Intro

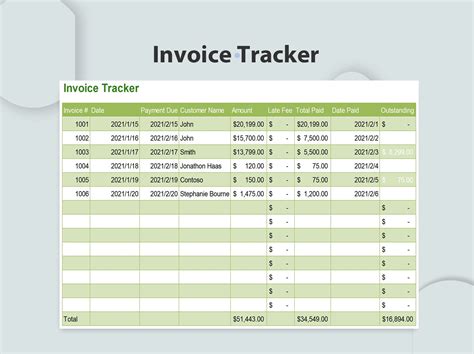

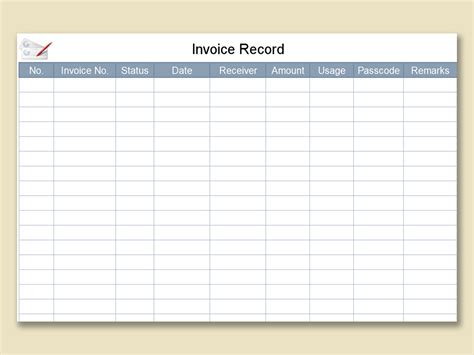

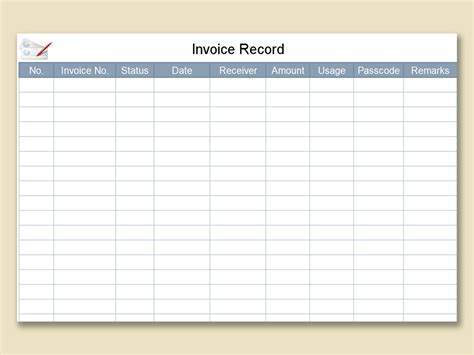

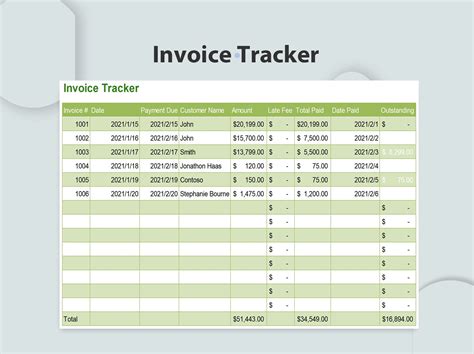

Streamline your business finances with our free Invoice Record Keeping Template in Excel. Easily track and manage invoices, payments, and clients in one place. Boost productivity and accuracy with automated calculations and customizable fields. Download now and simplify your accounting process with this essential tool for small businesses and entrepreneurs.

Effective invoice record keeping is crucial for any business to ensure smooth financial management, accurate accounting, and timely payment tracking. In today's digital age, utilizing templates can streamline this process, making it more efficient and less prone to errors. One of the most popular tools for creating and managing templates is Microsoft Excel, due to its versatility, accessibility, and the ease with which data can be analyzed and presented.

Importance of Invoice Record Keeping

Invoice record keeping is a critical aspect of business operations, serving as the backbone of financial management. Accurate and detailed records of invoices help in:

- Tracking Payments: Ensuring that payments are made on time and in full.

- Managing Cash Flow: Understanding the inflow and outflow of money helps in making informed financial decisions.

- Identifying Trends: Analyzing invoice records can reveal patterns or anomalies in spending or income, aiding in future planning.

- Compliance and Auditing: Maintaining comprehensive records is essential for tax purposes and audits.

