Intro

Unlock the secrets to accurate multifamily investment projections with our comprehensive guide to the 10 essential elements of a multifamily pro forma template. Learn how to create a robust financial model that includes key components such as revenue projections, expense forecasting, cash flow analysis, and more to inform your investment decisions and maximize returns.

Investing in multifamily properties can be a lucrative venture, but it requires careful planning and financial analysis to ensure success. A multifamily pro forma template is a crucial tool in this process, helping investors and developers to forecast income, expenses, and returns on investment. In this article, we will delve into the 10 essential elements of a multifamily pro forma template, providing a comprehensive guide for creating a robust financial model.

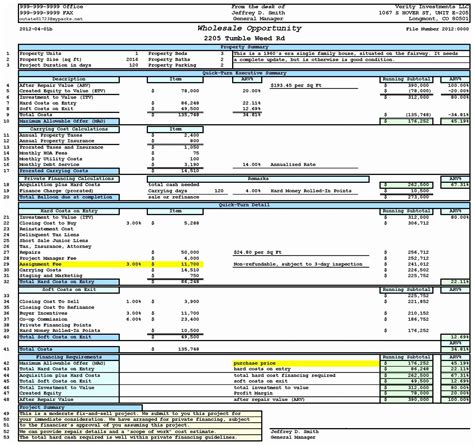

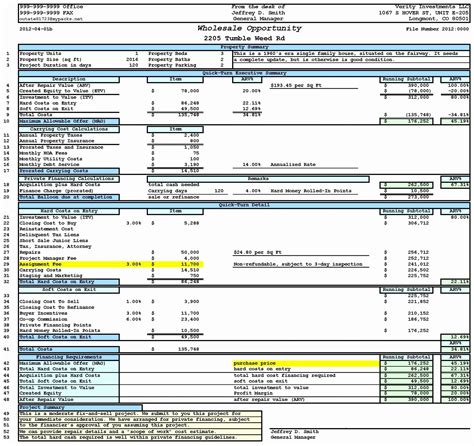

1. Property Information

A multifamily pro forma template should start with a section that outlines key property information. This includes:

- Property address and location

- Number of units and square footage

- Property type (apartment, condo, townhouse, etc.)

- Age and condition of the property

- Any unique features or amenities

This information serves as the foundation for the financial analysis and helps to establish the context for the pro forma.

Why Property Information Matters

Accurate property information is essential for creating a realistic financial model. It helps to determine the property's potential income, expenses, and cash flow. By including this information in the pro forma, investors and developers can make informed decisions about the property's viability.

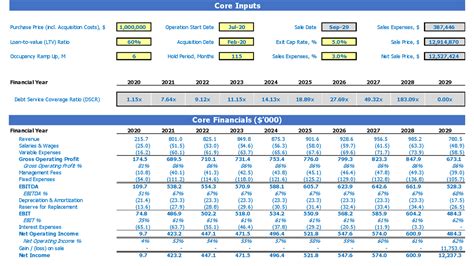

2. Assumptions and Inputs

A multifamily pro forma template relies on various assumptions and inputs to generate financial projections. These assumptions should be clearly outlined and should include:

- Rent growth rates

- Vacancy rates

- Operating expense ratios

- Capital improvement costs

- Financing terms and interest rates

These assumptions should be based on historical data, market trends, and industry benchmarks.

The Importance of Accurate Assumptions

Accurate assumptions are crucial for creating a reliable financial model. By using realistic inputs, investors and developers can generate more accurate projections and make better-informed decisions.

