Discover Navy Federal Certificate Of Deposit Rates, featuring competitive CD rates, flexible terms, and high-yield savings options for members, with low-risk investment and fixed returns.

The world of savings and investments can be overwhelming, especially with the numerous options available in the market. However, for those looking for a low-risk investment with a fixed return, certificates of deposit (CDs) are an attractive option. Navy Federal Credit Union, one of the largest and most reputable credit unions in the United States, offers competitive CD rates that can help individuals grow their savings over time. In this article, we will delve into the world of Navy Federal Certificate of Deposit rates, exploring the benefits, types of CDs available, and how to make the most of this investment opportunity.

When it comes to saving money, it's essential to consider the safety and security of your investment. CDs are time deposits offered by banks and credit unions with a fixed interest rate and maturity date. They tend to be low-risk investments, making them an excellent choice for those who want to avoid the volatility of the stock market. Navy Federal Credit Union, with its long history and strong financial standing, provides a secure environment for your savings. By understanding how CDs work and the rates offered by Navy Federal, you can make informed decisions about your financial future.

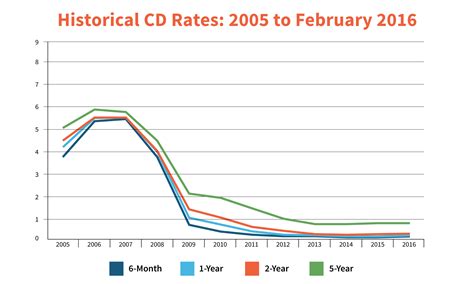

The importance of researching and comparing rates cannot be overstated. Different financial institutions offer varying rates, and even within the same institution, rates can differ based on the term length and type of CD. Navy Federal Certificate of Deposit rates are competitive, offering a range of options to suit different financial goals and timeframes. Whether you're looking for a short-term investment or a long-term savings plan, understanding the rates and terms can help you choose the best CD for your needs.

Navy Federal Certificate Of Deposit Rates Overview

Navy Federal Credit Union offers a variety of CDs, each with its unique features and benefits. The EasyStart Certificate, for example, requires a lower minimum deposit, making it more accessible to new investors. On the other hand, the Special EasyStart Certificate offers higher rates for those willing to commit to a longer term. Understanding the specifics of each type of CD, including the minimum deposit requirements, term lengths, and interest rates, is crucial for maximizing your savings.

Types Of Navy Federal Certificates Of Deposit

The types of CDs available at Navy Federal include:

- EasyStart Certificate: Designed for those new to CD investing, it requires a lower minimum deposit.

- Special EasyStart Certificate: Offers higher rates for longer terms, ideal for those looking to maximize their savings.

- Standard Certificate: The traditional CD option with competitive rates and flexible term lengths.

- Jumbo Certificate: Requires a higher minimum deposit but offers higher rates, suitable for larger investments.

- IRA Certificate: A retirement savings option that allows contributions to traditional or Roth IRAs.

Benefits Of Navy Federal Certificates Of Deposit

The benefits of investing in Navy Federal CDs are numerous:

- Fixed Rates: Your interest rate is locked in for the term of the CD, providing a predictable return on your investment.

- Low Risk: CDs are insured by the NCUA, protecting your deposit up to $250,000.

- Flexibility: Navy Federal offers a range of term lengths, from a few months to several years, allowing you to choose a CD that fits your financial timeline.

- Competitive Rates: Navy Federal's rates are competitive, ensuring you get a good return on your investment.

- Minimums: Some CDs have lower minimum deposit requirements, making them accessible to a wider range of investors.

How To Choose The Right Navy Federal Certificate Of Deposit

Choosing the right CD involves considering several factors, including your financial goals, the term length you're comfortable with, and the minimum deposit requirement. Here are some steps to help you make the right choice:

- Determine Your Financial Goals: Are you saving for a short-term goal or looking for a long-term investment?

- Consider the Term Length: Longer terms typically offer higher rates but tie up your money for an extended period.

- Check the Minimum Deposit: Ensure you can meet the minimum deposit requirement.

- Compare Rates: Look at the rates offered for different terms and types of CDs.

- Understand the Penalties: Be aware of the early withdrawal penalties if you need to access your money before the maturity date.

Navy Federal Certificate Of Deposit Rates Comparison

Comparing rates among different CDs and financial institutions is essential to find the best deal. Navy Federal's rates are competitive, but it's crucial to look at the entire picture, including term lengths, minimum deposits, and any promotional offers. By comparing these factors, you can make an informed decision that aligns with your financial goals and risk tolerance.

Maximizing Your Savings With Navy Federal Certificates Of Deposit

To maximize your savings with Navy Federal CDs:

- Take Advantage of Higher Rates: Longer terms and larger deposits can qualify you for higher rates.

- Consider Laddering: Investing in CDs of varying term lengths can provide consistent income and flexibility.

- Monitor Rate Changes: Keep an eye on rate changes and consider reinvesting in a new CD with a better rate at maturity.

- Combine with Other Savings Strategies: CDs can be part of a broader savings plan that includes other investment vehicles.

Navy Federal Certificate Of Deposit FAQs

Frequently Asked Questions about Navy Federal CDs include:

- Q: What is the minimum deposit for a Navy Federal CD? A: The minimum deposit varies by CD type, with some requiring as little as $50.

- Q: Can I withdraw my money before the maturity date? A: Yes, but you may face early withdrawal penalties.

- Q: Are Navy Federal CDs insured? A: Yes, they are insured by the NCUA up to $250,000.

Gallery of Navy Federal Certificate Of Deposit

Navy Federal Certificate Of Deposit Image Gallery

In conclusion, Navy Federal Certificate of Deposit rates offer a compelling opportunity for those looking to grow their savings with a low-risk investment. By understanding the types of CDs available, their benefits, and how to choose the right one, individuals can make informed decisions about their financial future. Whether you're a seasoned investor or just starting out, Navy Federal's competitive rates and flexible terms make their CDs an attractive option. We invite you to share your experiences with CDs, ask questions, or explore how Navy Federal can help you achieve your financial goals.