Discover 5 Navy Federal locations near you, offering banking, loans, and credit services with convenient ATM access, online banking, and mobile banking solutions for military members and families.

The importance of having accessible financial services cannot be overstated, especially for those serving in the military, veterans, and their families. Navy Federal Credit Union has been a stalwart in providing these services, with a wide range of locations that cater to the financial needs of its members. Understanding the significance of proximity and convenience, Navy Federal has strategically placed its branches and ATMs across the United States and abroad, ensuring that its members can manage their finances effectively, no matter where their duties or personal endeavors take them.

Navy Federal Credit Union's extensive network is a testament to its commitment to serving the military community. By offering numerous locations, both on and off military bases, Navy Federal makes it easier for its members to access banking services, loans, investments, and insurance products tailored to their unique needs. This accessibility is crucial, given the transient nature of military life, where individuals and families may be required to relocate frequently. The presence of Navy Federal locations in various parts of the country and overseas helps alleviate some of the stresses associated with these moves, providing a sense of financial stability and continuity.

The variety of services offered by Navy Federal Credit Union at its locations is another aspect that underscores its importance. From basic banking services like checking and savings accounts, to more complex financial products such as mortgages and investment portfolios, Navy Federal's branches are equipped to handle a wide range of financial transactions and inquiries. Moreover, the credit union's commitment to financial education and planning means that members can seek advice on managing their finances, planning for retirement, or achieving other long-term financial goals. This comprehensive approach to financial service provision sets Navy Federal apart and makes its locations invaluable resources for the military community.

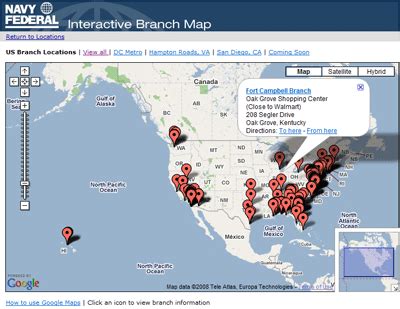

Introduction to Navy Federal Locations

Navy Federal Credit Union operates with the understanding that its members' financial needs are diverse and dynamic. To address this, the credit union has established a robust network of branches and ATMs. This network is designed to be as accessible as possible, with locations on military bases, in surrounding communities, and even in certain international locations. The strategic placement of these locations ensures that Navy Federal members can conduct their financial business with ease, regardless of their geographical location.

Benefits of Navy Federal Locations

The benefits of having numerous Navy Federal locations are multifaceted. Firstly, they provide members with easy access to their accounts, allowing for deposits, withdrawals, and other transactions to be performed conveniently. Secondly, these locations serve as hubs for financial advice and planning, offering members the opportunity to consult with financial experts who understand the unique challenges and opportunities faced by the military community. Lastly, the presence of Navy Federal locations in military communities fosters a sense of financial security and support, which is invaluable to individuals and families navigating the complexities of military life.

Key Services Offered

Some of the key services offered at Navy Federal locations include:

- Checking and savings accounts tailored to the needs of military personnel and their families

- Loans, including personal loans, mortgages, and auto loans, often with competitive rates and terms

- Investment products and retirement planning services

- Insurance options, such as auto, home, and life insurance

- Financial counseling and education resources

Strategic Locations

Navy Federal Credit Union's strategic approach to locating its branches and ATMs reflects its deep understanding of its members' needs. By placing locations on military bases, in communities with high concentrations of military personnel and veterans, and near major military installations, Navy Federal ensures that its services are readily accessible. This strategic placement also underscores the credit union's commitment to supporting the financial well-being of the military community, recognizing that easy access to financial services is a critical component of overall quality of life.

