Intro

Learn how to calculate beta in Excel easily with a simple formula. Discover the step-by-step process to measure stock volatility and market risk using beta calculation. Master the concept of beta in finance and its application in portfolio management, risk analysis, and investment decision-making with our expert guide.

Investors and financial analysts often use beta as a measure of volatility or risk in the stock market. Beta measures the systematic risk of a security in relation to the overall market. In this article, we'll explore how to calculate beta in Excel easily using a simple formula.

Understanding Beta

Before diving into the calculation, let's understand what beta represents. Beta is a measure of the volatility of a stock or portfolio in relation to the overall market. A beta of 1 indicates that the stock or portfolio has the same level of volatility as the market. A beta greater than 1 indicates higher volatility, while a beta less than 1 indicates lower volatility.

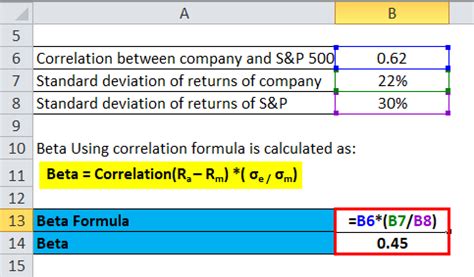

The Formula for Calculating Beta

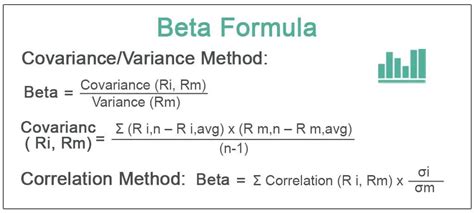

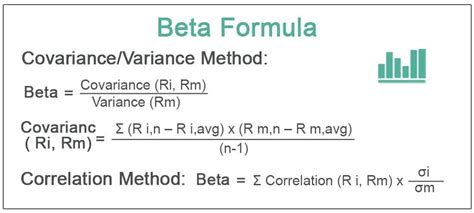

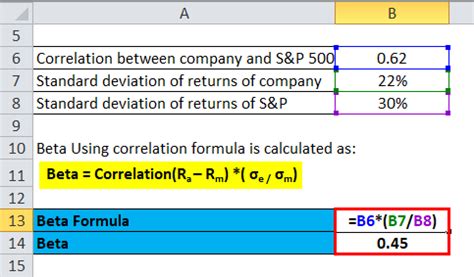

The formula for calculating beta is as follows:

Beta = Covariance (Stock Return, Market Return) / Variance (Market Return)

Where:

- Covariance (Stock Return, Market Return) is the covariance between the stock return and the market return.

- Variance (Market Return) is the variance of the market return.

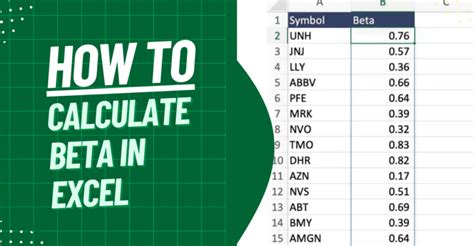

Calculating Beta in Excel

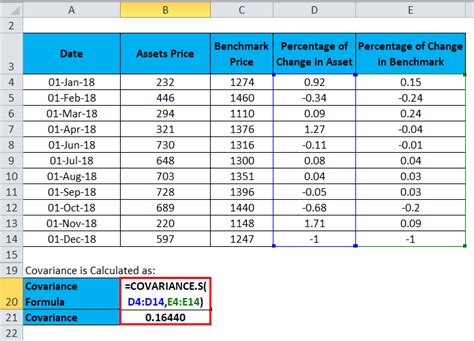

To calculate beta in Excel, we'll use the following steps:

- Collect historical data on the stock returns and market returns.

- Calculate the covariance between the stock returns and market returns using the COVAR function in Excel.

- Calculate the variance of the market returns using the VAR function in Excel.

- Use the formula for beta to calculate the beta value.

Assuming we have the historical data in columns A and B, we can use the following formula to calculate beta:

=BETA=COVAR(A2:A20,B2:B20)/VAR(B2:B20)

Where:

- A2:A20 is the range of stock returns.

- B2:B20 is the range of market returns.

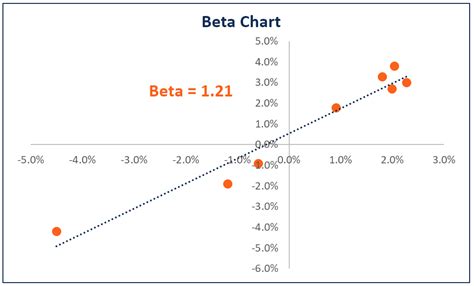

Example

Suppose we have the following historical data on stock returns and market returns:

| Stock Returns | Market Returns |

|---|---|

| 0.05 | 0.03 |

| 0.02 | 0.01 |

| 0.08 | 0.05 |

| ... | ... |

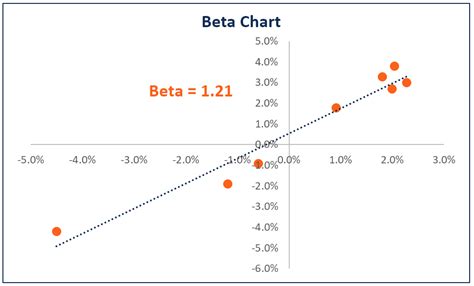

Using the formula above, we can calculate the beta value as follows:

=BETA=COVAR(A2:A20,B2:B20)/VAR(B2:B20) =BETA=0.00034/0.00015 =BETA=2.27

This means that the stock has a beta of 2.27, indicating that it is more volatile than the market.

Advantages of Using Excel to Calculate Beta

Using Excel to calculate beta has several advantages, including:

- Ease of use: Excel makes it easy to calculate beta using the COVAR and VAR functions.

- Flexibility: Excel allows you to use different historical data ranges and calculate beta for different stocks or portfolios.

- Accuracy: Excel provides accurate results, reducing the risk of human error.

Common Applications of Beta

Beta is commonly used in finance and investing to:

- Measure risk: Beta is used to measure the systematic risk of a security or portfolio.

- Evaluate performance: Beta is used to evaluate the performance of a security or portfolio relative to the market.

- Construct portfolios: Beta is used to construct portfolios that are optimized for risk and return.

Gallery of Beta Calculation Examples

Beta Calculation Examples

We hope this article has helped you understand how to calculate beta in Excel easily using a simple formula. Beta is a powerful tool for measuring risk and evaluating performance, and Excel makes it easy to calculate and analyze. Whether you're an investor, analyst, or student, we encourage you to try out the formula and explore the many applications of beta.