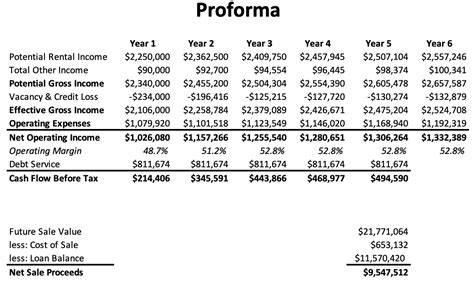

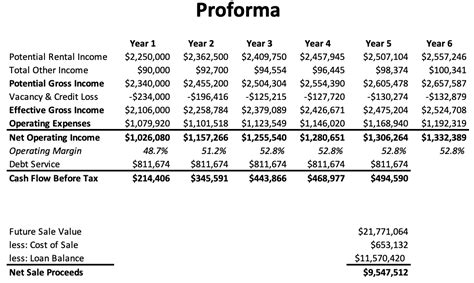

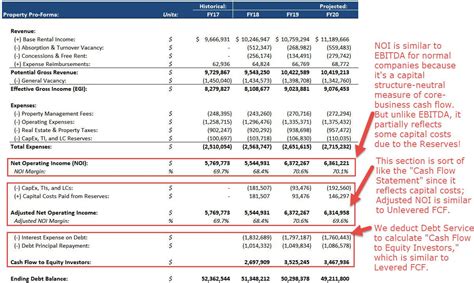

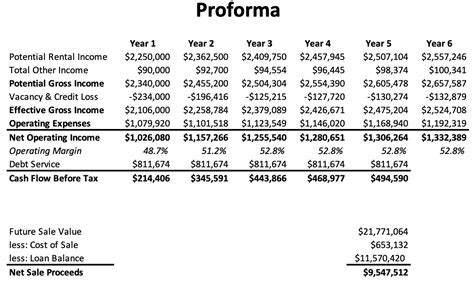

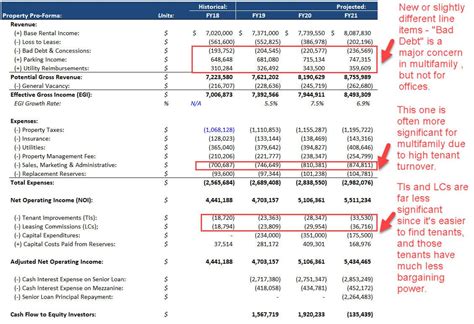

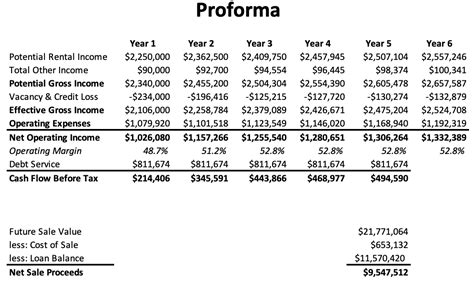

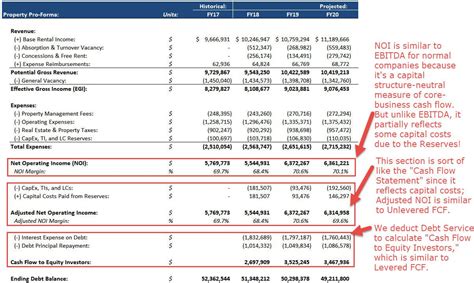

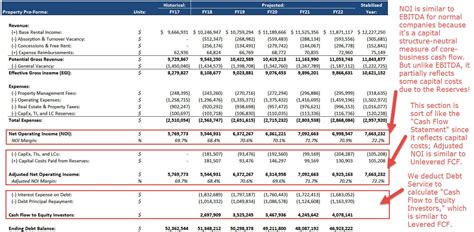

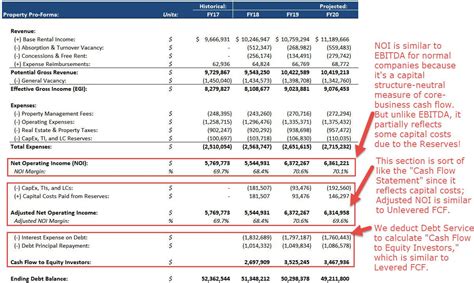

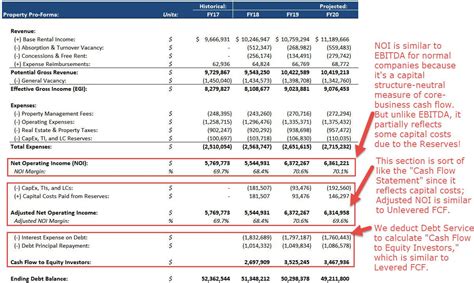

3. Income Statement

The income statement is a critical component of a multifamily pro forma template. It outlines the property's projected income and expenses over a specified period, typically 5-10 years. The income statement should include:

- Rental income

- Other income (parking, laundry, etc.)

