The growing annuity formula is a powerful financial tool used to calculate the future value of a series of periodic payments that increase at a constant rate. This formula is widely used in finance, accounting, and investment analysis. In this article, we will explore the growing annuity formula in Excel, its components, and provide step-by-step instructions on how to use it.

Understanding the Growing Annuity Formula

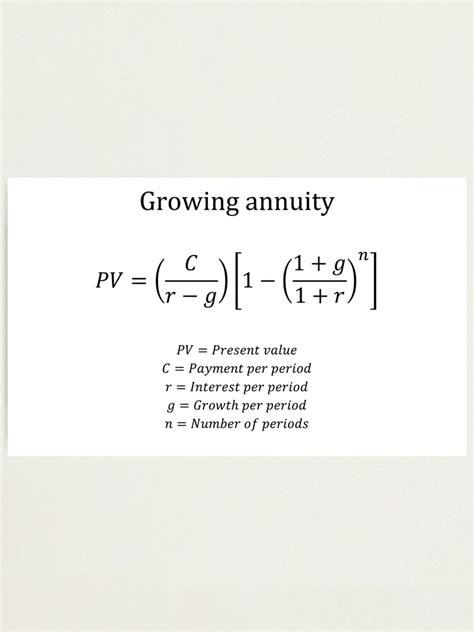

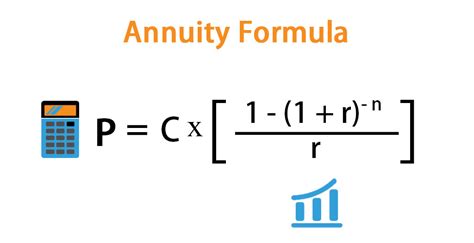

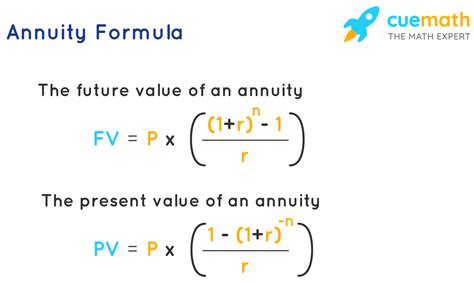

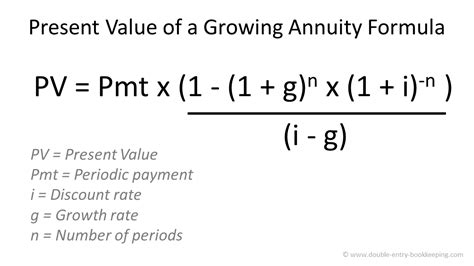

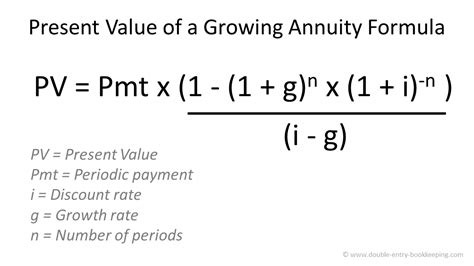

The growing annuity formula is an extension of the ordinary annuity formula, which calculates the future value of a series of periodic payments. The growing annuity formula takes into account the growth rate of the payments, which can be due to inflation, salary increases, or other factors. The formula is as follows:

FV = PMT x (((1 + g)^n - 1) / g) x (1 + r)^n

Where:

- FV = Future Value

- PMT = Periodic Payment

- g = Growth Rate

- n = Number of Periods

- r = Interest Rate

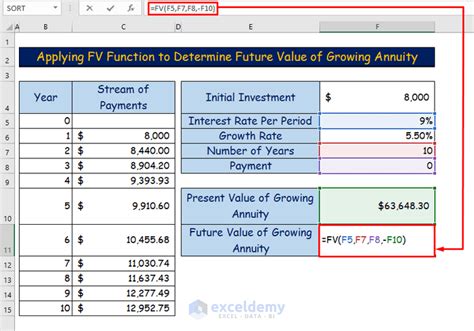

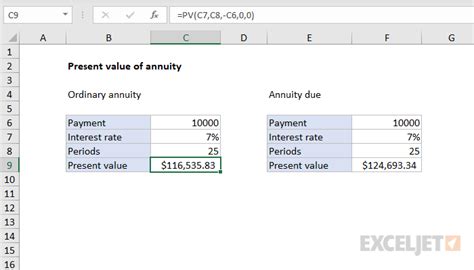

Using the Growing Annuity Formula in Excel

To use the growing annuity formula in Excel, you can use the FV function, which is a built-in function in Excel. The syntax for the FV function is as follows:

FV(rate, nper, pmt, [pv], [type])

Where:

- rate = Interest Rate

- nper = Number of Periods

- pmt = Periodic Payment

- [pv] = Present Value (optional)

- [type] = Payment Type (optional)

To calculate the future value of a growing annuity, you need to use the FV function in combination with the PMT function, which calculates the periodic payment. The PMT function has the following syntax:

PMT(rate, nper, pv, [fv], [type])

Where:

- rate = Interest Rate

- nper = Number of Periods

- pv = Present Value

- [fv] = Future Value (optional)

- [type] = Payment Type (optional)

Step-by-Step Instructions

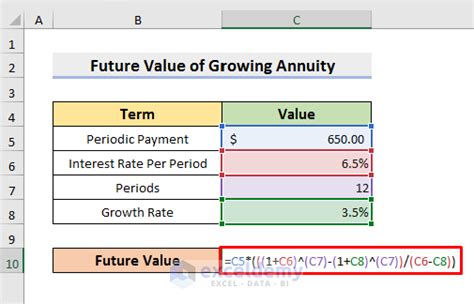

Here are the step-by-step instructions to calculate the future value of a growing annuity in Excel:

- Enter the interest rate: Enter the interest rate as a decimal value in a cell.

- Enter the number of periods: Enter the number of periods as a whole number in a cell.

- Enter the periodic payment: Enter the periodic payment as a decimal value in a cell.

- Enter the growth rate: Enter the growth rate as a decimal value in a cell.

- Calculate the future value: Use the FV function to calculate the future value of the growing annuity.

Example:

- Interest Rate: 5% (cell A1)

- Number of Periods: 10 years (cell A2)

- Periodic Payment: $1,000 (cell A3)

- Growth Rate: 3% (cell A4)

Formula: =FV(A1,A2,A3,,0)*(1+A4)^A2

Result: $14,509.09

Benefits of Using the Growing Annuity Formula

The growing annuity formula is a powerful tool that provides several benefits, including:

- Accurate calculations: The formula provides accurate calculations of the future value of a growing annuity.

- Flexibility: The formula can be used to calculate the future value of different types of annuities, including growing annuities.

- Savings: The formula can help individuals and businesses save money by accurately calculating the future value of their investments.

Common Applications of the Growing Annuity Formula

The growing annuity formula has several common applications, including:

- Retirement planning: The formula can be used to calculate the future value of retirement savings.

- Investment analysis: The formula can be used to analyze the performance of investments, such as stocks and bonds.

- Business planning: The formula can be used to calculate the future value of business investments and expenses.

Gallery of Growing Annuity Formula

Gallery of Growing Annuity Formula

Conclusion

The growing annuity formula is a powerful financial tool that provides accurate calculations of the future value of a growing annuity. The formula can be used in various applications, including retirement planning, investment analysis, and business planning. By following the step-by-step instructions and using the formula in Excel, individuals and businesses can save money and make informed financial decisions.

Share Your Thoughts

Do you have any experience with the growing annuity formula? Share your thoughts and experiences in the comments below.