Intro

Master the art of calculating profit and loss in Excel with ease. Learn how to create a profit and loss statement, calculate net profit, and analyze financial data using formulas and functions. Discover tips and tricks for accurate calculations, data visualization, and error-free spreadsheets. Simplify your financial analysis with Excel.

Managing finances effectively is crucial for the success of any business. Calculating profit and loss is a fundamental aspect of financial management, and Microsoft Excel is a powerful tool that can simplify this process. In this article, we will explore how to calculate profit and loss in Excel, making it easier for you to track your business's financial performance.

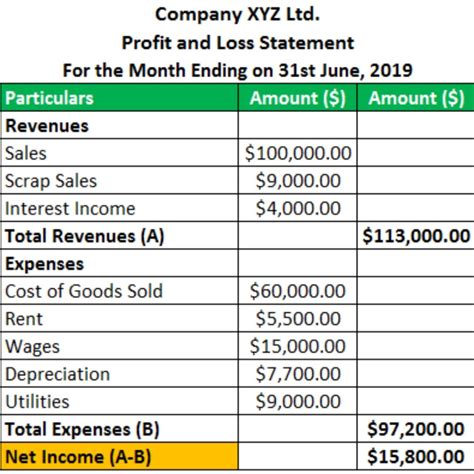

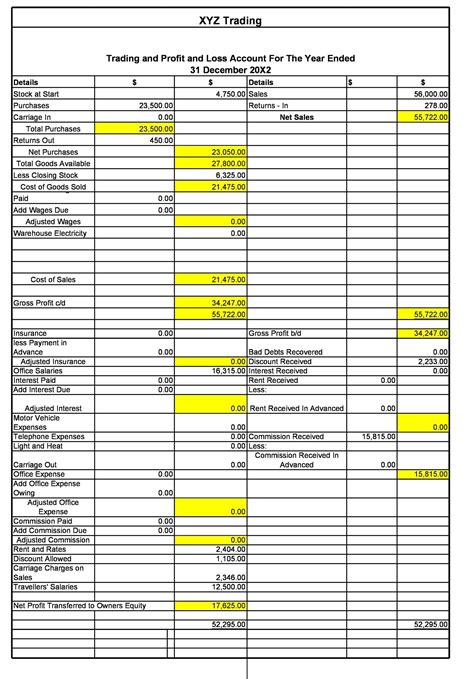

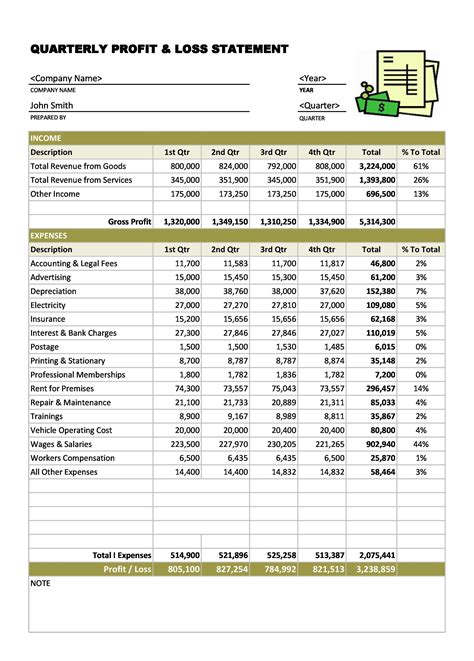

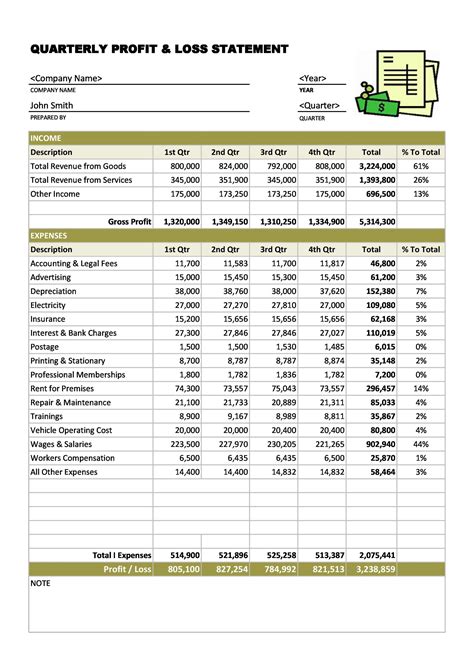

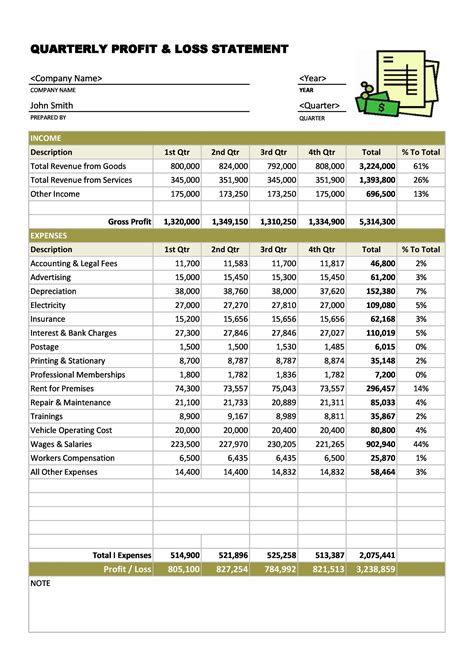

Understanding Profit and Loss Statements

A profit and loss statement, also known as an income statement, is a financial document that summarizes a company's revenues and expenses over a specific period. It provides insights into a company's financial performance, helping business owners make informed decisions. The statement consists of two main sections: revenues and expenses.

Revenues

Revenues refer to the income generated by a business from its normal operations. This includes sales, services, and other sources of income.

