Intro

Optimize your accounts receivable with a Late Payment Interest Calculator in Excel. Discover 5 ways this tool can help you streamline financial management, reduce bad debt, and improve cash flow. Learn how to calculate late payment interest, send reminders, and negotiate with clients effectively, all while minimizing financial losses.

Late payment interest calculator Excel can be a valuable tool for businesses and individuals alike. It helps calculate the interest on late payments, ensuring that you receive the correct amount of compensation for delayed payments. In this article, we will explore five ways that a late payment interest calculator Excel can help you manage your finances more effectively.

Understanding Late Payment Interest

Late payment interest is a fee charged on payments that are not made on time. It is usually calculated as a percentage of the outstanding amount and is intended to compensate the creditor for the delay in payment. Late payment interest can be calculated manually, but using a calculator or spreadsheet can simplify the process and reduce errors.

Benefits of Using a Late Payment Interest Calculator Excel

Using a late payment interest calculator Excel can help you manage your finances more effectively in several ways:

- Accurate Calculations: A late payment interest calculator Excel can perform complex calculations quickly and accurately, reducing the risk of errors.

- Time-Saving: Manual calculations can be time-consuming, especially when dealing with multiple late payments. A calculator or spreadsheet can automate the process, freeing up your time for other tasks.

- Customizable: A late payment interest calculator Excel can be customized to meet your specific needs, allowing you to adjust the interest rate, payment dates, and other variables.

5 Ways Late Payment Interest Calculator Excel Can Help

Here are five ways that a late payment interest calculator Excel can help you manage your finances more effectively:

