Learn about Navy Federal Credit Union Cashier Check, a secure payment method offering guaranteed funds, instant verification, and fraud protection, ideal for large transactions, home purchases, and business deals, with benefits like convenience and reliability.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial services to its members. One of the services provided by Navy Federal Credit Union is the issuance of cashier's checks, which are a type of official check that guarantees payment to the payee. In this article, we will delve into the world of Navy Federal Credit Union cashier checks, exploring their benefits, how they work, and the steps involved in obtaining one.

The importance of cashier checks cannot be overstated, as they provide a secure and reliable way to make large or significant payments. Whether you're buying a car, paying for a down payment on a house, or making a business transaction, a cashier's check can give you peace of mind knowing that the payment is guaranteed. Navy Federal Credit Union's cashier checks are particularly popular among its members, who appreciate the convenience, security, and flexibility they offer.

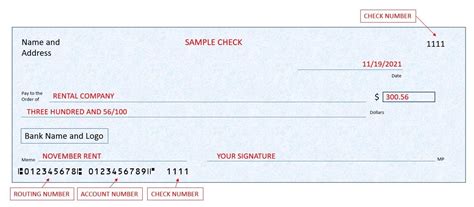

For those who may not be familiar with cashier checks, it's essential to understand how they differ from regular checks. A cashier's check is a check that is drawn on the credit union's own funds, rather than the account holder's funds. This means that the credit union guarantees the payment, making it a more secure and trustworthy form of payment. Navy Federal Credit Union's cashier checks are also backed by the credit union's strong financial standing, which provides an added layer of security and confidence for both the payer and the payee.

Navy Federal Credit Union Cashier Check Benefits

The benefits of using a Navy Federal Credit Union cashier check are numerous. For one, they provide a secure and guaranteed form of payment, which can be especially important for large or significant transactions. Additionally, cashier checks are often required for certain types of transactions, such as real estate purchases or car sales. Navy Federal Credit Union's cashier checks are also convenient to obtain, with members able to request them online, by phone, or in person at a branch.

Another benefit of using a Navy Federal Credit Union cashier check is the flexibility they offer. Members can choose from a variety of check styles and designs, and can even request a cashier's check with a specific name or business name printed on it. This can be especially useful for businesses or individuals who need to make frequent payments to vendors or suppliers.

How Navy Federal Credit Union Cashier Checks Work

So, how do Navy Federal Credit Union cashier checks work? The process is relatively straightforward. When a member requests a cashier's check, the credit union verifies the member's account information and ensures that they have sufficient funds to cover the check amount. The credit union then draws the check on its own funds, guaranteeing the payment to the payee.

The member can then use the cashier's check to make a payment to the payee, who can cash the check at any financial institution that accepts cashier checks. The credit union's guarantee of payment provides an added layer of security and confidence for both the payer and the payee, making it a popular choice for large or significant transactions.

Obtaining a Navy Federal Credit Union Cashier Check

Obtaining a Navy Federal Credit Union cashier check is a relatively simple process. Members can request a cashier's check online, by phone, or in person at a branch. To request a cashier's check online, members can log in to their account and follow the prompts to request a check. They will need to provide the payee's name, the check amount, and any other relevant information.

To request a cashier's check by phone, members can call the credit union's customer service number and speak with a representative. They will need to provide the same information as they would when requesting a check online.

Finally, members can also request a cashier's check in person at a branch. They will need to provide the same information as they would when requesting a check online or by phone, and the credit union representative will assist them with the process.

Navy Federal Credit Union Cashier Check Fees

While Navy Federal Credit Union cashier checks offer many benefits, there may be fees associated with obtaining one. The credit union charges a small fee for each cashier's check, which varies depending on the check amount and the member's account type.

Members can expect to pay a fee ranging from $5 to $20 per check, depending on the check amount and their account type. For example, members with a basic checking account may pay a higher fee than members with a premium checking account.