How to Use Excel for Invoice Record Keeping

Microsoft Excel offers a powerful platform for creating an invoice record keeping template. Here’s how to leverage its capabilities:

1. Setting Up the Template

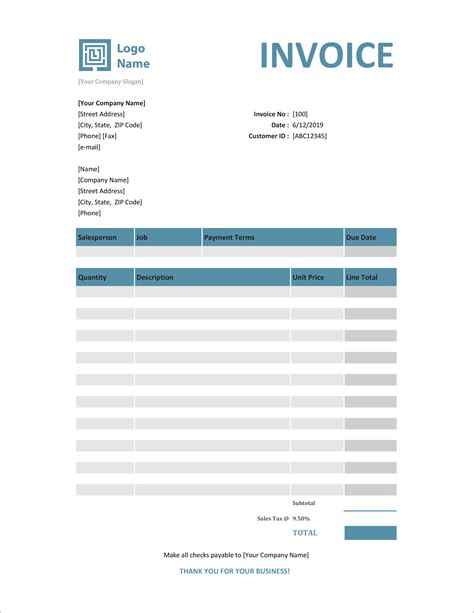

- Columns: Create columns for relevant data such as Invoice Number, Date Issued, Date Due, Client Name, Total Amount, Status (Paid/Unpaid), and Notes.

- Formulas: Use formulas to calculate totals and automate data entry where possible.

- Conditional Formatting: Highlight overdue invoices or unpaid amounts to quickly identify areas that need attention.

2. Utilizing Excel Functions

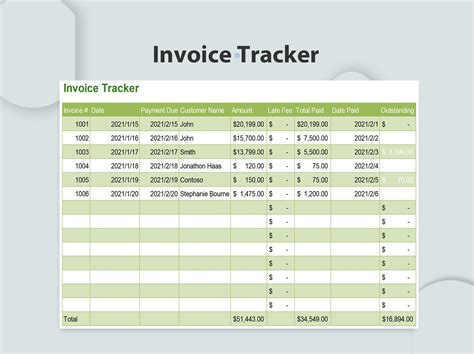

- Filtering and Sorting: Use Excel's filtering and sorting functions to organize invoices by date, client, or status.

- PivotTables: Create PivotTables to summarize data, making it easier to analyze trends and totals.

- Charts and Graphs: Incorporate charts and graphs to visually represent data, enhancing the understanding of financial trends.

