Intro

Unlock the secrets of your Business Activity Statement (BAS) costs. Learn how to navigate BAS compliance, understand GST obligations, and reduce unnecessary expenses. Discover expert tips on managing BAS costs, filing accurate returns, and avoiding common mistakes. Take control of your business finances and ensure seamless BAS lodgement.

As a business owner, managing your finances effectively is crucial to the success of your venture. One of the key components of your financial management is understanding your Business Activity Statement (BAS) costs. Your BAS is a critical document that outlines your business's financial transactions and helps you comply with tax laws and regulations. In this article, we will delve into the world of BAS costs, exploring what they are, how they work, and what you need to know to manage them effectively.

Understanding BAS Costs

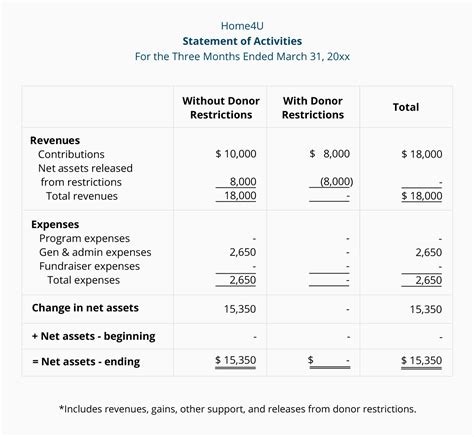

Your Business Activity Statement is a report that outlines your business's financial transactions over a specific period. It includes information about your income, expenses, GST (Goods and Services Tax), and other taxes. BAS costs refer to the expenses associated with preparing and lodging your BAS, including accounting fees, bookkeeping costs, and other related expenses.

Types of BAS Costs

There are several types of BAS costs that you need to be aware of, including:

- Accounting fees: These are the fees charged by your accountant or bookkeeper for preparing and lodging your BAS.

- Bookkeeping costs: These are the costs associated with maintaining your business's financial records, including invoicing, reconciliations, and journal entries.

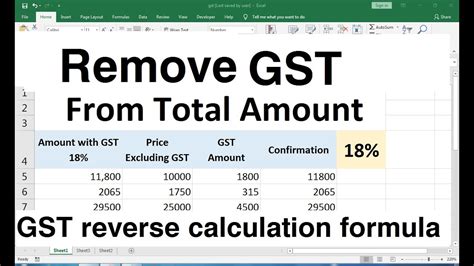

- GST costs: These are the costs associated with calculating and reporting your business's GST obligations.

- Payroll costs: These are the costs associated with processing your business's payroll, including PAYG (Pay As You Go) withholding and superannuation.

How BAS Costs Work

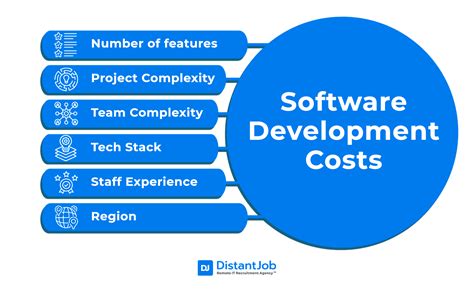

Your BAS costs are typically calculated based on the complexity of your business's financial transactions and the level of service required. For example, if you have a simple business with minimal transactions, your BAS costs may be lower than a business with complex transactions and multiple entities.

Factors Affecting BAS Costs

Several factors can affect your BAS costs, including:

- Business size and complexity: Larger businesses with more complex transactions tend to have higher BAS costs.

- Industry and type of business: Certain industries, such as construction or manufacturing, may have higher BAS costs due to the complexity of their financial transactions.

- Accounting and bookkeeping requirements: Businesses that require more frequent or complex accounting and bookkeeping services tend to have higher BAS costs.

- GST and tax obligations: Businesses with more complex GST and tax obligations tend to have higher BAS costs.

Managing BAS Costs

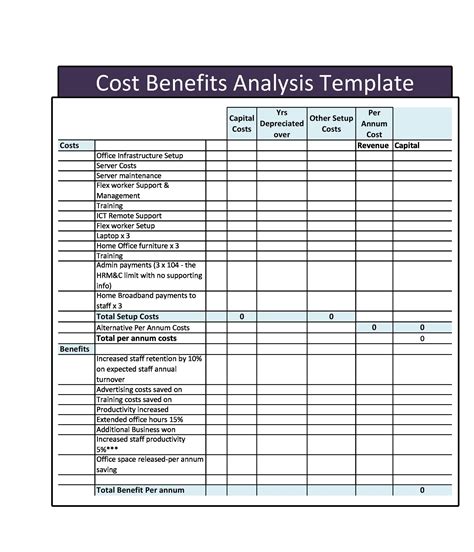

Managing your BAS costs effectively requires a combination of good financial management practices and smart accounting strategies. Here are some tips to help you manage your BAS costs:

- Keep accurate and detailed financial records: Accurate and detailed financial records can help reduce your BAS costs by minimizing errors and omissions.

- Choose the right accounting software: Using cloud-based accounting software can help streamline your financial management and reduce your BAS costs.

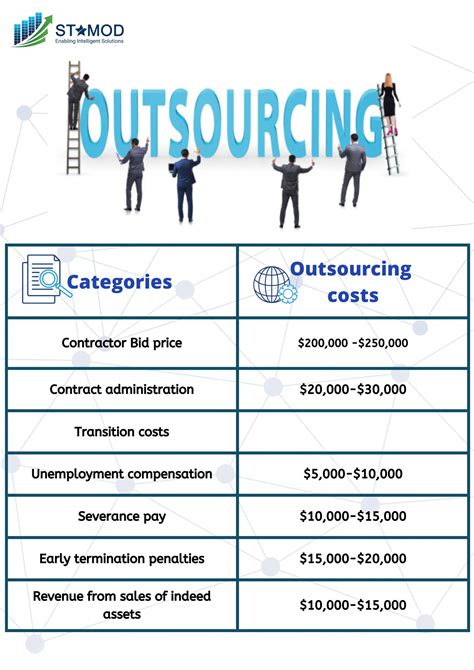

- Outsource your accounting and bookkeeping: Outsourcing your accounting and bookkeeping can help reduce your BAS costs by leveraging the expertise of a professional accounting firm.

Benefits of Understanding BAS Costs

Understanding your BAS costs can have several benefits for your business, including:

- Improved financial management: By understanding your BAS costs, you can better manage your finances and make informed decisions about your business.

- Reduced accounting fees: By keeping accurate and detailed financial records, you can reduce your accounting fees and minimize errors and omissions.

- Increased compliance: By understanding your BAS costs, you can ensure that your business is compliant with tax laws and regulations, reducing the risk of penalties and fines.

Conclusion

Understanding your Business Activity Statement costs is essential for effective financial management and compliance with tax laws and regulations. By understanding the types of BAS costs, how they work, and the factors that affect them, you can manage your BAS costs effectively and make informed decisions about your business. Remember to keep accurate and detailed financial records, choose the right accounting software, and outsource your accounting and bookkeeping to minimize your BAS costs.

Business Activity Statement Costs Gallery

We hope this article has provided you with a comprehensive understanding of Business Activity Statement costs and how to manage them effectively. If you have any questions or need further assistance, please don't hesitate to comment below or contact us.