Navy Federal Credit Union Cashier Check Requirements

To obtain a Navy Federal Credit Union cashier check, members must meet certain requirements. For one, they must have a valid account with the credit union, such as a checking or savings account. They must also have sufficient funds in their account to cover the check amount.

Additionally, members may need to provide identification and other documentation to verify their identity and account information. This can include a government-issued ID, such as a driver's license or passport, as well as proof of address and other documentation.

Navy Federal Credit Union Cashier Check Alternatives

While Navy Federal Credit Union cashier checks offer many benefits, there may be alternative options available for members. For example, members may be able to use a money order or a wire transfer to make a payment.

Money orders are a type of payment that can be purchased at a post office or other retail location. They are similar to cashier checks, but are typically less expensive and may not offer the same level of security and guarantee.

Wire transfers, on the other hand, are a type of electronic payment that can be made from one bank account to another. They are often faster and more convenient than cashier checks, but may not offer the same level of security and guarantee.

Navy Federal Credit Union Cashier Check FAQs

Here are some frequently asked questions about Navy Federal Credit Union cashier checks:

- Q: How long does it take to obtain a Navy Federal Credit Union cashier check? A: The time it takes to obtain a cashier's check can vary depending on the method of request. Online and phone requests are typically processed immediately, while in-person requests may take a few minutes to an hour.

- Q: Can I request a Navy Federal Credit Union cashier check online? A: Yes, members can request a cashier's check online by logging in to their account and following the prompts.

- Q: How much does a Navy Federal Credit Union cashier check cost? A: The fee for a cashier's check varies depending on the check amount and the member's account type. Members can expect to pay a fee ranging from $5 to $20 per check.

