Managing payroll can be a daunting task for small business owners and HR professionals. With the numerous laws and regulations surrounding payroll, it's essential to have a system that helps you stay organized and compliant. One way to simplify payroll management is by using a Google Sheets pay stub template.

Payroll management involves calculating employee salaries, deducting taxes and benefits, and ensuring timely payments. A well-designed pay stub template can help you streamline this process, reducing errors and saving time. In this article, we'll explore the benefits of using a Google Sheets pay stub template and provide a step-by-step guide on how to create and use one.

Benefits of Using a Google Sheets Pay Stub Template

Using a Google Sheets pay stub template offers several benefits, including:

- Easy to use: Google Sheets is a user-friendly platform that doesn't require extensive accounting knowledge.

- Customizable: You can tailor the template to suit your business needs and payroll requirements.

- Automated calculations: Google Sheets formulas can automate calculations, reducing errors and saving time.

- Collaboration: Multiple users can access and edit the template simultaneously, making it ideal for teams.

- Cost-effective: Google Sheets is a free platform, eliminating the need for expensive payroll software.

Creating a Google Sheets Pay Stub Template

Creating a Google Sheets pay stub template is a straightforward process. Here's a step-by-step guide to get you started:

- Create a new Google Sheet: Log in to your Google account and navigate to Google Sheets. Click on the "+" button to create a new spreadsheet.

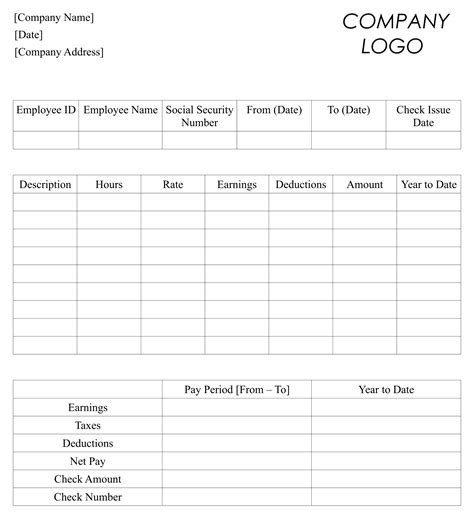

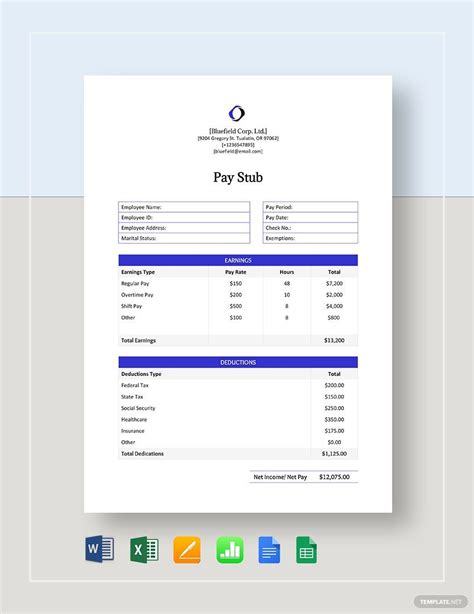

- Set up the template structure: Create separate sheets for each payroll component, such as employee information, salary, taxes, and benefits.

