Intro

Discover how much credit is needed for an apartment approval. Learn the average credit score required for rental applications, factors affecting credit scores, and tips to improve your creditworthiness. Get insider knowledge on FICO scores, credit reports, and rental history to increase your chances of securing your dream apartment.

How Much Credit Do I Need For an Apartment?

Renting an apartment can be a daunting task, especially when it comes to meeting the credit score requirements. A good credit score can make a huge difference in getting approved for an apartment, and it's essential to understand what landlords and property managers look for in a credit report.

Having a good credit score can give you a competitive edge in the rental market, as it indicates to the landlord that you're responsible with your finances and can pay rent on time. In this article, we'll explore how much credit you need to rent an apartment, what factors affect your credit score, and provide tips on how to improve your creditworthiness.

What Credit Score Do I Need to Rent an Apartment?

The credit score required to rent an apartment varies depending on the landlord, property manager, or rental company. Typically, a credit score of 600 or higher is considered good, but some landlords may require a higher score, often in the range of 650-700. However, it's not uncommon for some apartments to have more lenient credit score requirements, especially if you're a student or a first-time renter.

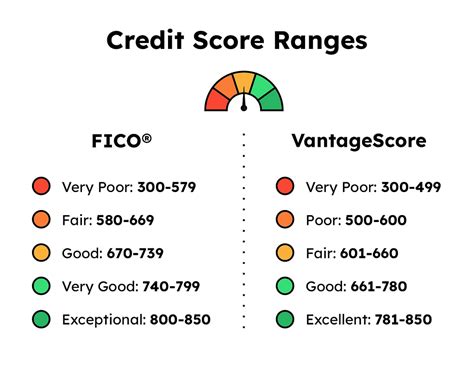

Here's a general breakdown of credit score ranges and their corresponding impact on apartment rentals:

- Excellent credit: 750-850 (you'll have a high chance of getting approved)

- Good credit: 700-749 (you'll likely get approved, but may face some scrutiny)

- Fair credit: 650-699 (you may face some difficulty getting approved, but it's not impossible)

- Poor credit: 600-649 (you may struggle to get approved, and may need to provide additional documentation)

- Bad credit: Below 600 (it may be challenging to get approved, and you may need to consider alternative options)

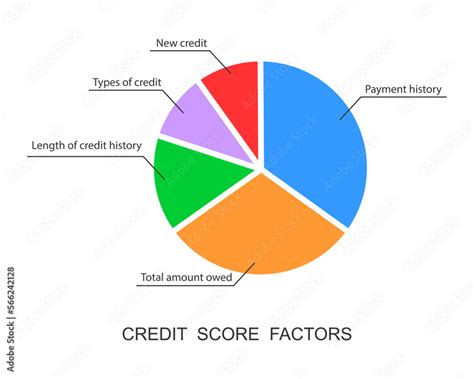

Factors That Affect Your Credit Score

Your credit score is calculated based on several factors, including:

- Payment history (35%): Your history of making on-time payments, late payments, and any accounts sent to collections.

- Credit utilization (30%): The amount of credit you're using compared to the amount available to you.

- Length of credit history (15%): The age of your oldest account, the age of your newest account, and the average age of all your accounts.

- Credit mix (10%): The variety of credit types you have, such as credit cards, loans, and mortgages.

- New credit (10%): New accounts, inquiries, and credit applications.

How to Improve Your Credit Score

If you're struggling to get approved for an apartment due to a poor credit score, don't worry! There are several ways to improve your creditworthiness:

- Make on-time payments: Pay all your bills on time, every time.

- Keep credit utilization low: Keep your credit utilization ratio below 30%.

- Monitor your credit report: Check your credit report regularly to ensure it's accurate and up-to-date.

- Don't open too many new accounts: Avoid applying for multiple credit cards or loans in a short period.

- Consider a co-signer: If you have a poor credit score, consider finding a co-signer with good credit to sign the lease with you.

Alternative Options for Renting an Apartment with Poor Credit

If you're struggling to get approved for an apartment due to poor credit, there are alternative options to consider:

- Second-chance rentals: Some landlords or property managers offer second-chance rentals for individuals with poor credit.

- Co-signer: Consider finding a co-signer with good credit to sign the lease with you.

- Short-term leases: Look for short-term leases or month-to-month rentals that may have more lenient credit score requirements.

- Room rentals: Consider renting a room instead of an entire apartment, as this may have more flexible credit score requirements.

Conclusion

Renting an apartment with poor credit can be challenging, but it's not impossible. By understanding the factors that affect your credit score and taking steps to improve your creditworthiness, you can increase your chances of getting approved for an apartment. Remember to also explore alternative options, such as second-chance rentals or co-signers, to help you secure a place to call home.

Apartment Credit Score Gallery