3. Automating Tasks

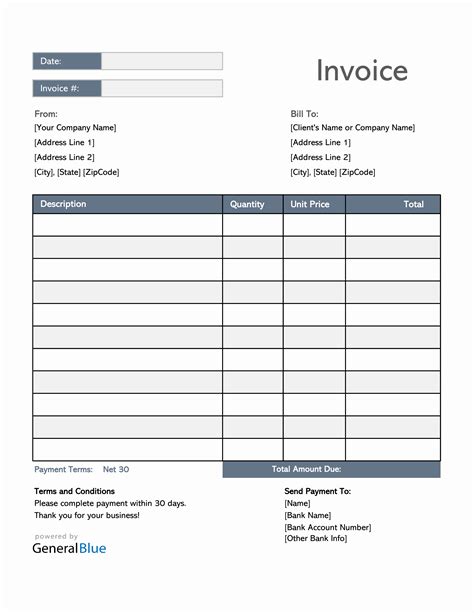

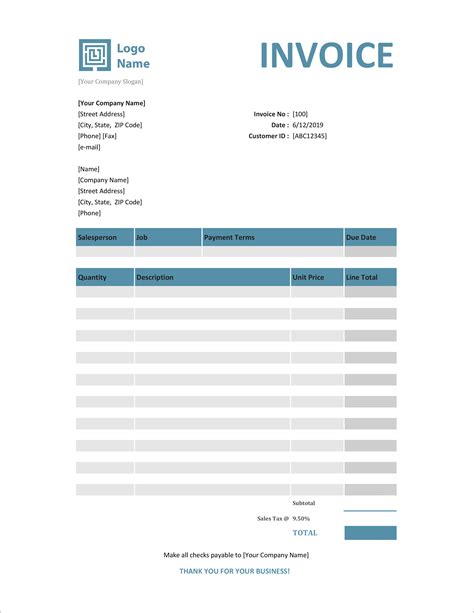

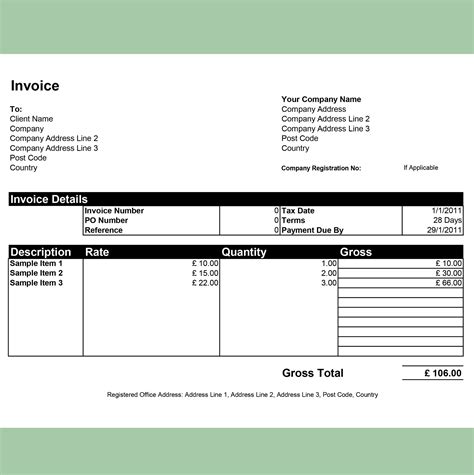

- Templates: Use Excel templates for creating new invoices, ensuring consistency and reducing the time spent on formatting.

- Macros: If you're familiar with VBA, create macros to automate repetitive tasks, such as sending reminders for overdue payments.

4. Ensuring Security and Accessibility

- Password Protection: Protect your Excel file with a password to ensure only authorized personnel have access.

- Cloud Sharing: Share your Excel file via cloud services like OneDrive or Google Drive, allowing for real-time collaboration and ensuring that your data is backed up.

Benefits of Using an Excel Template

Using an Excel template for invoice record keeping offers several benefits:

- Customization: Templates can be tailored to fit the specific needs of your business.

- Accuracy: Automated calculations reduce the risk of human error.

- Efficiency: Streamlines the invoicing process, saving time and resources.

- Flexibility: Can be easily shared and accessed by multiple users.

Creating an Efficient Invoice Record Keeping System

To create an efficient invoice record keeping system in Excel, consider the following steps:

- Define Your Needs: Determine what information you need to track and how you want to organize it.

- Set Up Your Template: Create your template, including relevant columns, formulas, and formatting.

- Automate Where Possible: Use Excel functions to automate tasks and reduce manual input.

- Regularly Review and Update: Schedule regular reviews of your invoice records to ensure they are accurate and up-to-date.

Conclusion

An Excel template for invoice record keeping is a valuable tool for businesses, offering a structured approach to managing financial data. By understanding the importance of invoice record keeping, leveraging Excel's capabilities, and creating an efficient system, businesses can significantly improve their financial management. Whether you're a small startup or an established company, an Excel template can help streamline your invoicing process, saving you time and resources.

FAQs

Q: What is the best way to organize an invoice record keeping template in Excel?

A: The best way to organize your template is to create relevant columns for data entry, use formulas for automation, and apply conditional formatting for quick identification of important information.

Q: How can I automate tasks in my Excel invoice template?

A: Use Excel functions such as filtering, sorting, and creating macros to automate repetitive tasks and streamline your invoicing process.

Q: What are the benefits of using an Excel template for invoice record keeping?

A: Benefits include customization, accuracy, efficiency, and flexibility. It allows for real-time collaboration and ensures that your data is backed up when shared via cloud services.

Q: How often should I review and update my invoice records?

A: Regular reviews are crucial. Schedule reviews at least quarterly to ensure your records are accurate and up-to-date.

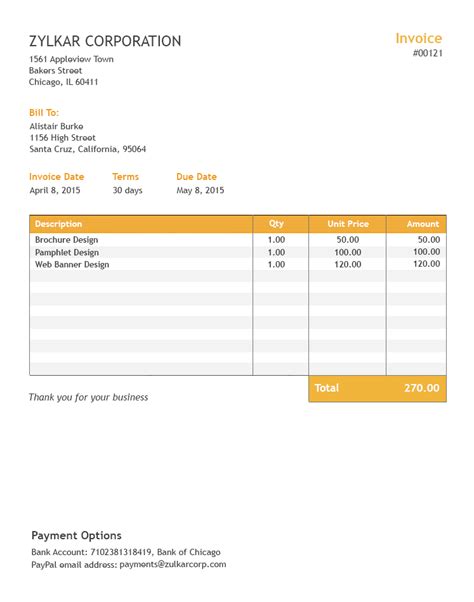

Gallery of Invoice Record Keeping Templates