- Total income

- Operating expenses (management fees, utilities, etc.)

- Net operating income (NOI)

- Capital improvements and reserves

The income statement provides a comprehensive picture of the property's financial performance and helps investors and developers to identify potential areas for improvement.

Understanding the Income Statement

The income statement is a powerful tool for analyzing a property's financial performance. By examining the income statement, investors and developers can identify trends, opportunities, and potential risks.

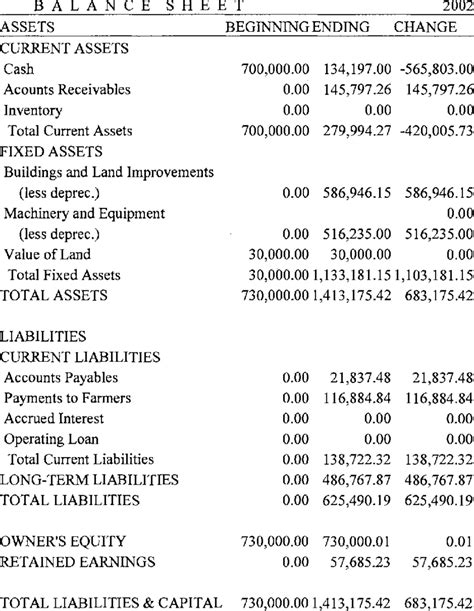

4. Balance Sheet

The balance sheet provides a snapshot of the property's financial position at a specific point in time. It should include:

- Assets (property value, cash reserves, etc.)

- Liabilities (loans, mortgages, etc.)

- Equity (investor contributions, retained earnings, etc.)

The balance sheet helps investors and developers to understand the property's overall financial health and make informed decisions about capital improvements and financing.

The Role of the Balance Sheet

The balance sheet plays a critical role in a multifamily pro forma template. By examining the balance sheet, investors and developers can gain insights into the property's financial position and make informed decisions about future investments.

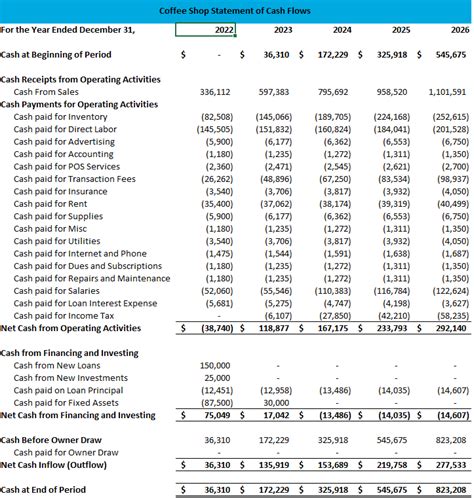

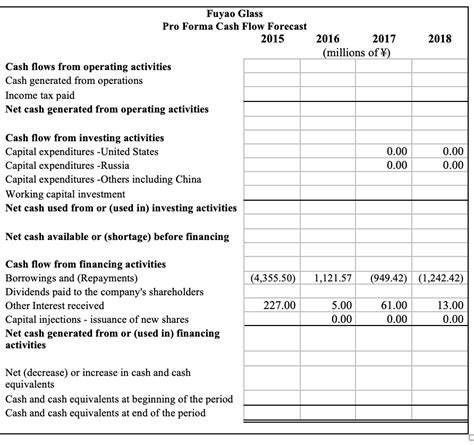

5. Cash Flow Statement

The cash flow statement outlines the property's inflows and outflows of cash over a specified period. It should include:

- Operating cash flows (rental income, operating expenses, etc.)

- Investing cash flows (capital improvements, etc.)

- Financing cash flows (loan payments, etc.)

The cash flow statement helps investors and developers to understand the property's liquidity and make informed decisions about financing and capital improvements.

