Discover Navy Federal personal loan rates today, with competitive APRs, flexible terms, and low fees, offering affordable borrowing options for members, including debt consolidation and credit builder loans.

As a leading financial institution, Navy Federal Credit Union offers a range of personal loan options to its members, with competitive rates and flexible terms. For those looking to consolidate debt, cover unexpected expenses, or finance a large purchase, Navy Federal personal loans can be an attractive option. In this article, we will delve into the current Navy Federal personal loan rates, exploring the benefits, eligibility requirements, and application process.

Navy Federal Credit Union has been serving its members for over 80 years, providing a wide range of financial products and services. With a strong focus on customer satisfaction and community involvement, Navy Federal has become one of the largest and most reputable credit unions in the United States. Their personal loan offerings are designed to meet the diverse needs of their members, with rates and terms that are often more favorable than those found at traditional banks.

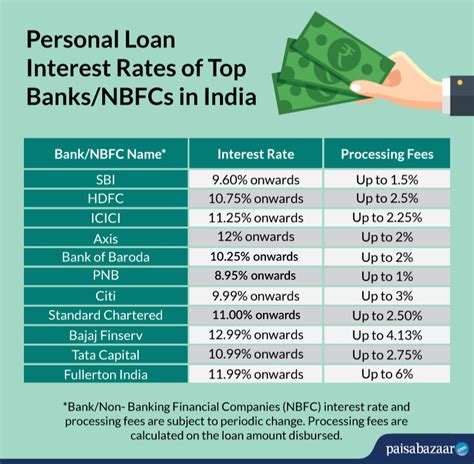

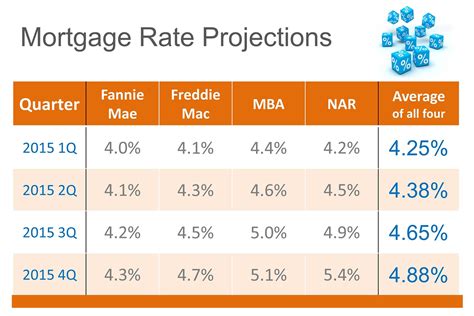

The current Navy Federal personal loan rates are competitive, with APRs ranging from 7.99% to 18.00%. These rates are subject to change, but they are generally lower than those offered by other lenders. Navy Federal also offers a range of loan terms, from 36 to 60 months, allowing borrowers to choose a repayment schedule that fits their budget and financial goals. Whether you're looking to borrow a small amount for a short period or a larger amount for a longer term, Navy Federal has a personal loan option that can meet your needs.

Navy Federal Personal Loan Benefits

One of the key benefits of Navy Federal personal loans is the flexibility they offer. Borrowers can use their loan funds for a variety of purposes, from consolidating debt to financing a wedding or a dream vacation. Navy Federal also offers a range of repayment options, including automatic payments and online payment tools, making it easy to manage your loan and stay on track. Additionally, Navy Federal personal loans have no origination fees, prepayment penalties, or hidden charges, ensuring that you know exactly what you're getting into when you apply.

Another advantage of Navy Federal personal loans is the eligibility requirements. As a credit union, Navy Federal is member-owned and operated, which means that membership is required to apply for a loan. However, membership is open to a wide range of individuals, including active-duty military personnel, veterans, and their families. Even if you're not a member of the military, you may still be eligible to join Navy Federal through your employer, school, or community organization.

Eligibility Requirements

To be eligible for a Navy Federal personal loan, you'll need to meet certain requirements. These include being a member of Navy Federal Credit Union, having a good credit history, and providing proof of income and employment. You'll also need to be at least 18 years old and have a valid Social Security number or Individual Taxpayer Identification Number (ITIN). Navy Federal uses a range of criteria to evaluate loan applications, including credit score, income, and debt-to-income ratio.

Credit Score Requirements

Navy Federal considers a range of credit scores when evaluating loan applications. While they don't disclose a specific minimum credit score requirement, they generally look for borrowers with good to excellent credit. This means that if you have a credit score of 700 or higher, you may be eligible for more favorable rates and terms. However, even if your credit score is lower, you may still be able to qualify for a Navy Federal personal loan, although your rates and terms may be less favorable.Application Process

The application process for Navy Federal personal loans is relatively straightforward. You can apply online, by phone, or in person at a Navy Federal branch. To apply, you'll need to provide some basic information, including your name, address, and Social Security number. You'll also need to provide proof of income and employment, as well as a valid government-issued ID.

Once you've submitted your application, Navy Federal will review your credit history and other factors to determine your eligibility and rates. If you're approved, you'll receive a loan offer outlining the terms and conditions of your loan. You can then review and accept the offer, and Navy Federal will disburse the funds to your account.

Loan Options

Navy Federal offers a range of personal loan options to meet the diverse needs of their members. These include:- Unsecured personal loans: These loans don't require collateral and can be used for a variety of purposes.

- Secured personal loans: These loans require collateral, such as a savings account or CD, and may offer more favorable rates and terms.

- Debt consolidation loans: These loans are designed to help you consolidate high-interest debt into a single, lower-interest loan.

- Personal lines of credit: These loans provide a revolving line of credit that you can use and reuse as needed.

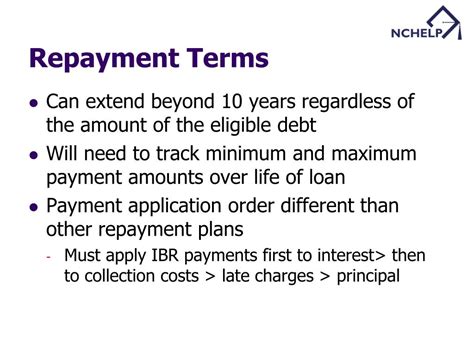

Repayment Options

Navy Federal offers a range of repayment options to help you manage your loan and stay on track. These include:

- Automatic payments: You can set up automatic payments from your Navy Federal account or from an external account.

- Online payments: You can make payments online through the Navy Federal website or mobile app.

- Phone payments: You can make payments by phone using the Navy Federal automated phone system.

- Mail payments: You can mail payments to Navy Federal using a check or money order.

Payment Calculators

Navy Federal provides a range of payment calculators to help you determine your monthly payments and total interest paid over the life of the loan. These calculators can be found on the Navy Federal website and can be used to compare different loan options and repayment terms.Customer Service

Navy Federal is known for its excellent customer service, with a range of options for getting help and support. These include:

- Phone support: You can call Navy Federal toll-free to speak with a representative.

- Email support: You can email Navy Federal for help and support.

- Online chat: You can chat with a Navy Federal representative online through the website or mobile app.

- Branch support: You can visit a Navy Federal branch in person for help and support.

FAQs

Here are some frequently asked questions about Navy Federal personal loans:- What are the current Navy Federal personal loan rates?

- How do I apply for a Navy Federal personal loan?

- What are the eligibility requirements for a Navy Federal personal loan?

- Can I use a Navy Federal personal loan for any purpose?

- How do I make payments on my Navy Federal personal loan?

Navy Federal Personal Loan Image Gallery

In conclusion, Navy Federal personal loans offer a range of benefits and advantages for borrowers. With competitive rates, flexible terms, and a range of repayment options, Navy Federal personal loans can be an attractive option for those looking to consolidate debt, cover unexpected expenses, or finance a large purchase. Whether you're a member of the military or a civilian, Navy Federal personal loans are worth considering. We invite you to share your thoughts and experiences with Navy Federal personal loans in the comments below. Have you applied for a Navy Federal personal loan? What was your experience like? Share your story and help others make informed decisions about their financial options.