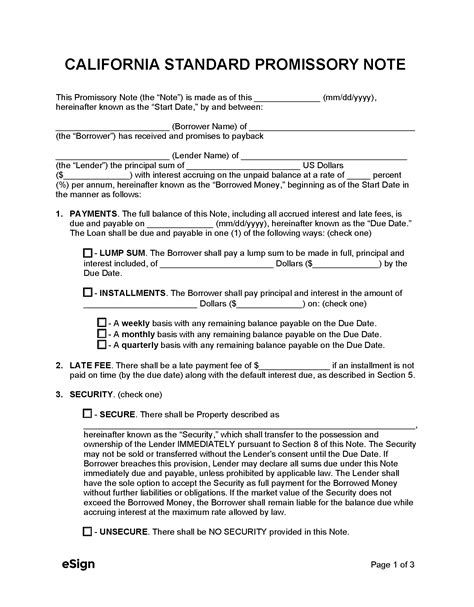

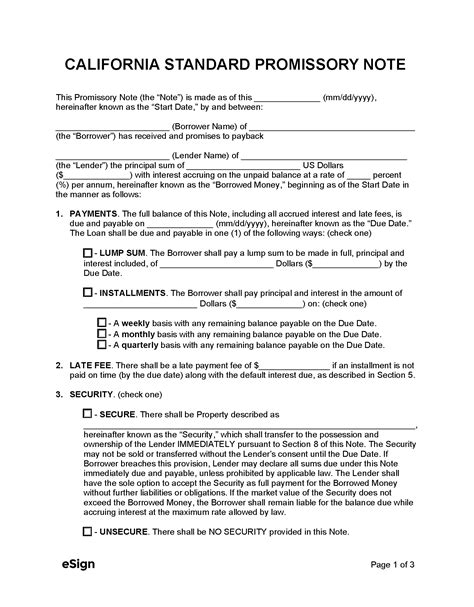

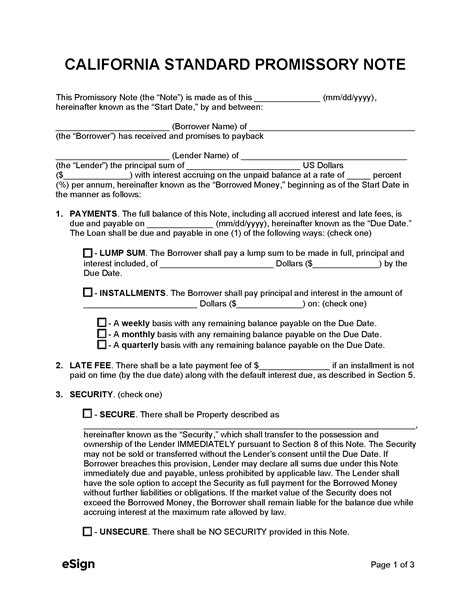

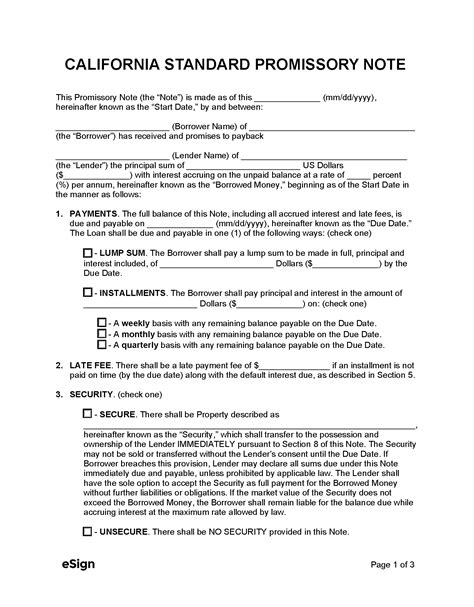

Key Elements of a California Promissory Note Template

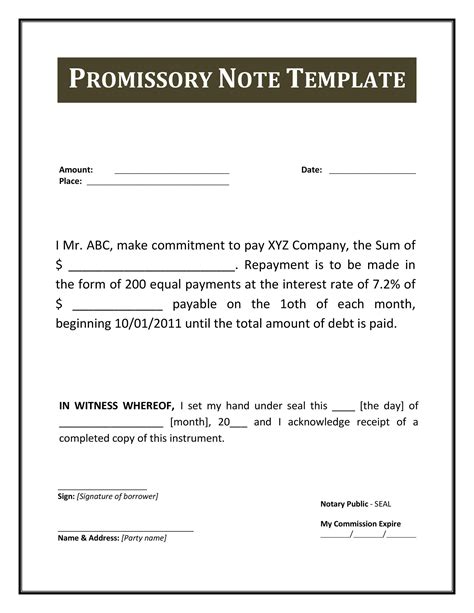

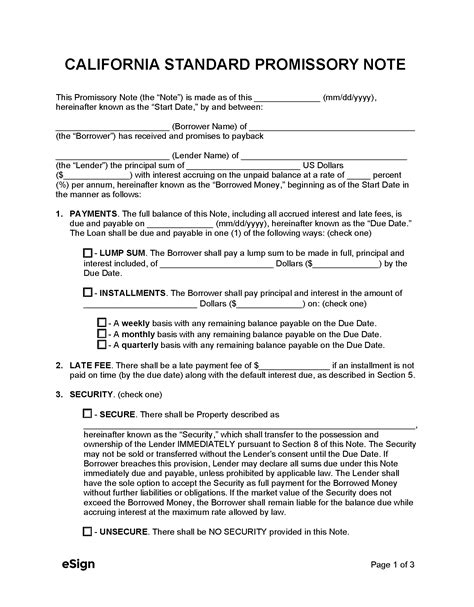

A California promissory note template typically includes the following essential elements:

- Borrower's name and address

- Lender's name and address

- Principal amount

- Interest rate

- Repayment terms, including payment schedule and late fees

- Default provisions

- Governing law and jurisdiction

5 Essential Tips for Creating a Valid California Promissory Note

- Clearly Define the Parties Involved

When creating a California promissory note, it is essential to clearly define the parties involved. This includes the borrower's name and address, as well as the lender's name and address. Ensure that the parties' information is accurate and up-to-date to avoid any potential disputes.

- Specify the Repayment Terms

The repayment terms are a critical component of a promissory note. Ensure that the note specifies the payment schedule, including the payment amount, frequency, and due date. Additionally, outline any late fees or penalties for missed payments.

- Include a Default Provision

A default provision outlines the consequences of the borrower's failure to repay the loan according to the agreed-upon terms. This provision should specify the events that constitute default, such as missing a payment or failing to pay the entire principal amount.

- Comply with California Laws and Regulations

California laws and regulations govern promissory notes. Ensure that your note complies with these requirements, including the state's usury laws, which regulate the maximum interest rate that can be charged.

- Have the Note Signed and Notarized

To ensure the validity of the promissory note, have both parties sign and notarize the document. This provides proof that the parties have agreed to the terms outlined in the note.

Benefits of Using a California Promissory Note Template

Using a California promissory note template provides several benefits, including:

- Ensures compliance with California laws and regulations

- Protects both parties' interests

- Provides a clear outline of the repayment terms

- Helps to prevent disputes

- Saves time and effort in creating a valid document

Conclusion

A California promissory note template is an essential document that outlines the terms of a loan agreement between two parties. By following the five essential tips outlined in this article, you can create a valid and enforceable document that protects both parties' interests. Remember to comply with California laws and regulations, clearly define the parties involved, specify the repayment terms, include a default provision, and have the note signed and notarized.

California Promissory Note Template Image Gallery

We hope this article has provided you with valuable insights into creating a valid and enforceable California promissory note template. If you have any further questions or concerns, please feel free to comment below.