Accessibility Features

Accessibility is a key consideration in the placement and design of Navy Federal locations. Features such as:

- Extended hours of operation to accommodate diverse schedules

- Drive-thru services for added convenience

- ATMs located both on and off military bases for 24/7 access to cash and account information

- Online banking and mobile banking apps for remote access to accounts and services

Community Engagement

Beyond providing financial services, Navy Federal locations also serve as hubs for community engagement. The credit union is actively involved in supporting local communities through various initiatives, such as financial literacy programs, charitable donations, and sponsorship of community events. This commitment to community underscores Navy Federal's role as not just a financial institution, but as a partner in the well-being and prosperity of the military community and the communities in which its members live and work.

Financial Education Initiatives

Navy Federal's financial education initiatives are a critical aspect of its community engagement efforts. These initiatives include:

- Workshops and seminars on topics such as budgeting, saving, and investing

- Online resources and tools for financial planning and education

- Partnerships with military and community organizations to provide financial education and support

Technological Advancements

In addition to its physical locations, Navy Federal Credit Union has also invested heavily in technological advancements to enhance the banking experience for its members. The credit union's online banking and mobile banking apps provide members with the ability to manage their accounts, pay bills, transfer funds, and apply for loans from anywhere in the world. This digital access complements the services offered at physical locations, ensuring that members have a comprehensive and convenient banking experience.

Digital Banking Services

Some of the digital banking services offered by Navy Federal include:

- Mobile deposit, allowing members to deposit checks remotely

- Bill pay and transfer services for easy management of finances

- Account monitoring and alerts for enhanced security and financial oversight

- Access to financial education resources and planning tools

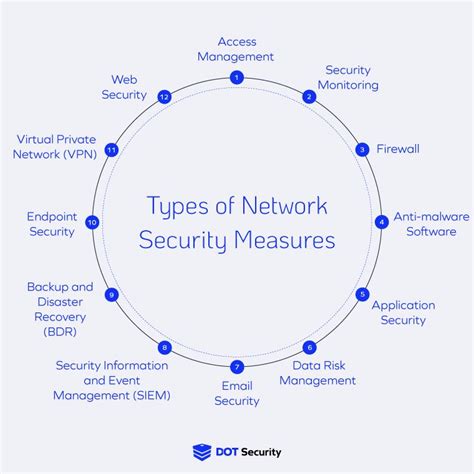

Security Measures

The security of members' financial information and assets is of paramount importance to Navy Federal Credit Union. To address this, the credit union has implemented robust security measures at its locations and across its digital platforms. These measures include state-of-the-art encryption, secure login processes, and regular monitoring of accounts for suspicious activity. Additionally, Navy Federal provides its members with resources and advice on how to protect themselves from financial fraud and identity theft, further enhancing the security of their financial transactions.

Protecting Member Information

Navy Federal's commitment to protecting member information includes:

- Compliance with all relevant financial regulations and standards

- Implementation of advanced security technologies to safeguard digital platforms

- Education and awareness programs to help members recognize and avoid financial scams

Conclusion and Future Directions

As Navy Federal Credit Union continues to evolve and expand its services, its locations will remain at the heart of its operations. By combining traditional banking services with cutting-edge technology and a deep commitment to the military community, Navy Federal is well-positioned to meet the changing needs of its members. Whether through its physical locations, digital platforms, or community engagement initiatives, Navy Federal Credit Union is dedicated to providing the financial support and resources necessary for its members to thrive.

Looking Ahead

Looking to the future, Navy Federal Credit Union is likely to continue innovating and adapting to the needs of its members. This may involve further expansion of its locations, both domestically and internationally, as well as the development of new financial products and services tailored to the military community. By staying true to its mission and values, Navy Federal will remain a trusted and invaluable partner for those serving in the military, veterans, and their families.

Navy Federal Locations Image Gallery

In conclusion, Navy Federal Credit Union's locations play a vital role in supporting the financial needs of the military community. By offering a comprehensive range of services, embracing technological advancements, and engaging deeply with the communities it serves, Navy Federal has established itself as a leader in military banking. As you consider your financial options, we invite you to explore how Navy Federal Credit Union can support your financial goals and well-being. Share your thoughts on the importance of accessible financial services for the military community, and let's work together to build a stronger, more secure financial future for all.