Intro

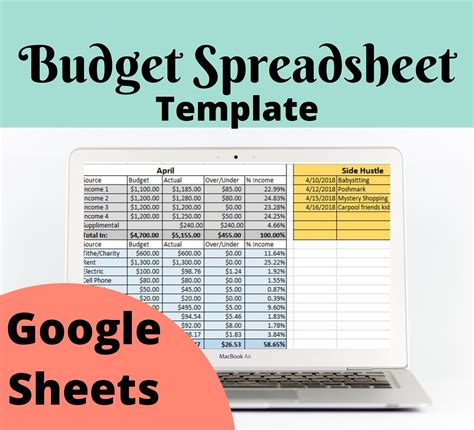

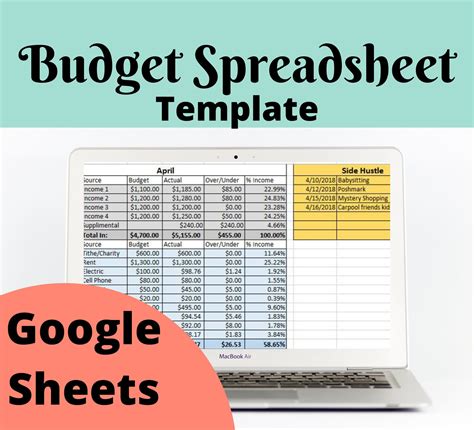

Managing finances can be a daunting task, especially for those who are not familiar with budgeting. However, with the right tools and templates, it can be made easier. One such tool is Google Sheets, a free online spreadsheet that can be used to create a bi-weekly budget template. In this article, we will explore 10 ways to manage finances with a Google Sheets bi-weekly budget template.

Using a Google Sheets bi-weekly budget template can help individuals keep track of their income and expenses, making it easier to manage their finances. Here are 10 ways to manage finances with a Google Sheets bi-weekly budget template:

Benefits of Using a Bi-Weekly Budget Template

Using a bi-weekly budget template can help individuals manage their finances more effectively. Here are some benefits of using a bi-weekly budget template:

- Helps to track income and expenses more accurately

- Allows for easier identification of areas where costs can be cut

- Enables individuals to make informed financial decisions

- Provides a clear picture of financial progress over time

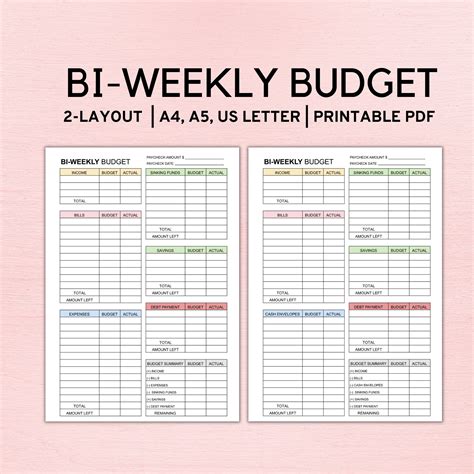

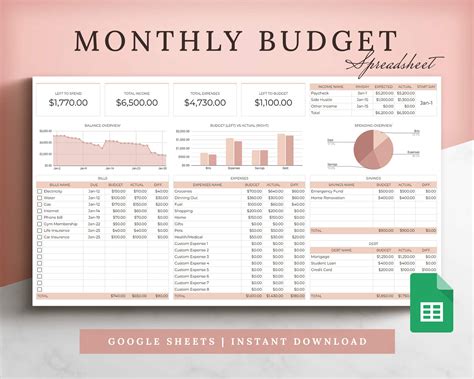

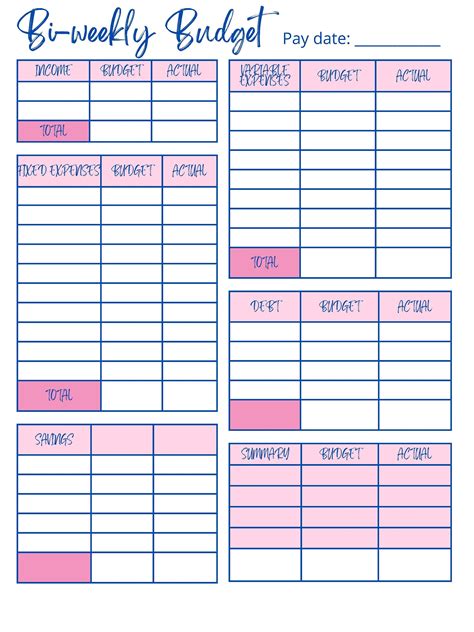

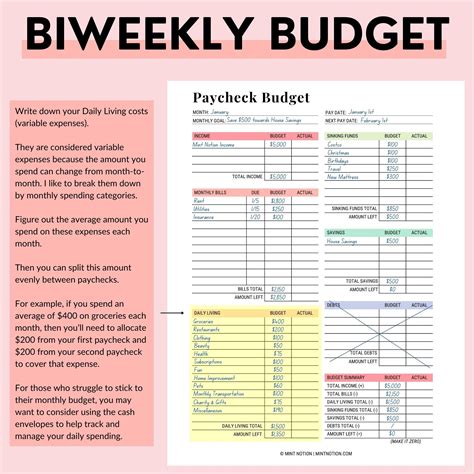

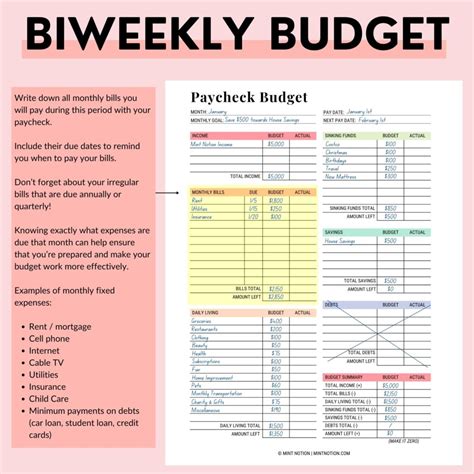

What to Include in a Bi-Weekly Budget Template

A bi-weekly budget template should include the following categories:

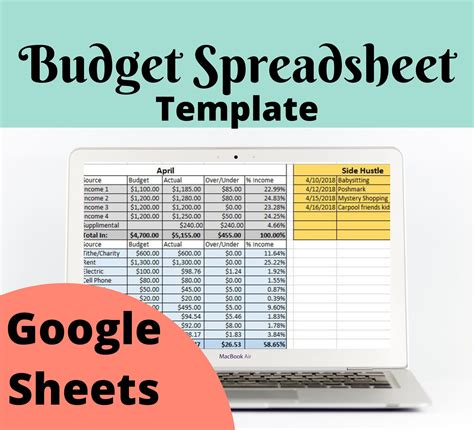

- Income: list all sources of income, including salary, investments, and any side hustles

- Fixed Expenses: include rent, utilities, car payment, and any other regular expenses

- Variable Expenses: include groceries, entertainment, and any other expenses that can vary from week to week

- Savings: include any savings goals, such as emergency fund or retirement savings

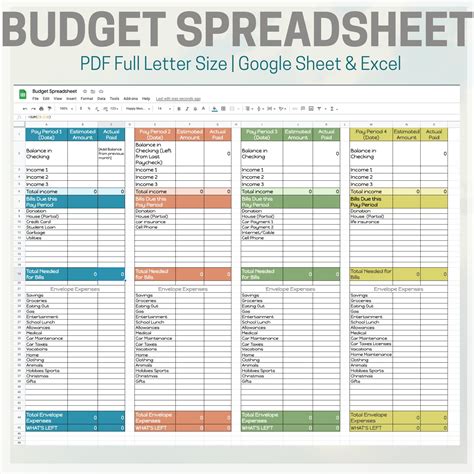

How to Create a Bi-Weekly Budget Template in Google Sheets

Creating a bi-weekly budget template in Google Sheets is easy. Here are the steps:

- Log in to Google Sheets and create a new spreadsheet

- Set up the columns for income, fixed expenses, variable expenses, and savings

- Enter the income and expenses for each category

- Use formulas to calculate the total income and expenses

- Use conditional formatting to highlight areas where costs can be cut

Tips for Using a Bi-Weekly Budget Template

Here are some tips for using a bi-weekly budget template:

- Review and update the budget regularly to ensure accuracy

- Use the 50/30/20 rule to allocate income towards necessities, discretionary spending, and savings

- Prioritize needs over wants

- Use budgeting apps to track expenses and stay on top of finances

Common Mistakes to Avoid When Using a Bi-Weekly Budget Template

Here are some common mistakes to avoid when using a bi-weekly budget template:

- Not regularly reviewing and updating the budget

- Not accounting for irregular expenses, such as car maintenance or property taxes

- Not prioritizing needs over wants

- Not using budgeting apps to track expenses

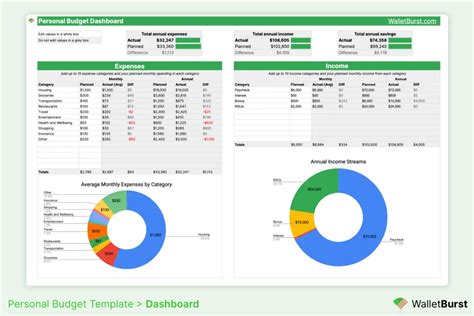

Advantages of Using Google Sheets for Budgeting

Here are some advantages of using Google Sheets for budgeting:

- Free and accessible online

- Collaborative features allow for easy sharing and editing

- Automatic saving and versioning

- Accessible from any device with an internet connection

Alternatives to Google Sheets for Budgeting

Here are some alternatives to Google Sheets for budgeting:

- Microsoft Excel

- LibreOffice Calc

- OpenOffice Calc

- Budgeting apps, such as Mint or Personal Capital

Conclusion

Managing finances can be made easier with a Google Sheets bi-weekly budget template. By following the steps outlined in this article, individuals can create a budget template that helps them track income and expenses, identify areas where costs can be cut, and make informed financial decisions. Remember to regularly review and update the budget, prioritize needs over wants, and use budgeting apps to track expenses.

Budgeting with Google Sheets: Final Thoughts

Using a Google Sheets bi-weekly budget template can help individuals manage their finances more effectively. By following the tips and avoiding common mistakes outlined in this article, individuals can create a budget that helps them achieve their financial goals. Remember to stay consistent, prioritize needs over wants, and use budgeting apps to track expenses.

We hope this article has provided you with valuable information on how to manage finances with a Google Sheets bi-weekly budget template. If you have any questions or comments, please leave them in the section below.

Google Sheets Budget Template Image Gallery