Intro

Master portfolio risk analysis with our step-by-step guide on calculating portfolio standard deviation in Excel. Learn how to measure investment volatility and diversification using variance, covariance, and standard deviation formulas. Improve your portfolio optimization skills with this easy-to-follow tutorial, covering Excel formulas, portfolio management, and risk assessment.

Calculating portfolio standard deviation in Excel can seem daunting, but with the right steps, it can be made easy. Portfolio standard deviation is a measure of the risk of a portfolio, and it's essential to calculate it to understand the potential volatility of your investments.

Why Calculate Portfolio Standard Deviation?

Calculating portfolio standard deviation is crucial because it helps you:

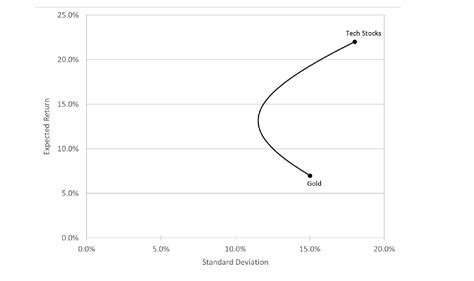

- Assess the risk of your portfolio: By calculating the standard deviation of your portfolio, you can understand the potential volatility of your investments.

- Compare portfolios: You can compare the standard deviation of different portfolios to determine which one is riskier.

- Optimize your portfolio: By understanding the standard deviation of your portfolio, you can optimize it to achieve your desired level of risk.

Step-by-Step Guide to Calculating Portfolio Standard Deviation in Excel

To calculate portfolio standard deviation in Excel, follow these steps:

Step 1: Gather Data

Gather the historical returns data for each asset in your portfolio. You can obtain this data from financial websites, such as Yahoo Finance or Quandl.

Step 2: Calculate the Weights of Each Asset

Calculate the weights of each asset in your portfolio. The weight of an asset is the proportion of the portfolio's total value that the asset represents.

Formula: Weight = (Asset Value / Total Portfolio Value)

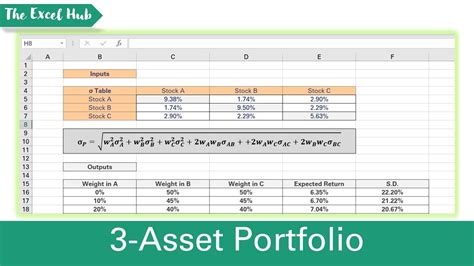

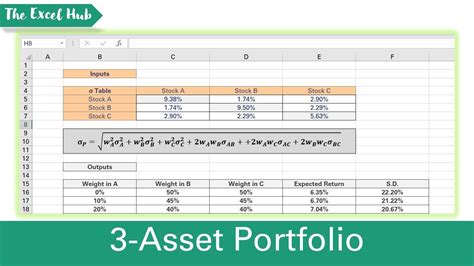

Step 3: Calculate the Covariance Matrix

Calculate the covariance matrix of the returns data. The covariance matrix measures the covariance between each pair of assets.

Formula: Covariance (i, j) = Σ [(Return i - Mean Return i) x (Return j - Mean Return j)] / (n - 1)

where i and j are the assets, n is the number of observations, and Mean Return is the average return of the asset.

Step 4: Calculate the Portfolio Variance

Calculate the portfolio variance using the covariance matrix.

Formula: Portfolio Variance = Σ [Weight i x Weight j x Covariance (i, j)]

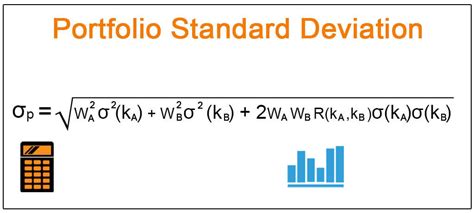

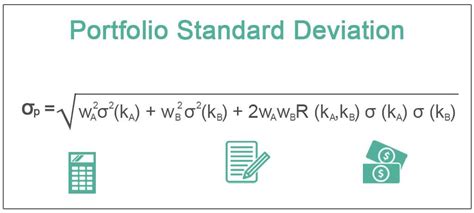

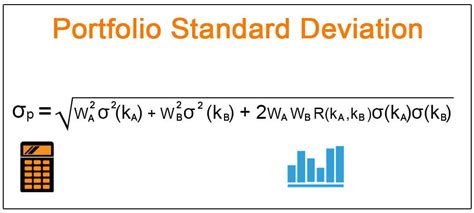

Step 5: Calculate the Portfolio Standard Deviation

Calculate the portfolio standard deviation by taking the square root of the portfolio variance.

Formula: Portfolio Standard Deviation = √Portfolio Variance

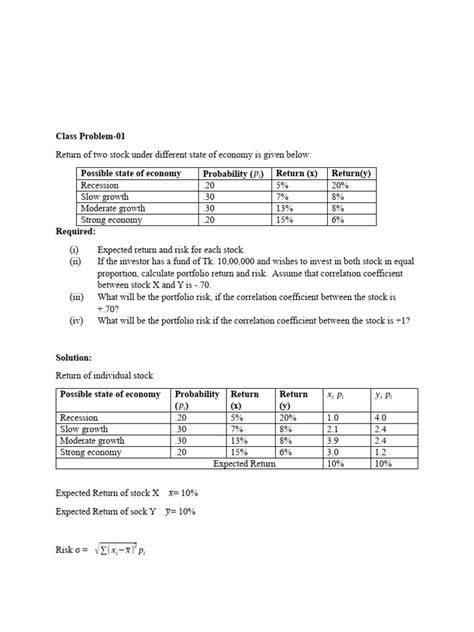

Example in Excel

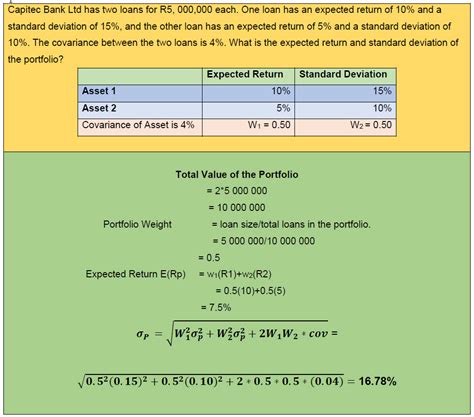

Suppose we have a portfolio with two assets, Stock A and Stock B. We want to calculate the portfolio standard deviation.

| Asset | Weight | Return |

|---|---|---|

| Stock A | 0.6 | 0.03 |

| Stock B | 0.4 | 0.05 |

Using the formulas above, we can calculate the portfolio standard deviation in Excel.

Gallery of Portfolio Standard Deviation Calculation

Portfolio Standard Deviation Calculation

By following these steps and using the formulas above, you can easily calculate the portfolio standard deviation in Excel. This calculation will help you understand the risk of your portfolio and make informed investment decisions.

FAQs

Q: What is portfolio standard deviation? A: Portfolio standard deviation is a measure of the risk of a portfolio, calculated by taking the square root of the portfolio variance.

Q: Why is portfolio standard deviation important? A: Portfolio standard deviation is important because it helps you understand the potential volatility of your investments and make informed decisions.

Q: How do I calculate portfolio standard deviation in Excel? A: To calculate portfolio standard deviation in Excel, follow the steps above, which include gathering data, calculating the weights of each asset, calculating the covariance matrix, calculating the portfolio variance, and finally calculating the portfolio standard deviation.

Share Your Thoughts!

Do you have any questions or comments about calculating portfolio standard deviation in Excel? Share your thoughts below!