Discover expert 5 Navy Federal Refinance Tips for mortgage refinancing, including loan options, credit score requirements, and debt consolidation strategies to lower interest rates and monthly payments.

Refinancing a loan can be a great way to save money on interest, lower monthly payments, and pay off debt faster. For members of the Navy Federal Credit Union, refinancing can be a particularly attractive option due to the credit union's competitive rates and flexible terms. In this article, we'll explore five Navy Federal refinance tips to help you make the most of this financial opportunity.

Refinancing a loan can seem like a daunting process, but with the right guidance, it can be a straightforward and rewarding experience. By understanding the benefits and drawbacks of refinancing, as well as the specific options available through Navy Federal, you can make informed decisions about your financial future. Whether you're looking to refinance a mortgage, auto loan, or personal loan, Navy Federal offers a range of products and services designed to help you achieve your goals.

One of the key advantages of refinancing with Navy Federal is the potential to save money on interest. By securing a lower interest rate or extending the loan term, you can reduce your monthly payments and free up more money in your budget for other expenses. Additionally, refinancing can provide an opportunity to tap into the equity in your home or consolidate debt into a single, more manageable loan. With Navy Federal's competitive rates and flexible terms, refinancing can be a great way to take control of your finances and achieve long-term stability.

Navy Federal Refinance Options

Benefits of Refinancing with Navy Federal

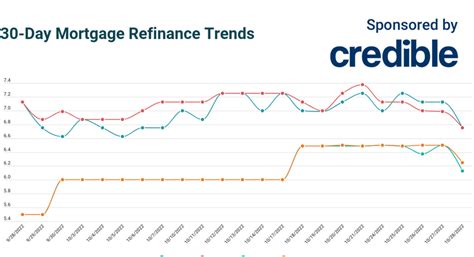

The benefits of refinancing with Navy Federal are numerous. For one, the credit union's competitive rates can help members save money on interest over the life of the loan. Additionally, Navy Federal's flexible terms can provide members with more options for repaying their loan, whether that means extending the loan term or making larger payments to pay off the loan faster. Refinancing with Navy Federal can also provide an opportunity to consolidate debt, tap into home equity, or cover unexpected expenses.Understanding Navy Federal Refinance Rates

Navy Federal Refinance Requirements

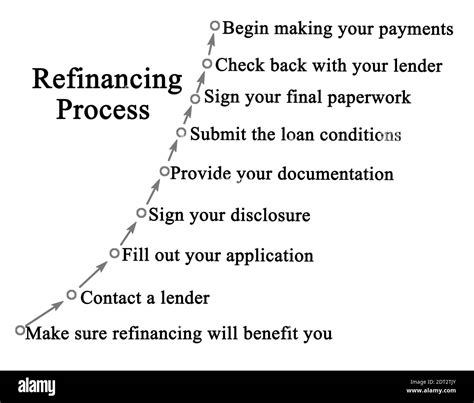

To refinance a loan with Navy Federal, members must meet certain requirements. These may include a minimum credit score, a certain amount of equity in the home (for mortgage refinancing), and other factors. By understanding these requirements, members can prepare themselves for the refinance process and ensure a smooth transition to their new loan. Additionally, Navy Federal's website and customer service representatives can provide valuable guidance and support throughout the refinance process.Navy Federal Refinance Process

Navy Federal Refinance Tips and Tricks

To get the most out of the Navy Federal refinance process, members should keep several tips and tricks in mind. For example, it's essential to research and compare rates to ensure the best possible deal on the refinance loan. Additionally, members should carefully review the terms and conditions of the new loan to ensure they understand all the costs and obligations associated with the loan. By being informed and prepared, members can navigate the refinance process with confidence and achieve their financial goals.Navy Federal Refinance FAQs

Common Navy Federal Refinance Mistakes

Despite the many benefits of refinancing with Navy Federal, there are several common mistakes that members should avoid. For example, failing to research and compare rates can result in a higher interest rate or less favorable terms. Additionally, not carefully reviewing the terms and conditions of the new loan can lead to unexpected costs or obligations. By being aware of these potential pitfalls, members can avoid common mistakes and achieve a successful refinance experience.Navy Federal Refinance Image Gallery

Final Thoughts on Navy Federal Refinance