Intro

Leaving the Air Force and navigating the civilian housing market can be daunting. Get expert guidance with our step-by-step house hunting guide, tailored specifically for Air Force veterans. Discover how to leverage your VA loan benefits, navigate PCS moves, and find your dream home with ease, all while avoiding common pitfalls and maximizing your military relocation advantages.

As a member of the Air Force, you're likely no stranger to relocation. But when it's time to leave the military and settle into civilian life, finding the right home can be a daunting task. That's why we've put together this comprehensive guide to help you navigate the house hunting process and find your dream home.

Whether you're a seasoned pro or a first-time buyer, this step-by-step guide will walk you through everything you need to know to make your transition to civilian life a smooth one. From preparing for the home buying process to closing the deal, we've got you covered.

Preparing for the Home Buying Process

Before you start house hunting, it's essential to get your finances in order. Here are a few things to consider:

- Check your credit score: Your credit score plays a significant role in determining the interest rate you'll qualify for and whether you'll be approved for a mortgage. Aim for a credit score of 700 or higher.

- Gather financial documents: You'll need to provide financial documents such as pay stubs, bank statements, and tax returns to your lender.

- Determine your budget: Calculate your affordability and determine how much home you can afford.

- Research mortgage options: Look into mortgage options such as VA loans, which offer favorable terms for military personnel.

Understanding Your Home Buying Options

As a member of the Air Force, you have access to several home buying options. Here are a few to consider:

- VA loans: VA loans offer favorable terms such as lower interest rates and lower or no down payment requirements.

- USDA loans: USDA loans offer favorable terms for borrowers who purchase homes in rural areas.

- FHA loans: FHA loans offer more lenient credit score requirements and lower down payment options.

Step 1: Determine Your Needs and Wants

Before you start house hunting, it's essential to determine your needs and wants. Here are a few things to consider:

- Location: Where do you want to live? Consider factors such as commute time, schools, and amenities.

- Size: How many bedrooms and bathrooms do you need?

- Type: Do you want a single-family home, condo, or townhouse?

- Amenities: Do you want a yard, pool, or other amenities?

Creating a Home Buying Checklist

Create a checklist to help you stay organized during the home buying process. Here are a few things to include:

- Home features: Make a list of the features you want and need in a home.

- Neighborhood amenities: Make a list of the amenities you want in a neighborhood.

- Commute time: Consider the commute time to work, schools, and other important locations.

Step 2: Research Neighborhoods and Communities

Once you've determined your needs and wants, it's time to research neighborhoods and communities. Here are a few things to consider:

- Schools: Research the local schools and their ratings.

- Crime rates: Research the crime rates in the area.

- Amenities: Research the amenities in the area such as parks, grocery stores, and restaurants.

Using Online Resources

There are several online resources you can use to research neighborhoods and communities. Here are a few:

- NeighborhoodScout: NeighborhoodScout provides detailed information about neighborhoods including crime rates, schools, and demographics.

- AreaVibes: AreaVibes provides information about neighborhoods including livability scores, crime rates, and amenities.

Step 3: Find a Real Estate Agent

Once you've researched neighborhoods and communities, it's time to find a real estate agent. Here are a few things to consider:

- Experience: Look for an agent with experience working with military personnel.

- Knowledge: Look for an agent who is knowledgeable about the local area.

- Communication: Look for an agent who communicates well and is responsive to your needs.

Interviewing Potential Agents

Interview several potential agents to find the right one for you. Here are a few questions to ask:

- What experience do you have working with military personnel?

- What knowledge do you have about the local area?

- How will you communicate with me throughout the home buying process?

Step 4: View Homes and Make an Offer

Once you've found a real estate agent, it's time to view homes and make an offer. Here are a few things to consider:

- View homes: Work with your agent to view homes that meet your needs and wants.

- Make an offer: When you find a home you love, work with your agent to make an offer.

- Negotiate: Be prepared to negotiate the terms of the sale.

Understanding the Home Inspection Process

The home inspection process is an essential part of the home buying process. Here's what you need to know:

- What is a home inspection?: A home inspection is a thorough examination of the home's condition.

- What does a home inspection cover?: A home inspection covers the home's major systems including the roof, plumbing, and electrical.

Step 5: Close the Deal

Once you've made an offer and negotiated the terms of the sale, it's time to close the deal. Here are a few things to consider:

- Finalize your financing: Work with your lender to finalize your financing.

- Review and sign documents: Review and sign the documents necessary to complete the sale.

- Get the keys: Once the sale is complete, get the keys to your new home!

Understanding the Closing Process

The closing process can be complex, but here's what you need to know:

- What is the closing process?: The closing process is the final step in the home buying process.

- What happens during the closing process?: During the closing process, the ownership of the home is transferred from the seller to the buyer.

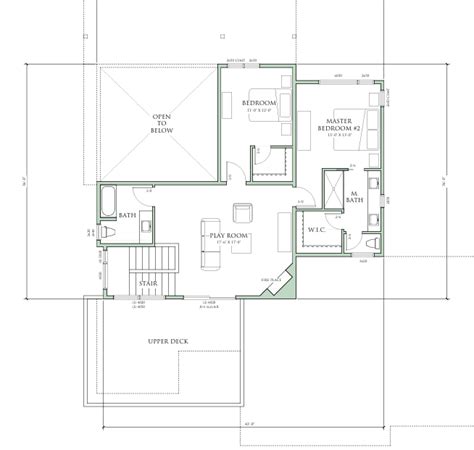

House Hunting Gallery

Final Thoughts

House hunting can be a daunting task, but with the right guidance, you can find your dream home. Remember to stay organized, do your research, and don't be afraid to ask for help. Good luck!