Expenses

Expenses, on the other hand, are the costs incurred by a business to generate revenues. This includes the cost of goods sold, operating expenses, and other expenses.

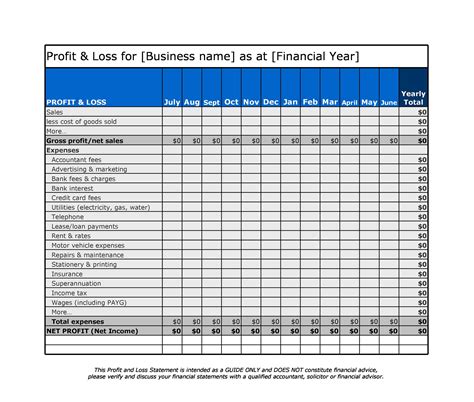

Setting Up a Profit and Loss Template in Excel

To calculate profit and loss in Excel, you need to set up a template. Here's a step-by-step guide to help you get started:

- Create a new Excel worksheet and give it a title, such as "Profit and Loss Statement."

- Set up the following columns:

- Date

- Revenues

- Cost of Goods Sold

- Gross Profit

- Operating Expenses

- Net Income

- Create a table to organize your data, using the columns you set up in step 2.

Entering Data into the Template

Once you have set up the template, you can start entering data into the table. Here's how:

- Enter the date range for which you want to calculate the profit and loss.

- Enter the revenues and cost of goods sold for each date.

- Calculate the gross profit by subtracting the cost of goods sold from the revenues.

- Enter the operating expenses for each date.

- Calculate the net income by subtracting the operating expenses from the gross profit.

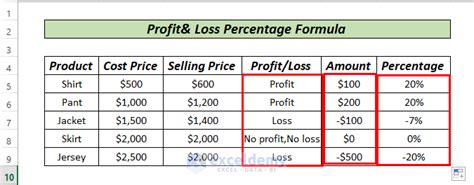

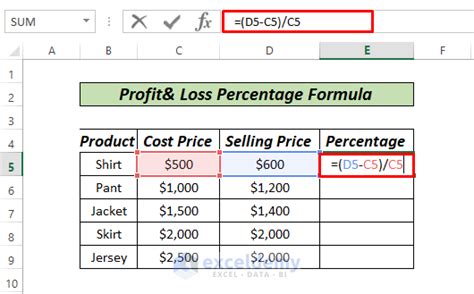

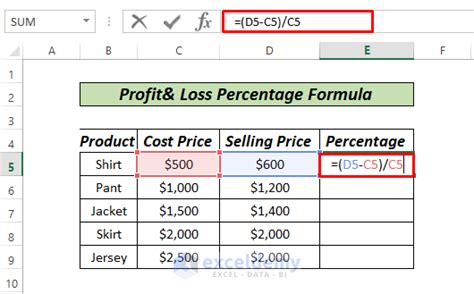

Using Formulas to Calculate Profit and Loss

Excel formulas can simplify the calculation process and reduce errors. Here are some formulas you can use:

- Gross Profit Formula:

=SUM(Revenues) - SUM(Cost of Goods Sold) - Net Income Formula:

=SUM(Gross Profit) - SUM(Operating Expenses)

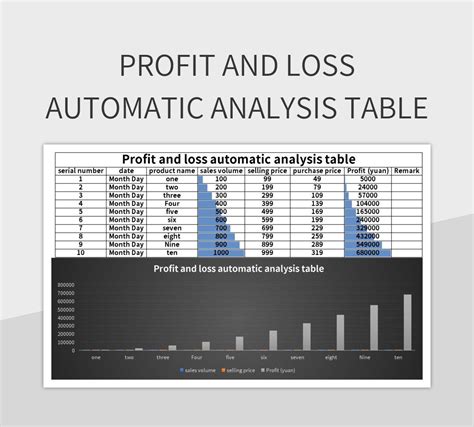

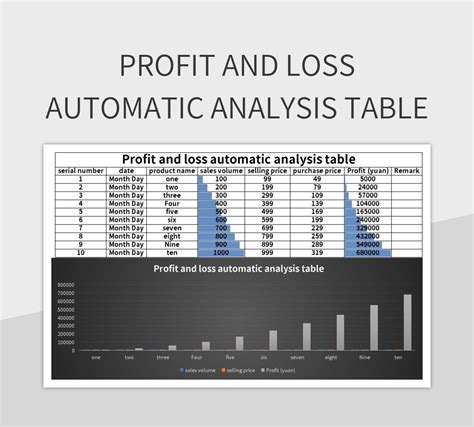

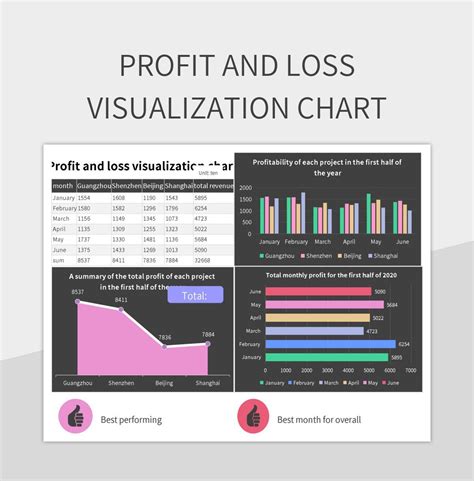

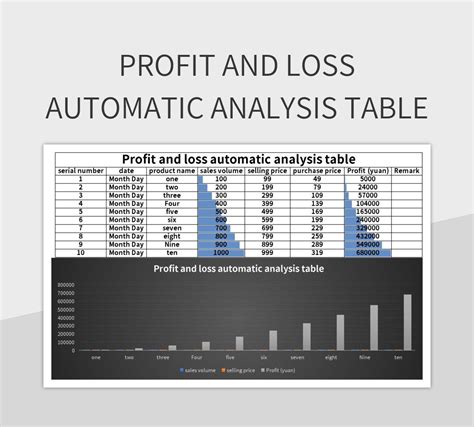

Using Charts to Visualize Profit and Loss

Charts can help you visualize your profit and loss data, making it easier to identify trends and patterns. Here's how to create a chart in Excel:

- Select the data range for which you want to create a chart.

- Go to the "Insert" tab and click on "Chart."

- Choose a chart type, such as a column chart or line chart.

- Customize the chart as needed.

Analyzing Profit and Loss Data

Analyzing your profit and loss data can help you identify areas for improvement and make informed business decisions. Here are some tips:

- Identify trends and patterns in your data.

- Compare your actual results to your budget or forecast.

- Analyze your gross profit margin and net income ratio.

- Identify areas where you can reduce costs or increase revenues.

Gallery of Profit and Loss Statements

Profit and Loss Statements

Final Thoughts

Calculating profit and loss in Excel is a straightforward process that can help you track your business's financial performance. By setting up a template, entering data, using formulas, and analyzing your data, you can make informed business decisions and drive growth. Remember to use charts to visualize your data and identify trends and patterns. With practice, you can become proficient in using Excel to calculate profit and loss, and take your business to the next level.

If you have any questions or comments, please feel free to share them below.