Discover Navy Federal business credit card options, featuring cashback rewards, low APRs, and exclusive benefits for business owners, with flexible financing and payment terms.

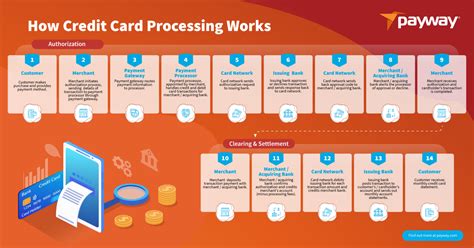

As a business owner, managing finances effectively is crucial for the success and growth of your company. One of the key tools that can help you achieve this is a business credit card. Navy Federal Credit Union, one of the largest and most reputable credit unions in the United States, offers a range of business credit card options designed to meet the diverse needs of business owners. In this article, we will delve into the world of Navy Federal business credit cards, exploring their benefits, features, and how they can help you manage your business expenses efficiently.

Navy Federal Credit Union has been serving its members for over 80 years, providing a wide array of financial products and services tailored to their needs. Their business credit cards are no exception, offering competitive rates, flexible terms, and rewards programs that can help businesses thrive. Whether you are a small business owner, an entrepreneur, or a large corporation, Navy Federal has a business credit card that can cater to your specific requirements. From cashback rewards to travel points, their cards are designed to provide value and help you make the most out of your business expenses.

The importance of choosing the right business credit card cannot be overstated. It can help you separate personal and business expenses, build business credit, and provide a convenient way to manage cash flow. Navy Federal's business credit cards come with a host of benefits, including zero liability protection, travel insurance, and purchase protection. Moreover, their rewards programs are designed to reward you for your business purchases, whether it's through cashback, points, or travel miles. By understanding the features and benefits of Navy Federal's business credit cards, you can make an informed decision that aligns with your business goals and financial strategy.

Types of Navy Federal Business Credit Cards

Navy Federal offers several types of business credit cards, each with its unique features and benefits. Their portfolio includes cashback credit cards, travel credit cards, and low-interest credit cards, among others. The Navy Federal Business Cash Card, for example, offers unlimited 1.5% cashback on all purchases, with no rotating categories or spending limits. This card is ideal for businesses that want to earn rewards on their everyday purchases without the hassle of tracking categories or limits. On the other hand, the Navy Federal Business Travel Card offers points that can be redeemed for travel, making it a great option for businesses with frequent travelers.

Key Features of Navy Federal Business Credit Cards

Some of the key features of Navy Federal business credit cards include: * Competitive interest rates and terms * Generous rewards programs, including cashback and travel points * Zero liability protection and purchase protection * Travel insurance and assistance * Flexible payment terms and online account management * Dedicated customer service for business membersThese features are designed to provide business owners with the tools they need to manage their finances effectively, while also rewarding them for their loyalty and purchases. By choosing a Navy Federal business credit card, you can enjoy these benefits and more, helping you to streamline your business expenses and achieve your financial goals.

Benefits of Using Navy Federal Business Credit Cards

There are numerous benefits to using Navy Federal business credit cards, including:

- Separation of personal and business expenses: This can help you keep your finances organized and make it easier to track business expenses for tax purposes.

- Building business credit: By using a business credit card and making timely payments, you can help establish and build your business credit profile.

- Rewards and cashback: Navy Federal's rewards programs can help you earn cashback, points, or travel miles on your business purchases, providing a valuable source of revenue or perks for your business.

- Convenience and flexibility: Business credit cards offer a convenient way to manage cash flow and make purchases, both online and offline.

By leveraging these benefits, business owners can streamline their financial management, reduce costs, and increase efficiency. Whether you are looking to expand your business, manage day-to-day expenses, or simply want a more convenient way to make purchases, Navy Federal's business credit cards can help.

