Intro

Unlock the mystery of Open With Reserves and boost your stock trading skills. Discover the top 5 ways to understand this crucial concept, including its implications on stock prices, order types, and risk management. Learn how to navigate reserves, limit orders, and market volatility to make informed investment decisions.

In the world of business, finance, and personal relationships, understanding the concept of "open with reserves" is crucial for effective communication and decision-making. While the term may seem straightforward, its meaning can be nuanced and context-dependent. In this article, we will delve into the concept of "open with reserves" and explore five ways to understand its meaning.

1. Reserve Prices in Auctions

In the context of auctions, "open with reserves" refers to a type of auction where the seller sets a minimum price, known as the reserve price, below which the item will not be sold. This means that even if there is only one bidder, the auctioneer will not sell the item if the bid is lower than the reserve price. The reserve price is usually not disclosed to the bidders, and the auctioneer will only reveal whether the bid has met the reserve price or not.

For example, imagine an art auction where the seller sets a reserve price of $10,000 for a painting. If the highest bid is only $8,000, the auctioneer will not sell the painting, as the bid did not meet the reserve price.

2. Conditional Agreements in Business

In business, "open with reserves" can refer to a type of agreement or contract that is conditional upon certain terms or conditions being met. This means that the parties involved have agreed to certain terms, but the agreement is not finalized until all conditions have been satisfied.

For instance, a company may agree to purchase a piece of land, but the agreement is contingent upon the seller obtaining the necessary zoning permits. If the seller fails to obtain the permits, the agreement is null and void.

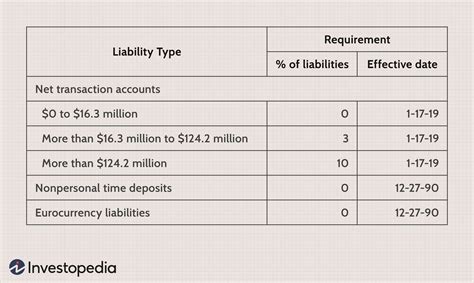

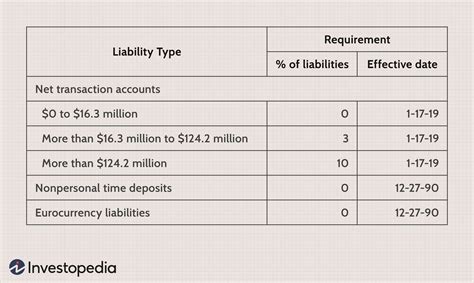

3. Financial Reporting and Reserves

In finance, "open with reserves" can refer to the practice of setting aside funds or assets as a reserve against potential losses or liabilities. This means that a company may allocate a portion of its profits or assets to a reserve account, which can be used to cover unexpected expenses or losses.

For example, an insurance company may set aside a reserve fund to cover potential claims or payouts. This fund is typically invested in low-risk assets, such as bonds or stocks, and can be used to pay out claims or expenses if needed.

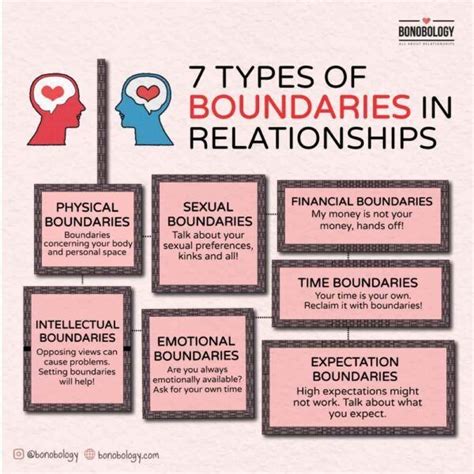

4. Personal Relationships and Boundaries

In personal relationships, "open with reserves" can refer to a situation where one person is open to the relationship, but also maintains certain boundaries or reservations. This means that the person is willing to engage with the other person, but also prioritizes their own needs and limits.

For instance, someone may be open to a romantic relationship, but also maintains a reserve about committing to a long-term partnership. This reserve can serve as a protection mechanism, allowing the person to maintain their independence and autonomy.

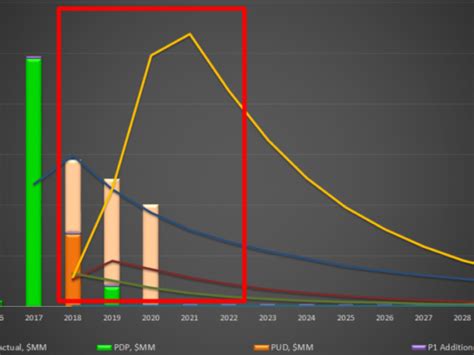

5. Investment Strategies and Reserves

In investing, "open with reserves" can refer to a strategy where an investor allocates a portion of their portfolio to a reserve fund, which can be used to take advantage of market opportunities or cover potential losses. This means that the investor maintains a reserve fund, which can be invested in low-risk assets, such as cash or bonds.

For example, an investor may allocate 20% of their portfolio to a reserve fund, which can be used to buy stocks or other assets if the market declines. This reserve fund can serve as a hedge against potential losses, allowing the investor to maintain their overall portfolio value.

Open With Reserves Meaning Image Gallery

In conclusion, the concept of "open with reserves" can have different meanings depending on the context. Whether it's in auctions, business agreements, financial reporting, personal relationships, or investment strategies, understanding the concept of "open with reserves" is crucial for effective communication and decision-making. By recognizing the different ways in which "open with reserves" can be applied, individuals can make more informed decisions and achieve their goals.