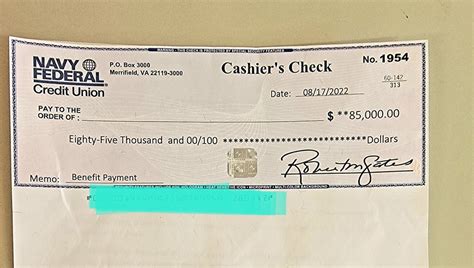

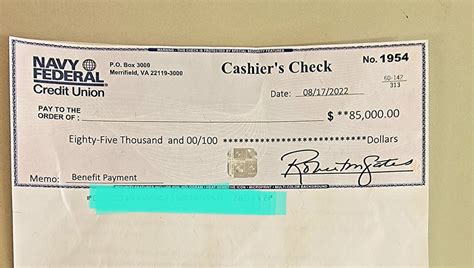

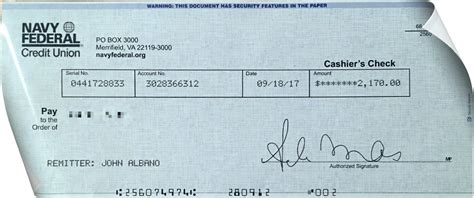

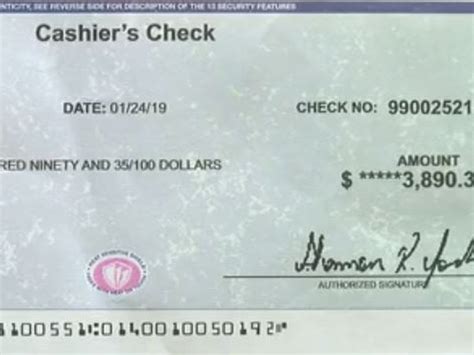

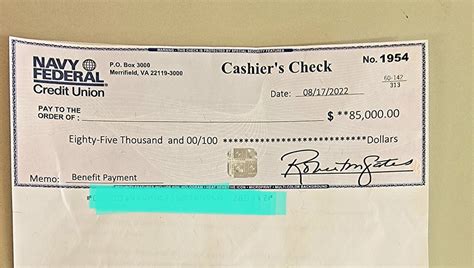

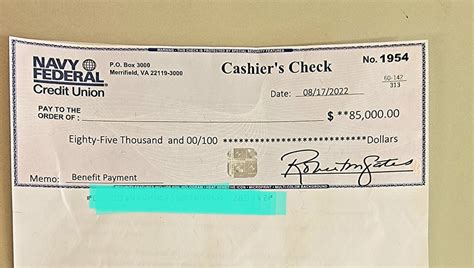

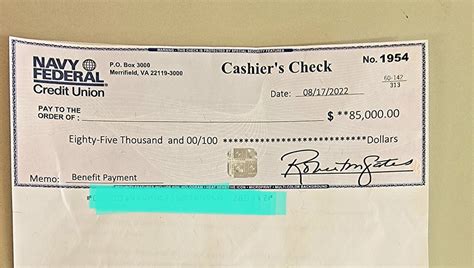

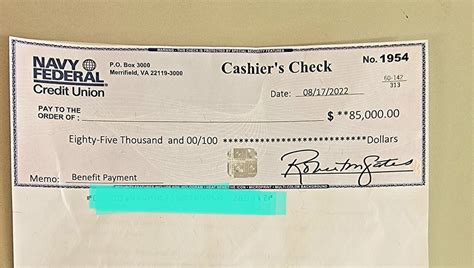

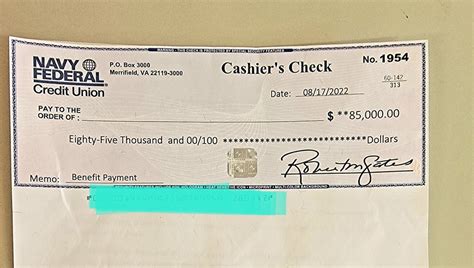

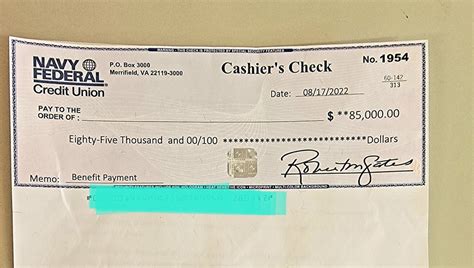

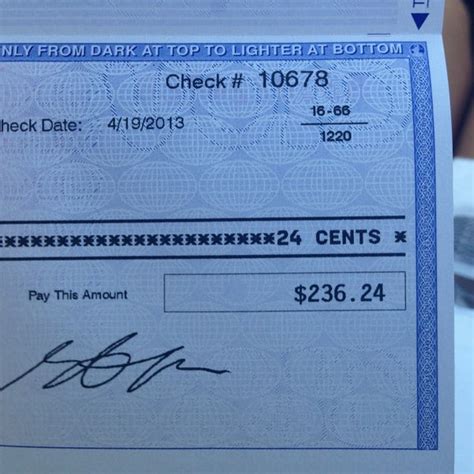

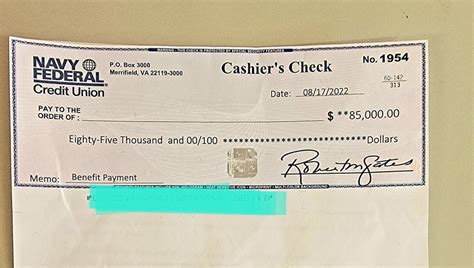

Navy Federal Credit Union Cashier Check Image Gallery

Final Thoughts on Navy Federal Credit Union Cashier Checks

In conclusion, Navy Federal Credit Union cashier checks offer a secure and reliable way to make large or significant payments. With their guaranteed payment and flexibility, they are a popular choice among credit union members. Whether you're buying a car, paying for a down payment on a house, or making a business transaction, a Navy Federal Credit Union cashier check can provide peace of mind and confidence in your payment.

We hope this article has provided you with a comprehensive understanding of Navy Federal Credit Union cashier checks, including their benefits, how they work, and the steps involved in obtaining one. If you have any further questions or would like to learn more about credit union services, please don't hesitate to reach out. Share your thoughts and experiences with Navy Federal Credit Union cashier checks in the comments below, and don't forget to share this article with anyone who may benefit from this information.