Understanding Cash Flow

The cash flow statement is a critical component of a multifamily pro forma template. By examining the cash flow statement, investors and developers can gain insights into the property's liquidity and make informed decisions about financing and capital improvements.

6. Debt Service Coverage Ratio (DSCR)

The DSCR is a critical metric that measures a property's ability to cover its debt obligations. It should be calculated as:

- Net operating income (NOI) / total debt service

A DSCR of 1.0 or higher indicates that the property is generating sufficient cash flow to cover its debt obligations.

Understanding DSCR

The DSCR is a critical metric that helps investors and developers to understand a property's ability to cover its debt obligations. By examining the DSCR, investors and developers can make informed decisions about financing and capital improvements.

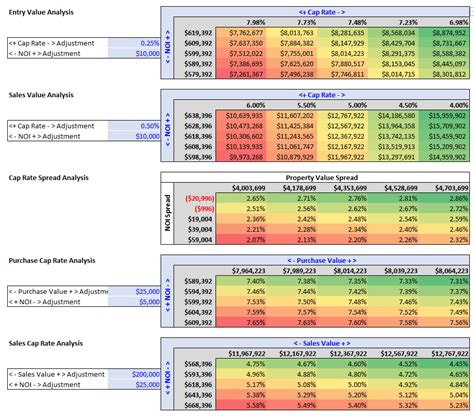

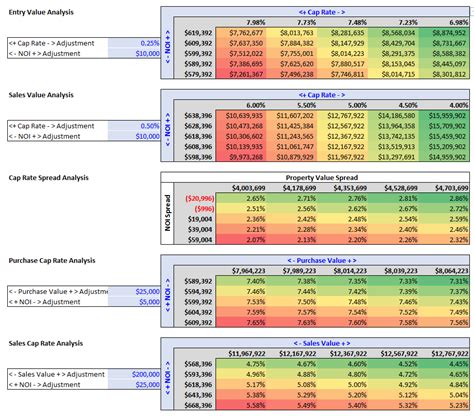

7. Capitalization Rate (Cap Rate)

The cap rate is a critical metric that measures a property's return on investment. It should be calculated as:

- Net operating income (NOI) / property value

A higher cap rate indicates a higher return on investment.

Understanding Cap Rate

The cap rate is a critical metric that helps investors and developers to understand a property's return on investment. By examining the cap rate, investors and developers can make informed decisions about investments and financing.

8. Internal Rate of Return (IRR)

The IRR is a critical metric that measures a property's return on investment over a specified period. It should be calculated as:

- Net present value (NPV) / initial investment

A higher IRR indicates a higher return on investment.

Understanding IRR

The IRR is a critical metric that helps investors and developers to understand a property's return on investment over a specified period. By examining the IRR, investors and developers can make informed decisions about investments and financing.

9. Sensitivity Analysis

A sensitivity analysis is a critical component of a multifamily pro forma template. It should outline the potential impact of changes in assumptions and inputs on the property's financial performance.

- Rent growth rates

- Vacancy rates

- Operating expense ratios

- Capital improvement costs

- Financing terms and interest rates

By examining the sensitivity analysis, investors and developers can gain insights into the property's potential risks and opportunities.

Understanding Sensitivity Analysis

The sensitivity analysis is a critical component of a multifamily pro forma template. By examining the sensitivity analysis, investors and developers can gain insights into the property's potential risks and opportunities.

10. Conclusion and Recommendations

A multifamily pro forma template should conclude with a summary of the property's financial performance and recommendations for future investments.

- Summary of key findings

- Recommendations for financing and capital improvements

- Potential risks and opportunities

By following these 10 essential elements, investors and developers can create a comprehensive multifamily pro forma template that provides a clear picture of a property's financial performance and potential.

We hope this article has provided a comprehensive guide to creating a multifamily pro forma template. By following these 10 essential elements, investors and developers can make informed decisions about investments and financing.

Multifamily Pro Forma Template Image Gallery

We encourage you to share your thoughts and experiences with multifamily pro forma templates in the comments below. How do you use pro forma templates in your investment and development projects? What are some common challenges you face when creating pro forma templates? Share your insights and let's continue the conversation!