1. Calculating Interest on Late Payments

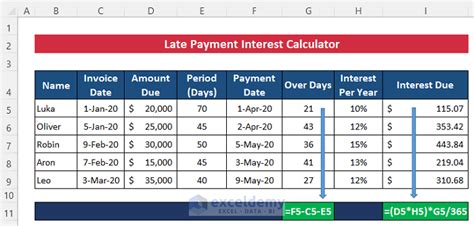

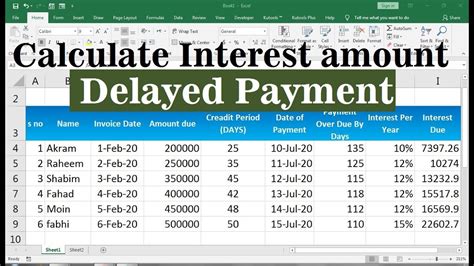

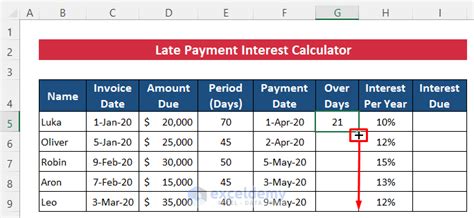

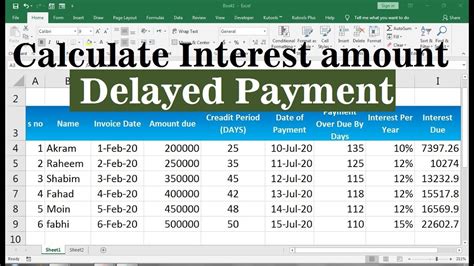

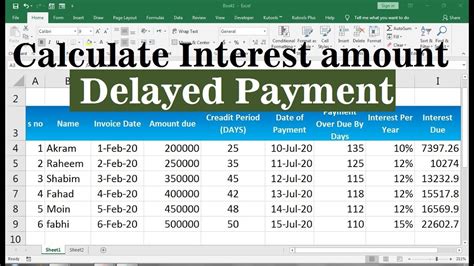

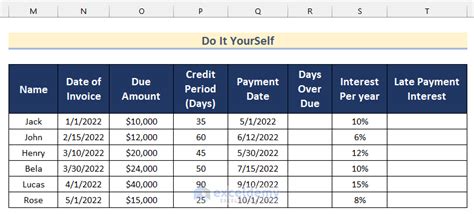

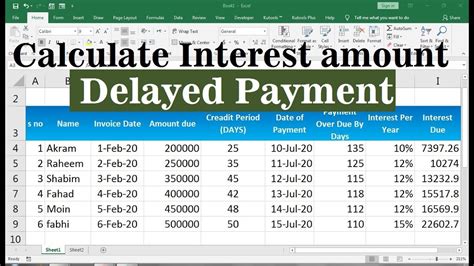

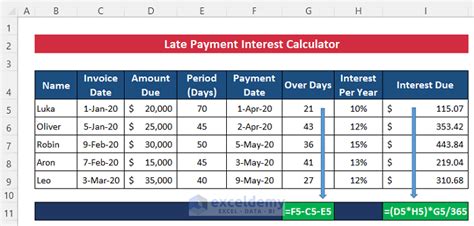

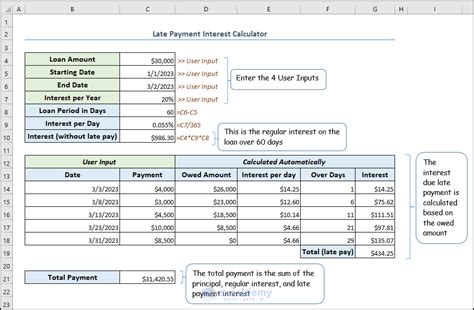

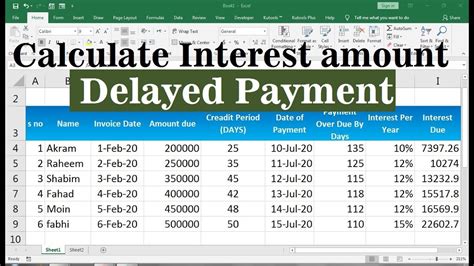

A late payment interest calculator Excel can help you calculate the interest on late payments accurately and quickly. Simply enter the outstanding amount, interest rate, and payment dates, and the calculator will perform the calculation for you.

2. Identifying Late Payment Trends

By tracking late payments and interest over time, you can identify trends and patterns in your finances. This can help you anticipate and prevent late payments in the future.

3. Negotiating with Debtors

A late payment interest calculator Excel can help you negotiate with debtors more effectively. By providing accurate calculations of late payment interest, you can demonstrate the cost of delayed payments and negotiate a settlement.

4. Improving Cash Flow Management

By calculating late payment interest accurately, you can better manage your cash flow. This can help you prioritize payments, manage debt, and make informed financial decisions.

5. Reducing Financial Stress

Late payment interest can be a significant source of financial stress. By using a late payment interest calculator Excel, you can reduce the stress and anxiety associated with managing late payments.

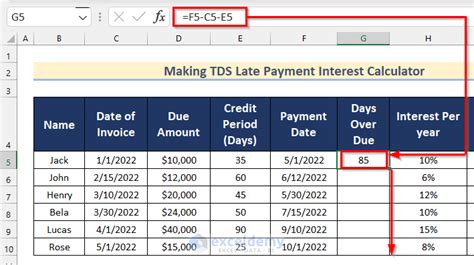

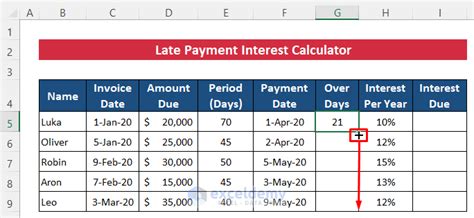

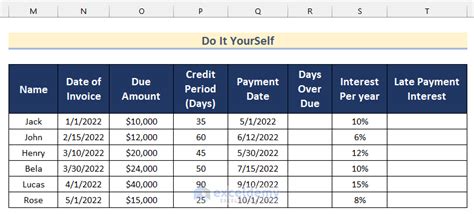

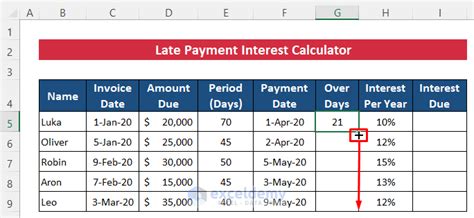

Creating a Late Payment Interest Calculator Excel

Creating a late payment interest calculator Excel is a straightforward process. Here are the steps to follow:

- Open Excel: Open a new Excel spreadsheet and create a table to enter the outstanding amount, interest rate, and payment dates.

- Enter Formulas: Enter the formulas to calculate the late payment interest, using the outstanding amount, interest rate, and payment dates as variables.

- Customize: Customize the calculator to meet your specific needs, adjusting the interest rate, payment dates, and other variables as necessary.

Conclusion

A late payment interest calculator Excel can be a valuable tool for businesses and individuals alike. By calculating late payment interest accurately, identifying trends, negotiating with debtors, improving cash flow management, and reducing financial stress, you can manage your finances more effectively.

Late Payment Interest Calculator Excel Image Gallery

Now that you've read about the benefits of a late payment interest calculator Excel, why not try creating one for yourself? With the right tools and knowledge, you can manage your finances more effectively and reduce the stress associated with late payments. Share your experiences and tips in the comments below!