Simple interest is a fundamental concept in finance and mathematics, and being able to calculate it quickly and accurately is an essential skill. Fortunately, Microsoft Excel provides an easy way to calculate simple interest, and in this article, we'll show you how to do it.

Calculating simple interest is a straightforward process that involves multiplying the principal amount by the interest rate and the time period. However, using Excel can save you time and effort, especially when dealing with complex calculations or multiple investments.

Understanding Simple Interest

Before we dive into the Excel calculations, let's quickly review the concept of simple interest. Simple interest is a type of interest that is calculated only on the principal amount, without taking into account any accrued interest.

The formula for simple interest is:

Simple Interest = Principal x Rate x Time

Where:

- Principal is the initial amount of money

- Rate is the interest rate (expressed as a decimal)

- Time is the time period (expressed in years)

For example, if you deposit $1,000 into a savings account that earns a 5% interest rate per annum, the simple interest would be:

Simple Interest = $1,000 x 0.05 x 1 = $50

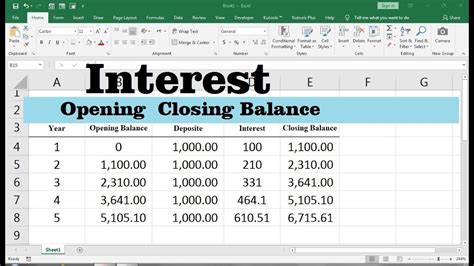

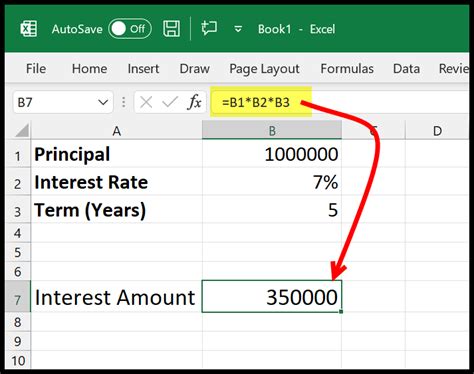

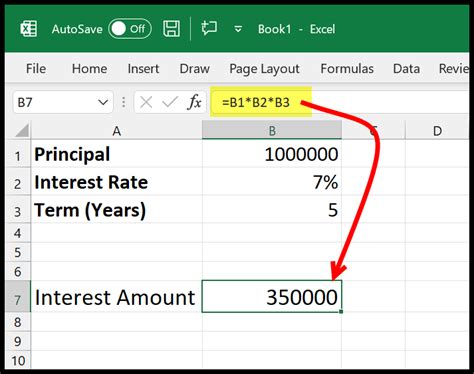

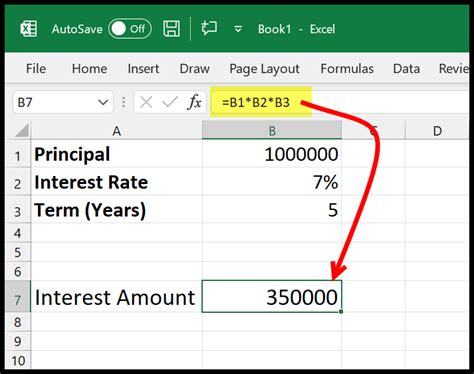

Calculating Simple Interest in Excel

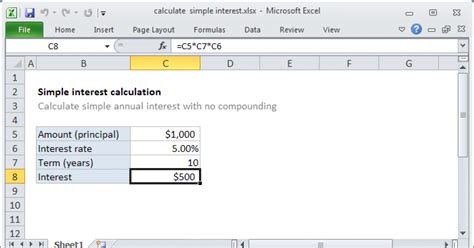

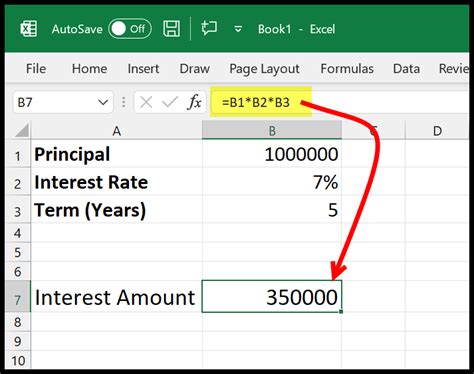

Now that we've reviewed the concept of simple interest, let's see how to calculate it in Excel.