How to Choose the Right Navy Federal Business Credit Card

Choosing the right business credit card can be a daunting task, especially with the numerous options available. Here are some tips to help you choose the right Navy Federal business credit card for your business: * Consider your business needs: Think about your business expenses, cash flow, and financial goals. Do you need a card with a low interest rate, or one with a generous rewards program? * Evaluate the rewards program: Navy Federal's rewards programs vary by card, so consider which type of rewards aligns best with your business needs. * Check the fees and terms: Look at the annual fee, interest rate, and other terms to ensure they fit within your budget and financial strategy. * Read reviews and ask for referrals: Research what other business owners have to say about Navy Federal's business credit cards, and ask for referrals from colleagues or peers.By following these tips, you can make an informed decision and choose a Navy Federal business credit card that meets your business needs and helps you achieve your financial goals.

Navy Federal Business Credit Card Rewards Programs

Navy Federal's business credit card rewards programs are designed to reward you for your business purchases. Their cashback program, for example, offers unlimited 1.5% cashback on all purchases, with no rotating categories or spending limits. This means you can earn cashback on every purchase, from office supplies to travel expenses. Their travel rewards program, on the other hand, offers points that can be redeemed for travel, making it a great option for businesses with frequent travelers.

Some of the key benefits of Navy Federal's rewards programs include:

- Unlimited cashback or travel points

- No rotating categories or spending limits

- Rewards that never expire

- Flexible redemption options, including cashback, travel, or gift cards

By leveraging these rewards programs, business owners can earn valuable rewards on their business purchases, providing a source of revenue or perks for their business.

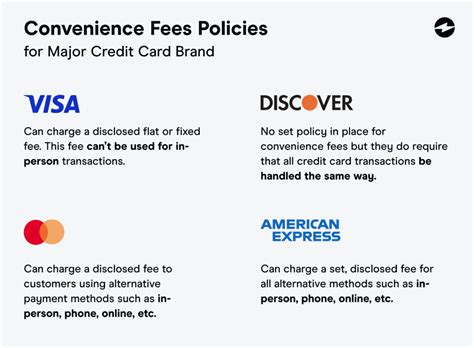

Navy Federal Business Credit Card Fees and Terms

Navy Federal's business credit card fees and terms vary by card, but here are some general details: * Annual fee: Some Navy Federal business credit cards come with an annual fee, which can range from $0 to $95. * Interest rate: The interest rate on Navy Federal business credit cards can range from 12.99% to 18.00% APR, depending on the card and your creditworthiness. * Late fee: Navy Federal charges a late fee of up to $40 for late payments. * Foreign transaction fee: Some Navy Federal business credit cards come with a foreign transaction fee, which can range from 1% to 3% of the transaction amount.It's essential to review the fees and terms of any business credit card before applying, to ensure they fit within your budget and financial strategy.

Navy Federal Business Credit Card Customer Service

Navy Federal is known for its excellent customer service, and their business credit card customer service is no exception. They offer dedicated customer service for business members, with a team of experts available to help with any questions or concerns. You can reach them by phone, email, or online chat, making it easy to get the help you need whenever you need it.

Some of the key benefits of Navy Federal's customer service include:

- Dedicated customer service team for business members

- 24/7 phone and online support

- Online account management and bill pay

- Mobile banking app for on-the-go access

By providing excellent customer service, Navy Federal helps business owners manage their finances with confidence, knowing that help is always available when they need it.

How to Apply for a Navy Federal Business Credit Card

Applying for a Navy Federal business credit card is a straightforward process, which can be completed online or by phone. Here are the steps to follow: * Check your eligibility: You must be a Navy Federal member to apply for a business credit card. * Choose your card: Select the business credit card that best meets your business needs. * Gather required documents: You'll need to provide business and personal financial information, as well as identification. * Apply online or by phone: Submit your application online or by phone, and wait for a decision.By following these steps, you can apply for a Navy Federal business credit card and start enjoying the benefits of their rewards programs, flexible terms, and excellent customer service.

Navy Federal Business Credit Card Image Gallery

In conclusion, Navy Federal business credit cards offer a range of benefits and features that can help business owners manage their finances effectively. From cashback rewards to travel points, their rewards programs are designed to reward you for your business purchases. By choosing a Navy Federal business credit card, you can enjoy competitive rates, flexible terms, and excellent customer service, helping you to achieve your financial goals and grow your business. We invite you to share your thoughts and experiences with Navy Federal business credit cards in the comments below, and to explore their range of products and services to find the one that best meets your business needs.