Intro

Unlock the power of Excel to boost your business profits! Learn how to calculate profitability in Excel with our step-by-step guide, covering key metrics like revenue, cost, and margin analysis. Master essential formulas and techniques to optimize pricing, reduce costs, and maximize ROI, driving business growth and success.

In today's fast-paced business environment, understanding the financial health of your organization is crucial for making informed decisions. One key metric to gauge financial performance is profitability. Calculating profitability in Excel can be a daunting task, especially for those without extensive financial analysis experience. However, with the right tools and knowledge, you can easily navigate the process. In this comprehensive guide, we will walk you through a step-by-step approach to calculating profitability in Excel.

Why is Profitability Important?

Profitability is a critical indicator of a company's financial well-being. It measures the ability of a business to generate earnings relative to its expenses and costs. By analyzing profitability, you can identify areas of improvement, optimize resource allocation, and make strategic decisions to drive growth. Moreover, profitability metrics can be used to compare performance across different periods, departments, or projects.

Understanding Profitability Metrics

Before diving into the Excel calculations, it's essential to understand the various profitability metrics. The most common ones include:

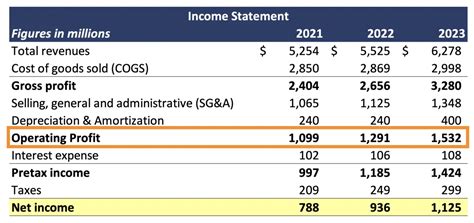

- Gross Profit: The difference between revenue and the cost of goods sold (COGS).

- Operating Profit: The profit earned from core business operations, calculated by subtracting operating expenses from gross profit.

- Net Profit: The profit earned after deducting all expenses, including taxes and interest, from operating profit.

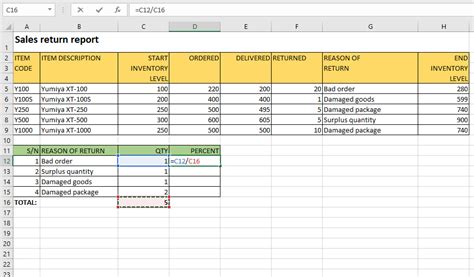

Setting Up Your Excel Worksheet

To calculate profitability in Excel, you'll need to set up a worksheet with the necessary data. Here's a step-by-step guide:

- Create a new worksheet: Open a new Excel workbook and create a worksheet for your profitability analysis.

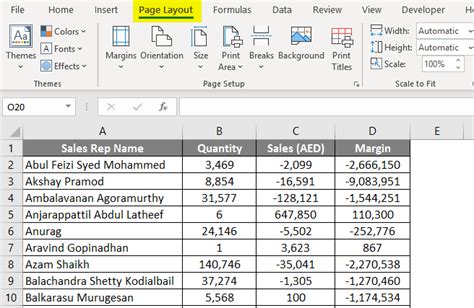

- Enter data: Input your company's financial data, including revenue, COGS, operating expenses, and other relevant costs.

- Organize data: Structure your data in a logical and consistent manner, using headers and labels to identify different sections.

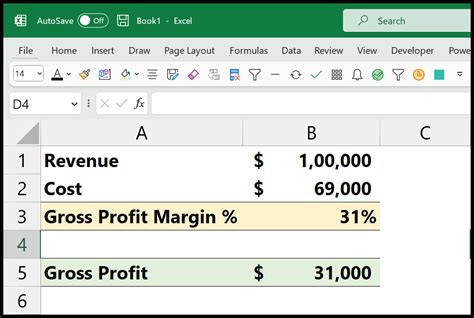

Calculating Gross Profit

To calculate gross profit, you'll need to subtract COGS from revenue. Here's the formula:

Gross Profit = Revenue - COGS

In Excel, you can use the following formula:

=A1-B1

Where:

- A1 represents the revenue cell

- B1 represents the COGS cell

Calculating Operating Profit

To calculate operating profit, you'll need to subtract operating expenses from gross profit. Here's the formula:

Operating Profit = Gross Profit - Operating Expenses

In Excel, you can use the following formula:

=C1-D1

Where:

- C1 represents the gross profit cell

- D1 represents the operating expenses cell

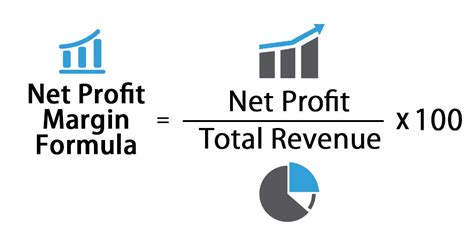

Calculating Net Profit

To calculate net profit, you'll need to subtract all expenses, including taxes and interest, from operating profit. Here's the formula:

Net Profit = Operating Profit - Taxes - Interest

In Excel, you can use the following formula:

=E1-F1-G1

Where:

- E1 represents the operating profit cell

- F1 represents the taxes cell

- G1 represents the interest cell

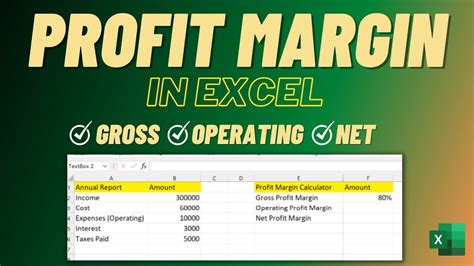

Analyzing Profitability Metrics

Once you've calculated your profitability metrics, you can analyze the results to identify areas of improvement. Here are some tips:

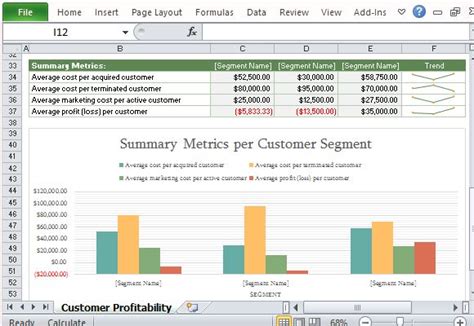

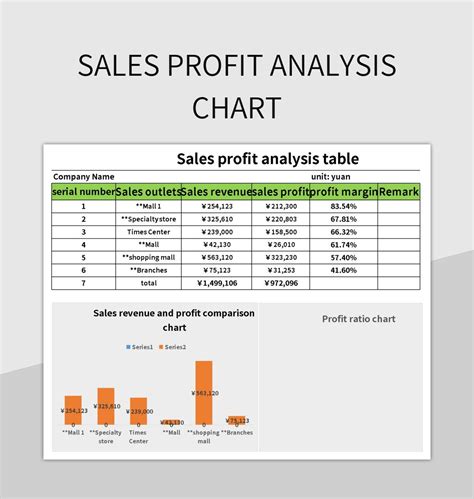

- Compare metrics: Compare your profitability metrics across different periods or departments to identify trends and patterns.

- Analyze ratios: Calculate profitability ratios, such as the gross margin ratio or operating profit margin, to evaluate performance.

- Visualize data: Use charts and graphs to visualize your profitability data and make it easier to understand.

Common Profitability Formulas in Excel

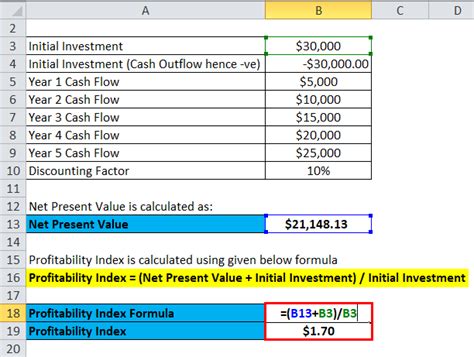

Here are some common profitability formulas you can use in Excel:

- Gross Margin Ratio: (Gross Profit / Revenue) x 100

- Operating Profit Margin: (Operating Profit / Revenue) x 100

- Net Profit Margin: (Net Profit / Revenue) x 100

- Return on Sales (ROS): (Net Profit / Revenue) x 100

Gallery of Profitability Formulas in Excel

Profitability Formulas in Excel

Conclusion and Next Steps

Calculating profitability in Excel is a straightforward process that can provide valuable insights into your company's financial performance. By following the steps outlined in this guide, you can easily calculate your profitability metrics and analyze the results to identify areas of improvement. Remember to use the formulas and ratios outlined in this guide to get the most out of your profitability analysis.

We hope this guide has been helpful in your profitability analysis journey. If you have any questions or need further assistance, please don't hesitate to comment below. Share your experiences and tips for calculating profitability in Excel, and help others in the community improve their financial analysis skills.