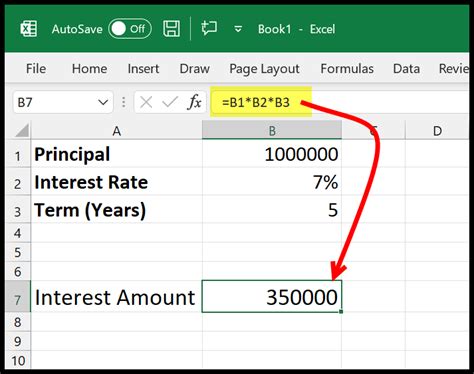

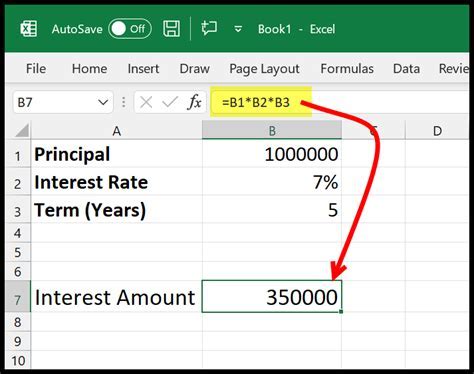

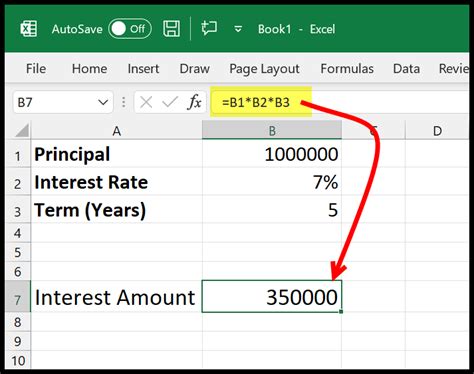

Assuming you have the principal amount, interest rate, and time period in separate cells, you can use the following formula:

=Principal x Rate x Time

For example, if the principal amount is in cell A1, the interest rate is in cell B1, and the time period is in cell C1, the formula would be:

=A1B1C1

You can also use the PRODUCT function to calculate the simple interest:

=PRODUCT(A1, B1, C1)

Both of these formulas will give you the same result, which is the simple interest.

Using Excel Functions to Calculate Simple Interest

While the formulas we showed you earlier are straightforward, Excel provides a few built-in functions that can make calculating simple interest even easier.

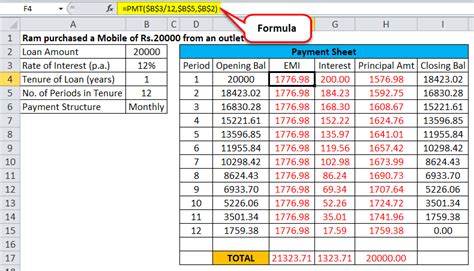

One such function is the IPMT function, which calculates the interest portion of a loan payment.

The syntax for the IPMT function is:

IPMT(rate, per, nper, pv, [fv], [type])

Where:

- rate is the interest rate

- per is the period for which you want to calculate the interest

- nper is the total number of periods

- pv is the present value (the principal amount)

- fv is the future value (optional)

- type is the type of interest (optional)

For example, if you want to calculate the simple interest for a loan with a principal amount of $10,000, an interest rate of 6% per annum, and a time period of 5 years, you can use the following formula:

=IPMT(0.06, 5, 5, 10000)

This formula will return the simple interest for the 5-year period.

Another function you can use is the ISPMT function, which calculates the interest portion of a loan payment.