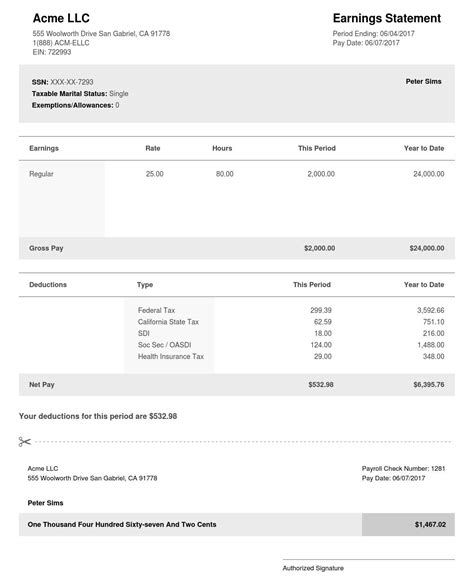

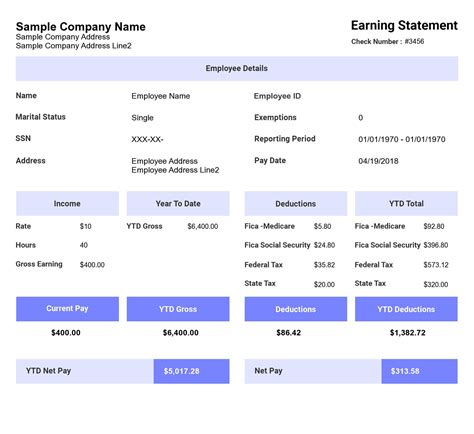

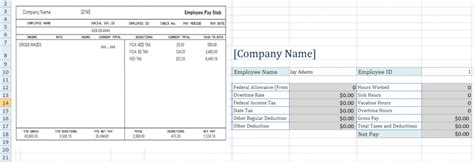

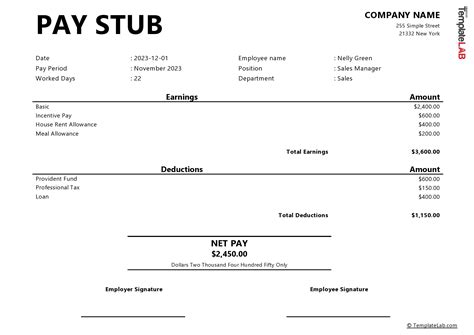

- Design the pay stub template: Use tables and formatting to create a professional-looking pay stub template. Include essential fields like employee name, pay period, gross pay, deductions, and net pay.

- Use formulas for calculations: Use Google Sheets formulas to automate calculations, such as calculating taxes, benefits, and net pay.

- Test and refine the template: Test the template with sample data and refine it as needed to ensure accuracy and compliance.

Using the Google Sheets Pay Stub Template

Using the Google Sheets pay stub template is easy. Here's a step-by-step guide:

- Enter employee information: Enter employee data, such as name, address, and social security number.

- Input payroll data: Input payroll data, such as hours worked, salary, and benefits.

- Calculate payroll: Use the template's formulas to calculate payroll, including taxes and deductions.

- Generate pay stubs: Generate pay stubs for each employee, including essential information like pay period, gross pay, and net pay.

- Review and approve: Review and approve pay stubs for accuracy and compliance.

Best Practices for Using a Google Sheets Pay Stub Template

To get the most out of your Google Sheets pay stub template, follow these best practices:

- Regularly update the template: Regularly update the template to ensure compliance with changing laws and regulations.

- Use data validation: Use data validation to ensure accuracy and prevent errors.

- Keep it organized: Keep the template organized and easy to use, even for multiple users.

- Use passwords and permissions: Use passwords and permissions to ensure sensitive data is protected.

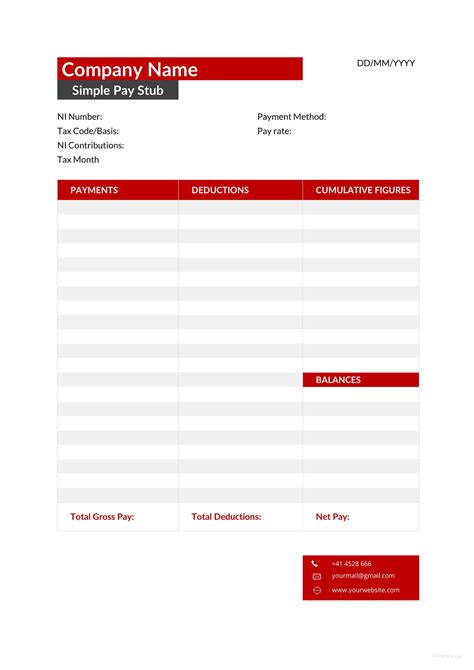

Gallery of Pay Stub Templates

Pay Stub Template Gallery

In conclusion, using a Google Sheets pay stub template can simplify payroll management and reduce errors. By following the steps outlined in this article, you can create and use a professional-looking pay stub template that meets your business needs. Remember to regularly update the template and follow best practices to ensure compliance and accuracy.

If you have any questions or comments, please feel free to share them below.