Creating a lease amortization schedule in Excel can be a straightforward process, even for those without extensive financial expertise. In this article, we'll guide you through a step-by-step approach to setting up an amortization schedule for a lease in Excel, highlighting the importance of understanding lease terms, Excel formulas, and best practices for readability and error prevention.

Understanding Lease Amortization

Before diving into the process, it's essential to understand what lease amortization is. Amortization in the context of a lease refers to the process of spreading the cost of the asset over its useful life. This is crucial for accounting purposes, as it helps in recognizing the expense in the financial statements in a systematic manner.

Key Components of a Lease Amortization Schedule

- Lease Term: The duration of the lease agreement.

- Lease Payments: The periodic payments made to the lessor.

- Interest Rate: The rate at which interest is calculated on the lease.

- Present Value: The current worth of the future lease payments.

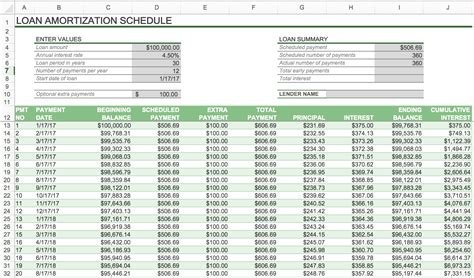

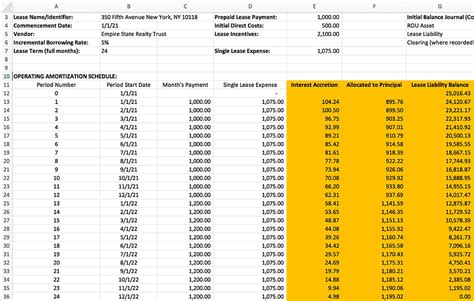

Setting Up the Amortization Schedule in Excel

To set up an amortization schedule in Excel, follow these steps:

-

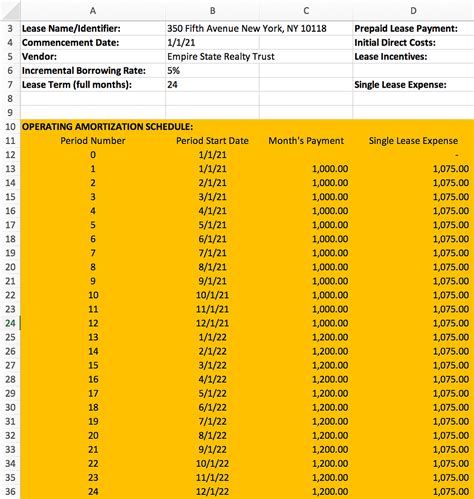

Input the Lease Details: Start by inputting the lease term, lease payments, and the interest rate into separate cells. For example, you can use cells A1, A2, and A3 for these inputs, respectively.

-

Calculate the Present Value: Use the PV function in Excel to calculate the present value of the lease. The syntax is

=PV(rate, nper, pmt, [fv], [type]). For a lease, you typically set [fv] to 0, and [type] to 0 for payments made at the end of the period. -