The syntax for the ISPMT function is:

ISPMT(rate, per, nper, pv)

Where:

- rate is the interest rate

- per is the period for which you want to calculate the interest

- nper is the total number of periods

- pv is the present value (the principal amount)

For example, if you want to calculate the simple interest for a loan with a principal amount of $10,000, an interest rate of 6% per annum, and a time period of 5 years, you can use the following formula:

=ISPMT(0.06, 5, 5, 10000)

This formula will return the simple interest for the 5-year period.

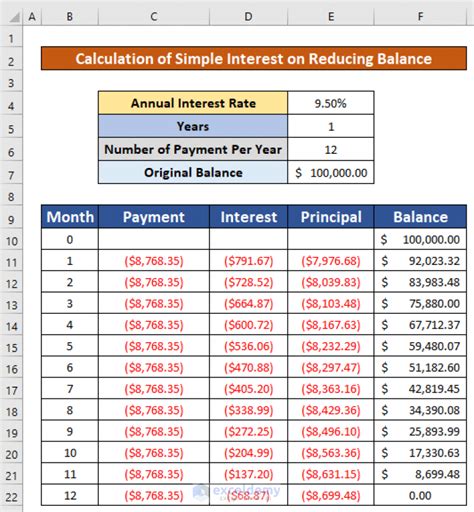

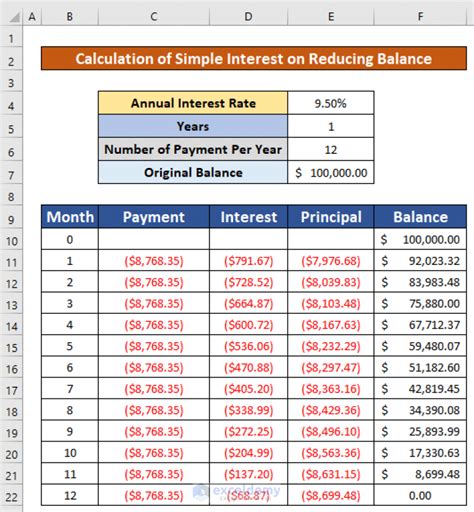

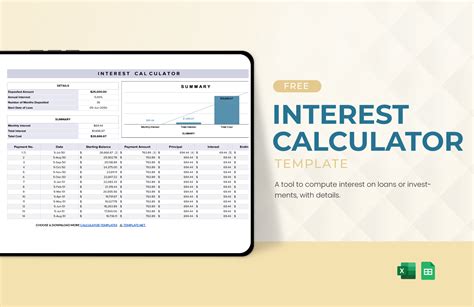

Using Excel Templates to Calculate Simple Interest

If you need to calculate simple interest frequently, you may want to consider using an Excel template.

Excel templates are pre-designed spreadsheets that you can use to perform specific calculations. They often include formulas and formatting that make it easy to enter data and get results.

To find simple interest templates in Excel, follow these steps:

- Open Excel and click on the "File" tab.

- Click on "New" and then click on " Templates".

- In the "Search for online templates" field, type "simple interest" and press Enter.

- Browse through the results and click on a template that suits your needs.

Once you've downloaded a template, you can customize it to suit your needs. Most templates will include fields for the principal amount, interest rate, and time period, as well as formulas to calculate the simple interest.

Benefits of Using Excel to Calculate Simple Interest

Using Excel to calculate simple interest has several benefits, including:

- Accuracy: Excel's formulas and functions ensure accurate calculations, reducing the risk of errors.

- Speed: Excel calculations are fast and efficient, saving you time and effort.

- Flexibility: Excel allows you to customize templates and formulas to suit your specific needs.

- Scalability: Excel can handle complex calculations and large datasets with ease.

Overall, using Excel to calculate simple interest is a convenient and efficient way to perform financial calculations.

Simple Interest Excel Calculations Image Gallery

Conclusion

Calculating simple interest in Excel is a straightforward process that can be done using formulas, functions, or templates. By following the steps outlined in this article, you can quickly and accurately calculate simple interest for a variety of financial calculations.

Whether you're a student, a professional, or just someone looking to manage your finances, understanding how to calculate simple interest in Excel is an essential skill that can save you time and effort.

So why not give it a try? Open up Excel and start calculating simple interest today!