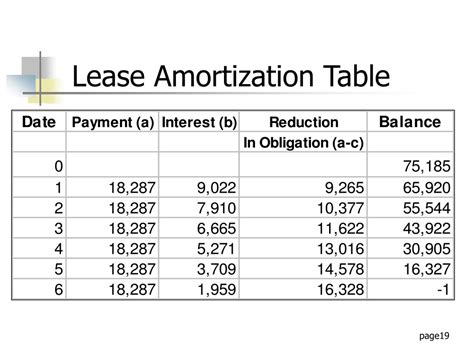

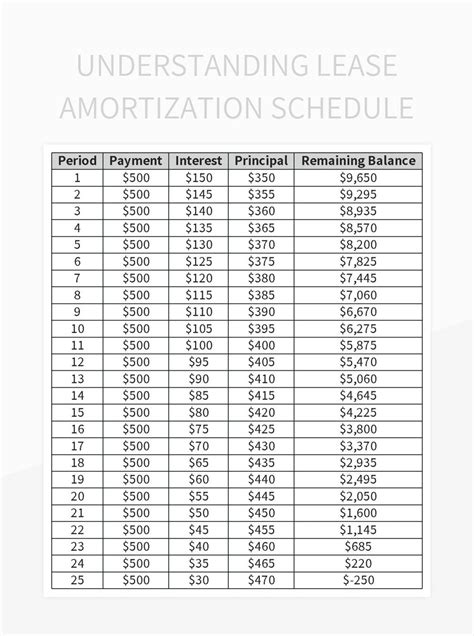

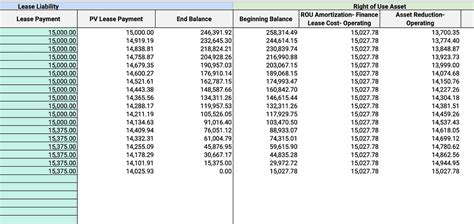

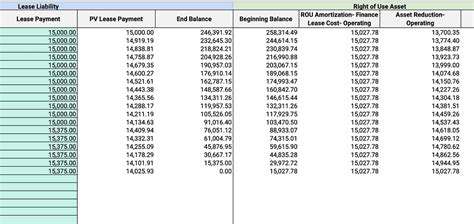

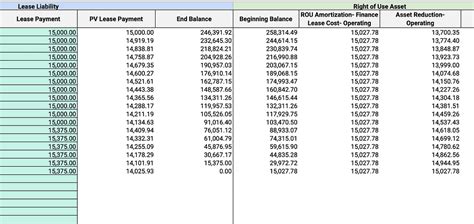

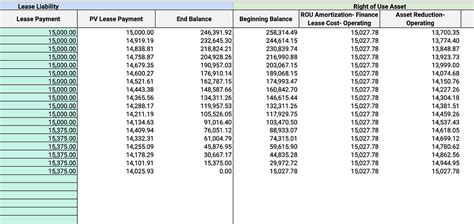

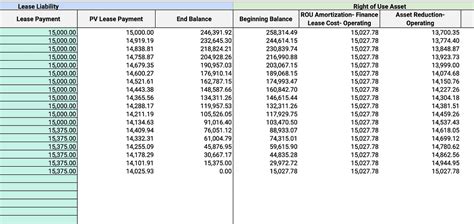

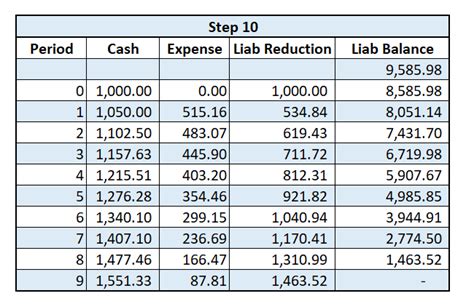

Create the Amortization Table: Set up a table with columns for the period, beginning balance, payment, interest, principal, and ending balance.

-

Formulas for the Amortization Table:

- Beginning Balance: Starts with the present value and decreases by the principal paid in each period.

- Payment: This is the fixed lease payment.

- Interest: Calculated as the beginning balance multiplied by the interest rate.

- Principal: The payment minus the interest.

- Ending Balance: The beginning balance minus the principal.

-

Copy the Formulas: Copy the formulas down for all the periods in the lease term.

Tips for Accuracy and Readability

- Use Absolute References: For formulas that reference the interest rate or lease payment, use absolute references (e.g., $A$3) to ensure that the reference doesn't change when you copy the formula.

- Format for Clarity: Use number formatting and borders to make your table easy to read.

- Error Check: Double-check your formulas and calculations to ensure accuracy.

Conclusion

Creating a lease amortization schedule in Excel is a practical skill that can aid in financial planning and analysis. By following the steps outlined above and adhering to best practices for Excel, you can efficiently manage and analyze lease agreements.

Take Action

To make the most out of this guide, we encourage you to:

- Practice setting up a lease amortization schedule with hypothetical data.

- Apply the skills to real-world lease agreements.

- Share your experiences or questions in the comments section below.

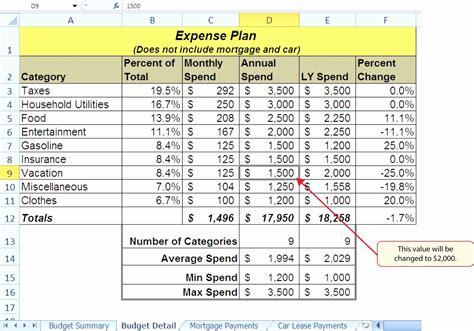

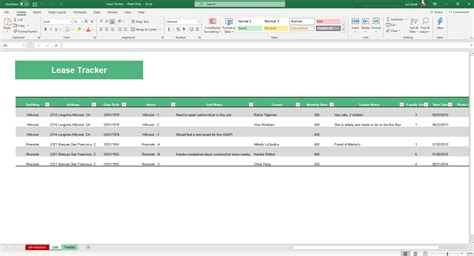

Gallery of Lease Amortization in Excel

Lease Amortization Excel Templates

Frequently Asked Questions

-

What is the purpose of a lease amortization schedule?

- The primary purpose is to spread the cost of the leased asset over its useful life for accounting and financial analysis purposes.

-

How do I calculate the interest in each period?

- Interest is calculated as the beginning balance of the period multiplied by the interest rate.

-

Can I use Excel formulas to automate the calculation of the principal paid?

- Yes, the principal paid can be calculated by subtracting the interest from the lease payment.

-

Is it necessary to update the amortization schedule manually every period?

- No, if set up correctly with formulas, the schedule will automatically update for each period based on the previous period's ending balance.

-

How can I ensure accuracy in my lease amortization schedule?

- Double-check your formulas, ensure that you're using absolute references where necessary, and format your table for clarity to prevent errors.